CA FTB 100S Schedule K-1 2020 free printable template

Show details

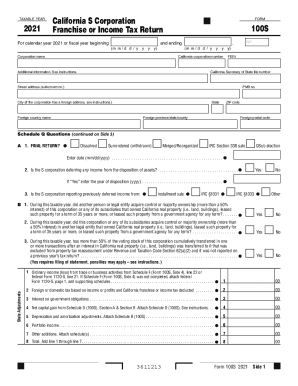

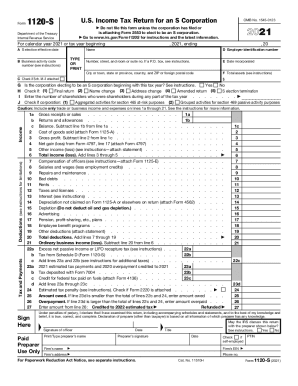

TAXABLE YEAR2020Shareholders Share of Income, Deductions, Credits, etc. CALIFORNIA SCHEDULEK1 (100S)For use by an S corporation and its shareholders only. For calendar year 2020 or fiscal year beginning

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 100S Schedule K-1

Edit your CA FTB 100S Schedule K-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 100S Schedule K-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA FTB 100S Schedule K-1 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA FTB 100S Schedule K-1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 100S Schedule K-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 100S Schedule K-1

How to fill out CA FTB 100S Schedule K-1

01

Download the CA FTB 100S Schedule K-1 form from the California Franchise Tax Board website.

02

Enter the name and taxpayer identification number of the S corporation at the top of the form.

03

Fill in the recipient's information, including their name, address, and taxpayer identification number.

04

Report the amounts of income, deductions, and credits allocated to the recipient in the appropriate boxes.

05

Include any additional information required under applicable instructions.

06

Review the completed form for accuracy.

07

Sign and date the form where indicated.

08

Provide a copy of the filled-out K-1 to the recipient.

Who needs CA FTB 100S Schedule K-1?

01

S corporations that are required to report income, deductions, and credits to their shareholders for California tax purposes.

02

Shareholders of S corporations who need to report their share of the company's income and deductions on their personal tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What does Schedule K mean?

What Is Schedule K-1? Schedule K-1 is a federal tax document used to report the income, losses, and dividends for a business' or financial entity's partners or an S corporation's shareholders. The K-1 form is also used to report income distributions from trusts and estates to beneficiaries.

Do you have to file a K1 with taxes?

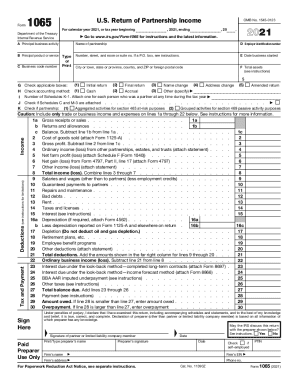

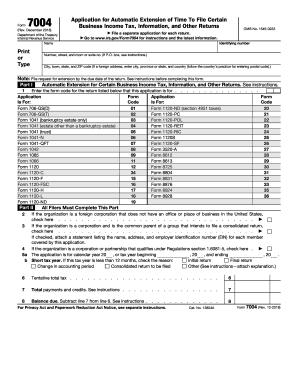

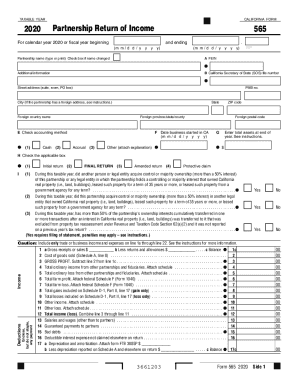

Pass-through entities Sole proprietors and single-member LLCs do not need to file a Schedule K-1. But partnerships, S corps and trusts and estates do — their owners file them along with their personal tax returns. Each has its own form and set of instructions: Form 1065 applies to partnerships.

Is Schedule K and K-1 the same?

IRS Schedule K, also known as Schedule K-1, has two distinct forms for businesses: Schedule K-1 (Form 1120S), Shareholder's Share of Income, Deductions, Credits, etc. Schedule K-1 (Form 1065), Partner's Share of Income, Deduction, Credits, etc.

Who typically receives a Schedule K 1?

If you have an ownership interest in a partnership, S corp, or LLC, you may receive a Schedule K-1. You should report the information from the K-1 on your individual tax return. Form K-1, Partner's Share of Income, Deductions, Credits, etc. is a tax form issued by a partnership to its partners.

Does everyone have a Schedule K 1?

You will always receive an IRS Form K1 As long as you are a partner or shareholder of a business that operates as a pass-through entity, you will receive a Schedule K 1, even if the company has had losses during the tax year.

Is Schedule C the same as Schedule K-1?

If your business is a sole proprietorship or a single-member LLC, you report your business income on a Schedule C for your 1040. If your business is a partnership or a multiple-member LLC, you get your business income on a Schedule K-1 for your 1040.

