DC SBA form 2483-SD 2021-2026 free printable template

Show details

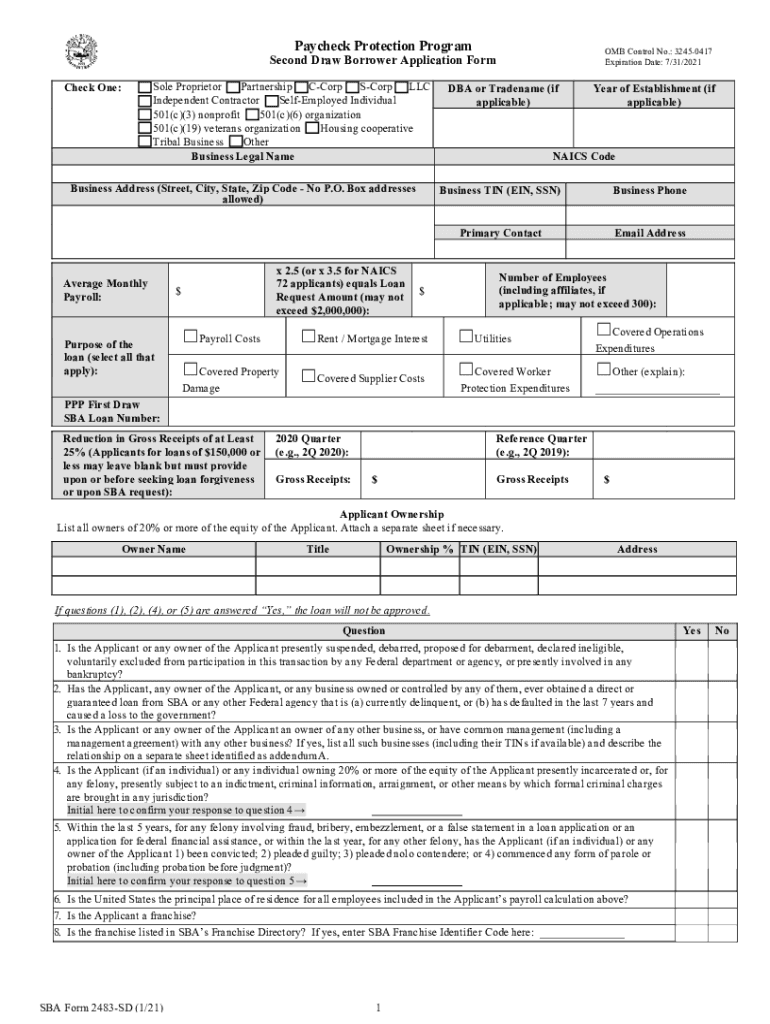

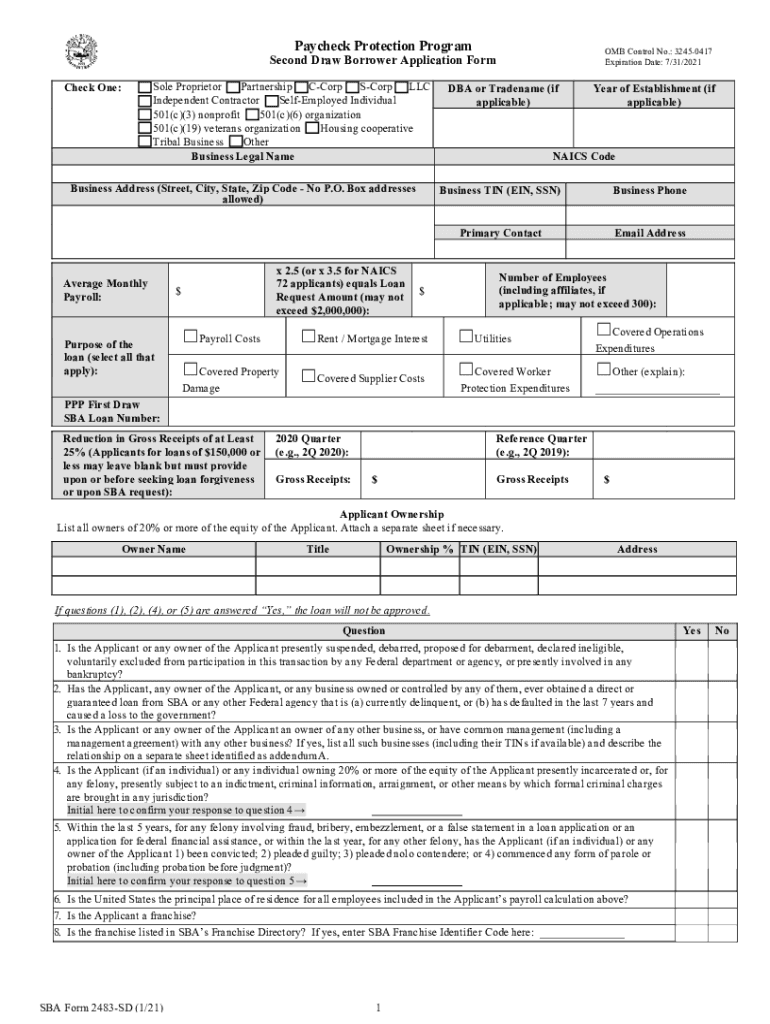

Paycheck Protection Program OMB Control No.: 32450417 Expiration Date: 7/31/2021Second Draw Borrower Application Form Sole Proprietor Partnership Corp Score LLC Independent Contractor Reemployed Individual

