Get the free STATE OF NEW HAMPSHIRE - sos.nh.gov - sos nh

Show details

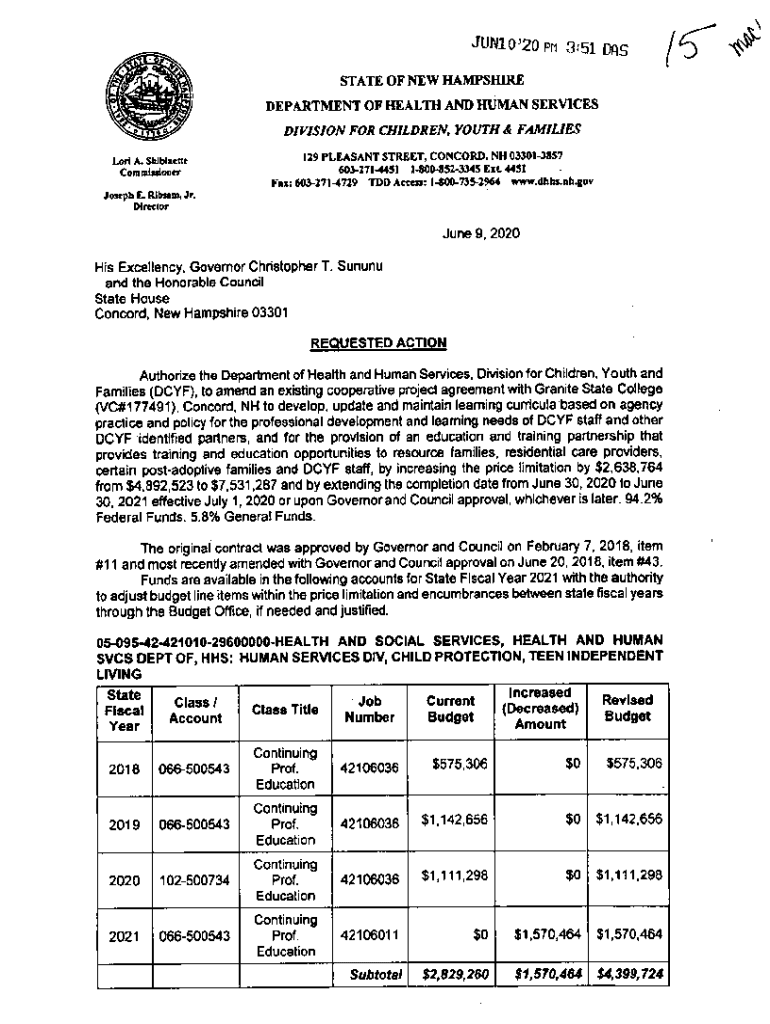

JUN10 '20 PH 3.51 Dots STATE OF NEW HAMPSHIREDEPARTMENT OF HEALTH AND HUMAN SERVICESDIVISION FOR CHILDREN YOUTH & FAMILIES 129 PLEASANT STREET, CONCORD, NH 033013857Lori A. SliiWaette ConmiMloocr603271445118008523345

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign state of new hampshire

Edit your state of new hampshire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your state of new hampshire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing state of new hampshire online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit state of new hampshire. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out state of new hampshire

How to fill out state of new hampshire

01

To fill out the state of New Hampshire, follow these steps:

02

Obtain the required forms: You can either download them from the official website of the New Hampshire Department of Revenue Administration or request them by mail.

03

Complete the personal information: Fill in your full legal name, social security number, and date of birth.

04

Provide your residency information: Indicate whether you are a resident, part-year resident, or nonresident of New Hampshire.

05

Report your income: Include all types of income you received during the tax year, such as wages, self-employment income, rental income, and investment income.

06

Deduct eligible expenses: Claim deductions for expenses such as student loan interest, medical expenses, and property taxes.

07

Calculate your tax liability: Use the New Hampshire tax tables or tax computation worksheet to determine the amount you owe or the refund you are entitled to.

08

Sign and date the form: Verify the accuracy of your information, sign the form, and include the current date.

09

Submit your completed form: Mail the form to the address provided on the instruction sheet or submit it electronically through the New Hampshire e-File system if eligible.

Who needs state of new hampshire?

01

Various individuals and entities may need the state of New Hampshire for different purposes, including:

02

Residents of New Hampshire: Individuals who live in New Hampshire for all or part of the year may need to fill out the state tax forms to fulfill their tax obligations.

03

Businesses operating in New Hampshire: Companies that conduct business activities in the state are required to comply with the state tax laws and file appropriate tax returns.

04

Employees earning income in New Hampshire: Non-resident individuals who work in New Hampshire and earn income may need to file a nonresident tax return in the state.

05

Individuals receiving income from New Hampshire sources: Non-residents who receive certain types of income from New Hampshire sources, such as rental income or capital gains, may also need to file a tax return in the state.

06

It is advised to consult with a tax professional or the New Hampshire Department of Revenue Administration for specific guidance on who needs to file the state tax forms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send state of new hampshire for eSignature?

state of new hampshire is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I sign the state of new hampshire electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your state of new hampshire in seconds.

How do I edit state of new hampshire on an iOS device?

You certainly can. You can quickly edit, distribute, and sign state of new hampshire on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is the state of New Hampshire?

New Hampshire is a state located in the New England region of the northeastern United States.

Who is required to file state of New Hampshire?

Individuals and businesses with income earned in New Hampshire are required to file state taxes.

How to fill out state of New Hampshire?

To fill out the state forms, obtain the required tax forms from the New Hampshire Department of Revenue Administration's website, and follow the instructions provided for reporting income and deductions.

What is the purpose of state of New Hampshire?

The purpose of the state tax forms is to report income for taxation, ensuring compliance with state tax laws.

What information must be reported on state of New Hampshire?

Taxpayers must report income, deductions, exemptions, and relevant tax credits on their state tax returns.

Fill out your state of new hampshire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

State Of New Hampshire is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.