Get the free Long-term care insurance applications can only be accepted from U - pacificadvisors

Show details

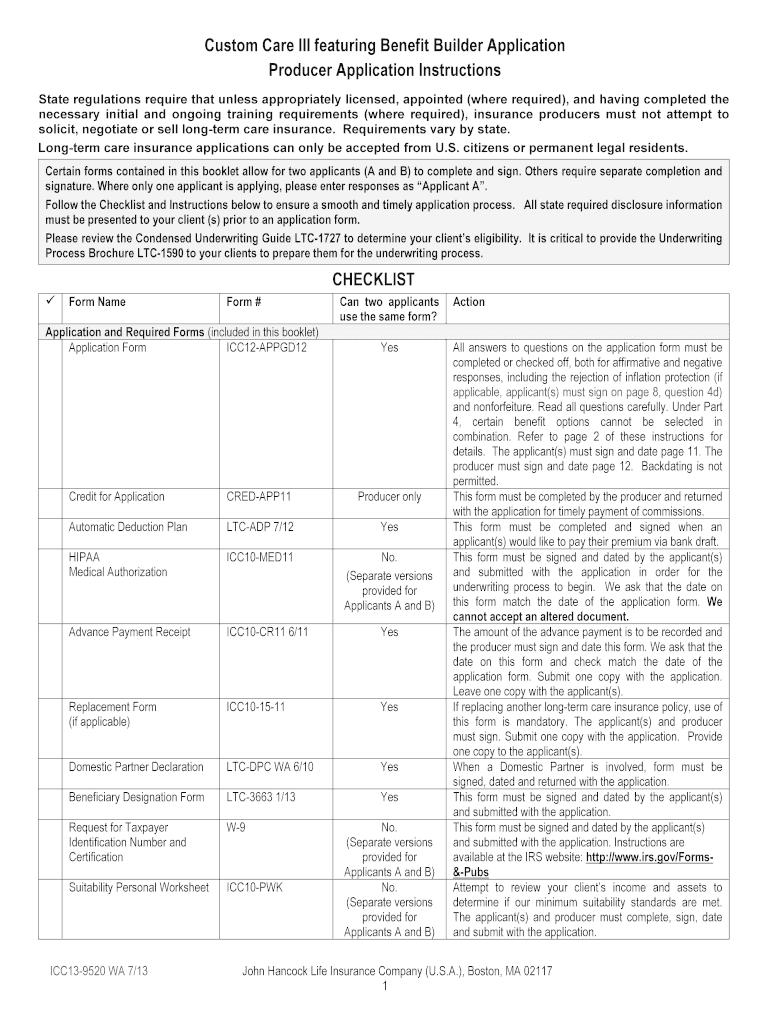

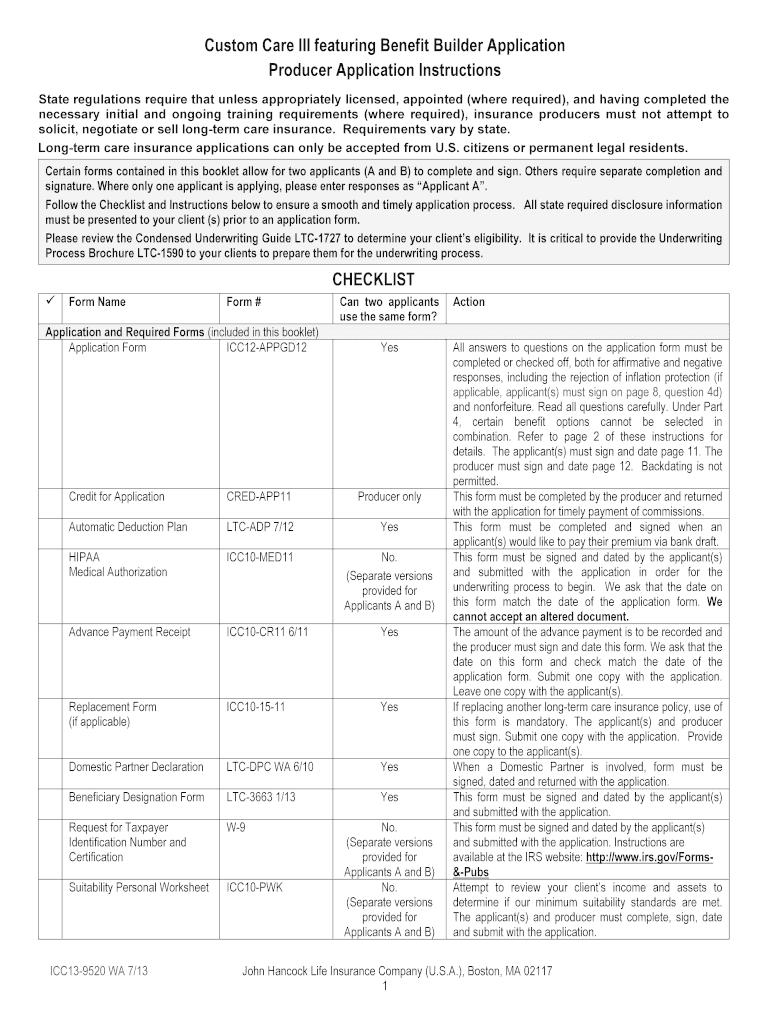

Custom Care III featuring Benefit Builder Application

Producer Application Instructions

State regulations require that unless appropriately licensed, appointed (where required), and having completed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long-term care insurance applications

Edit your long-term care insurance applications form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long-term care insurance applications form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing long-term care insurance applications online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit long-term care insurance applications. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long-term care insurance applications

How to fill out long-term care insurance applications:

01

Gather all necessary personal information: You will need to provide details such as your name, date of birth, contact information, and Social Security number. Make sure to have this information readily available before starting the application process.

02

Provide information about your health history: Long-term care insurance applications typically require you to disclose any pre-existing medical conditions or previous treatments. Be prepared to answer questions about your current health status, any medications you take, and any surgeries or hospitalizations you have had in the past.

03

Assess your long-term care needs: Determine the type and amount of coverage you require based on your individual needs and preferences. Consider factors such as where you would prefer to receive care, the duration of coverage you desire, and the daily benefit amount you would like your policy to provide.

04

Understand the policy terms and options: Read through the insurance application thoroughly to understand the different policy terms and options available to you. This includes understanding the waiting period before benefits kick in, inflation protection options, and any exclusions or limitations that may apply.

05

Seek professional advice if needed: Long-term care insurance can be complex, so it may be beneficial to consult with a financial advisor or an insurance agent who specializes in long-term care insurance. They can help you navigate the application process, explain different policy features, and ensure you make an informed decision.

Who needs long-term care insurance applications:

01

Individuals who want to safeguard their financial future: Long-term care can be costly, and having insurance coverage can help protect your savings and other assets from being depleted by high care costs. If you are concerned about the financial impact of long-term care, obtaining an insurance policy may be a valuable option.

02

