Get the free Secured Bond offer

Show details

JULY – SEPT 2008 THE NEWSLETTER OF MARC INVESTMENT EDITION In this Issue MARC Rapid Saver Secured Bond offer Investor roadshows MARC s Cash PIE Term Deposit Mill brook Resort promotion Ex-lease

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign secured bond offer

Edit your secured bond offer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your secured bond offer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

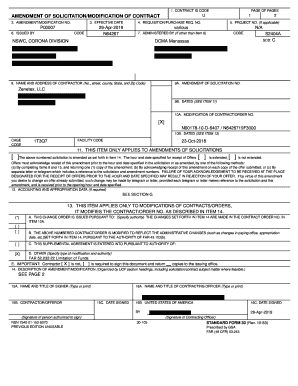

Editing secured bond offer online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit secured bond offer. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out secured bond offer

How to fill out a secured bond offer:

01

Obtain the necessary forms: Start by obtaining the required forms for a secured bond offer. These forms can typically be obtained from your local financial institution or through online platforms that provide assistance in bond transactions.

02

Review the instructions: Carefully read and understand the instructions provided with the forms. The instructions will guide you through the process of filling out the secured bond offer accurately and efficiently.

03

Provide personal information: Begin by providing your personal information such as your full name, contact details, and social security number. This information is essential for identifying and verifying your identity as the bond issuer.

04

State the bond details: Specify the details of the bond, including the principal amount you wish to offer, the maturity date, and any interest rate or coupon payment information. It is important to be precise and accurate when filling out these details.

05

Describe the collateral: In a secured bond offer, collateral is pledged as security against the bond. Clearly describe the collateral being offered, including its type, value, and any relevant identifying details. Providing accurate information about the collateral will ensure transparency and credibility.

06

Sign and date the offer: Once all the required information has been provided, carefully review the filled-out form to ensure accuracy. Sign and date the secured bond offer form to acknowledge your understanding and agreement with the terms and conditions of the bond issuance.

Who needs a secured bond offer:

01

Corporations: Corporations may require secured bond offers to raise capital for various purposes, such as expansion plans, refinancing debt, or funding acquisitions. Secured bonds offer investors a higher level of security by using specific assets as collateral.

02

Municipalities: Municipal governments often use secured bond offers to finance public infrastructure projects, such as building schools, bridges, or water treatment facilities. The collateral provided in the form of the municipality's assets helps attract investors and lower borrowing costs.

03

Individuals: In certain cases, individuals may opt for secured bond offers to obtain financing for personal ventures or obligations. For example, someone looking to start a business may offer secured bonds backed by personal assets as collateral.

In conclusion, filling out a secured bond offer involves following the provided instructions, providing accurate personal and bond details, describing the collateral, and signing the form. Secured bond offers are commonly utilized by corporations, municipalities, and individuals to secure financing for various purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is secured bond offer?

A secured bond offer is a type of bond that is backed by a specific asset or collateral.

Who is required to file secured bond offer?

Companies or individuals looking to issue a secured bond are required to file a secured bond offer.

How to fill out secured bond offer?

To fill out a secured bond offer, one must provide details on the issuer, the bond terms, the collateral being offered, and other relevant information.

What is the purpose of secured bond offer?

The purpose of a secured bond offer is to raise capital by issuing bonds that are backed by collateral, providing investors with a sense of security.

What information must be reported on secured bond offer?

Information such as the issuer's financial standing, the terms of the bond, the collateral being offered, and any risks associated with the investment must be reported on a secured bond offer.

Where do I find secured bond offer?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the secured bond offer in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How can I edit secured bond offer on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing secured bond offer.

How do I fill out secured bond offer on an Android device?

On Android, use the pdfFiller mobile app to finish your secured bond offer. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your secured bond offer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Secured Bond Offer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.