What is Schedule K or Schedule C?

Use Schedule C (Form 1040) to report income or loss from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if: Your primary purpose for engaging in the activity is for income or profit.

What is a Schedule K-1 on a tax return?

Schedule K-1 for S corporations The S corporation provides Schedule K-1s that reports each shareholder's share of income, losses, deductions and credits. The shareholders use the information on the K-1 to report the same thing on their separate tax returns.

Is K1 same as 1099 K?

What is the difference between a K1 and 1099? The difference between a K1 and a 1099 is: A K1 is used for a partnership, reporting tax items that need to be declared by the owners. A 1099 is generally a tax information document for only one owner, one person.

Should I report Schedule K?

Owners of pass-through entities must file the Schedule K-1 tax form along with their personal tax return to report their share of business profits, losses, deductions, and credits. Beneficiaries of trusts and estates must also submit a Schedule K-1.

Is Schedule K the same as k1?

IRS Schedule K, also known as Schedule K-1, has two distinct forms for businesses: Schedule K-1 (Form 1120S), Shareholder's Share of Income, Deductions, Credits, etc. Schedule K-1 (Form 1065), Partner's Share of Income, Deduction, Credits, etc.

Who receives Schedule k1?

K-1s are provided to the IRS with the partnership's tax return and also to each partner so that they can add the information to their own tax returns. For example, if a business earns $100,000 of taxable income and has four equal partners, each partner should receive a K-1 with $25,000 of income on it.

Does everyone have a K 1 form?

For example, your LLC can have two members or 2,000. Your LLC can also have many different types of members, including individuals, other LLCs, corporations and partnerships. Every member of your LLC, regardless of type, must receive a K-1. LLCs do not send Schedule K-1 to the IRS.

Who needs a Schedule K 1?

If you have an ownership interest in a partnership, S corp, or LLC, you may receive a Schedule K-1. You should report the information from the K-1 on your individual tax return. Form K-1, Partner's Share of Income, Deductions, Credits, etc. is a tax form issued by a partnership to its partners.

What is a Schedule K 1 equivalent?

Summary. Schedule K-1 is an IRS tax form used by partnerships to report income, deductions, and credit of their partners. The Canadian equivalent of Schedule K-1 is the T5013. K-1 splits partnership earnings so that earnings can be taxed at an individual income tax rate instead of the corporate tax rate.

Who receives a Schedule K-1?

Schedule K-1 is a schedule of IRS Form 1065, U.S. Return of Partnership Income. It's provided to partners in a business partnership to report their share of a partnership's profits, losses, deductions and credits to the IRS.

Is K1 income considered income?

Just like any other income or tax document you get during tax season, you need to report your schedule K-1 when you file your taxes -- for two reasons: It's taxable income. It's already been reported to the IRS by the entity that paid you, so the IRS will know if you omit it when you file taxes.

Is Schedule K-1 the same as 1099?

The difference between a K1 and a 1099 is: A K1 is used for a partnership, reporting tax items that need to be declared by the owners. A 1099 is generally a tax information document for only one owner, one person.

Is k1 necessary?

You must present an IRS Schedule K 1 if you belong to a pass-through entity. The different types of entities that need to submit are: S corporations. partnerships.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CA FTB 100S Schedule K-1 to be eSigned by others?

When you're ready to share your CA FTB 100S Schedule K-1, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I make changes in CA FTB 100S Schedule K-1?

The editing procedure is simple with pdfFiller. Open your CA FTB 100S Schedule K-1 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out CA FTB 100S Schedule K-1 on an Android device?

Complete your CA FTB 100S Schedule K-1 and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is CA FTB 100S Schedule K-1?

CA FTB 100S Schedule K-1 is a form used in California to report income, deductions, and credits from an S corporation to its shareholders.

Who is required to file CA FTB 100S Schedule K-1?

S corporations doing business in California are required to file CA FTB 100S Schedule K-1 for each shareholder, reporting their share of the corporation's income, deductions, and credits.

How to fill out CA FTB 100S Schedule K-1?

To fill out CA FTB 100S Schedule K-1, you need to provide the shareholder's information, the S corporation's information, and report the shareholder's share of income, deductions, and credits from the corporation's financial records.

What is the purpose of CA FTB 100S Schedule K-1?

The purpose of CA FTB 100S Schedule K-1 is to inform shareholders of their individual share of the S corporation's income, deductions, and credits, which they need for their personal income tax filings.

What information must be reported on CA FTB 100S Schedule K-1?

CA FTB 100S Schedule K-1 must report the shareholder's name, address, the S corporation's identifying number, the shareholder's share of ordinary income, capital gains, dividends, and any special deductions or credits allocated to them.

Fill out your CA FTB 100S Schedule K-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 100s Schedule K-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.