Those without sufficient retirement savings: If you have limited retirement savings, long-term care insurance can provide a safety net to cover the expenses associated with extended care. It can help you avoid burdening your family members with the financial responsibility of paying for your care.

03

Individuals with a family history of chronic illnesses: If you have a family history of medical conditions that may require long-term care, such as Alzheimer's disease or certain types of cancer, having long-term care insurance can alleviate the potential financial strain associated with these conditions.

04

Individuals who wish to have control over their care options: Long-term care insurance provides individuals with the flexibility to choose where and how they receive care. By having this coverage, you can have more control over your care decisions and potentially receive care in the comfort of your own home.

Ultimately, the decision to obtain long-term care insurance and fill out the associated applications will depend on your personal circumstances, financial situation, and future care preferences. It is essential to thoroughly research and evaluate different insurance policies before making a decision to ensure it aligns with your needs and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my long-term care insurance applications in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your long-term care insurance applications along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

Can I create an eSignature for the long-term care insurance applications in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your long-term care insurance applications and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit long-term care insurance applications on an Android device?

You can edit, sign, and distribute long-term care insurance applications on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is long-term care insurance applications?

Long-term care insurance applications are forms that individuals fill out in order to apply for insurance coverage for long-term care services.

Who is required to file long-term care insurance applications?

Individuals who are interested in purchasing long-term care insurance coverage are required to file long-term care insurance applications.

How to fill out long-term care insurance applications?

Long-term care insurance applications can be filled out by providing personal information, medical history, and details about the type of coverage desired.

What is the purpose of long-term care insurance applications?

The purpose of long-term care insurance applications is to collect necessary information to determine eligibility for long-term care insurance coverage.

What information must be reported on long-term care insurance applications?

Information such as personal details, medical history, desired coverage options, and financial information may need to be reported on long-term care insurance applications.

Fill out your long-term care insurance applications online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long-Term Care Insurance Applications is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.