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign DC SBA form 2483-SD

Edit your DC SBA form 2483-SD form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your DC SBA form 2483-SD form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit DC SBA form 2483-SD online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit DC SBA form 2483-SD. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out DC SBA form 2483-SD

How to fill out DC SBA form 2483-SD

01

Download the DC SBA form 2483-SD from the official website.

02

Begin by filling in your business name at the top of the form.

03

Provide your business address including street, city, state, and zip code.

04

Enter your taxpayer identification number (TIN) or social security number (SSN).

05

Indicate your business structure (e.g., sole proprietorship, partnership, corporation).

06

Fill in the number of employees as of a specific date.

07

Enter your average monthly payroll amount.

08

Include details about any other funds received from other federal assistance programs if applicable.

09

Review the terms and conditions of the application and sign and date the form.

10

Submit the completed form according to the instructions provided.

Who needs DC SBA form 2483-SD?

01

Businesses seeking financial assistance through the Paycheck Protection Program (PPP).

02

Small businesses, sole proprietors, and independent contractors in need of COVID-19 relief funds.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between form 3508 EZ and 3508S?

The difference between the forms lies in the calculations you need to do. Form 3508 requires the most calculations, Form 3508EZ requires less calculations, and Form 3508S is nearly calculation-free (cue the celebration). The form you use depends on certain factors such as: How much you borrowed.

What is the deadline for 2nd PPP loan?

Borrowers can apply for a Second Draw PPP Loan until March 31, 2021, through any existing SBA 7(a) lender or through any federally insured depository institution, federally insured credit union, eligible non-bank lender, or Farm Credit System institution that is participating in PPP.

What is a 2483 SD form?

The forms are Form 2483 – Paycheck Protection Program Borrower Application Form and Form 2483-SD – PPP Second Draw Borrower Application Form.

How do you calculate maximum loan for second draw?

The sum of the total monthly payroll costs paid or incurred as of the date on which you apply for the second draw PPP loan, divided by. The number of months in which those payroll costs were paid or incurred, multiplied by 2.5 (borrowers with an NAICS beginning with 72 will multiply by 3.5)

Is Blueacorn doing second draw?

Learn more. PPP borrowers are eligible for up to 2.5x monthly payroll costs for their initial PPP loan, as well as any second draw. If your business falls under NAICS code 72 (Accommodation and Food Services), you may qualify for up to 3.5x monthly payroll costs for a second draw. All second draws are limited to $2M.

Is SBA accepting PPP second draw applications?

You're an Eligible Entity To be eligible for a Second Draw from your PPP loan, you must first meet the SBA's criteria of an eligible entity, meaning you qualify as a(n): Small business. Independent contractor. Eligible self-employed individual.

What are the requirements for the second draw PPP?

Previously received a First Draw PPP loan and will or has used the full amount only for authorized uses, Has no more than 300 employees, and. Can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020.

Does Womply automatically apply for second draw?

You cannot receive a Second Draw loan unless your First Draw loan is fully disbursed. To comply with this rule, we will ensure your Second Draw loan is submitted to the SBA only after their database registers your First Draw loan in the correct status.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify DC SBA form 2483-SD without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your DC SBA form 2483-SD into a dynamic fillable form that you can manage and eSign from anywhere.

How do I complete DC SBA form 2483-SD online?

pdfFiller has made it easy to fill out and sign DC SBA form 2483-SD. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I make edits in DC SBA form 2483-SD without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your DC SBA form 2483-SD, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

What is DC SBA form 2483-SD?

DC SBA form 2483-SD is a form used for the Paycheck Protection Program (PPP) which provides small businesses financial assistance to help retain their workforce during adverse economic conditions.

Who is required to file DC SBA form 2483-SD?

Small businesses and certain nonprofit organizations that are seeking a Paycheck Protection Program loan to cover payroll costs and other eligible expenses are required to file DC SBA form 2483-SD.

How to fill out DC SBA form 2483-SD?

To fill out DC SBA form 2483-SD, applicants must provide information such as their business details, number of employees, average monthly payroll costs, and the amount of the loan they are applying for.

What is the purpose of DC SBA form 2483-SD?

The purpose of DC SBA form 2483-SD is to facilitate the application process for small businesses applying for a loan under the Paycheck Protection Program to help manage their payroll and other expenses during economic downturns.

What information must be reported on DC SBA form 2483-SD?

Information that must be reported on DC SBA form 2483-SD includes the applicant's business name, business address, taxpayer identification number, number of employees, payroll costs, and requested loan amount.

Fill out your DC SBA form 2483-SD online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

DC SBA Form 2483-SD is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.