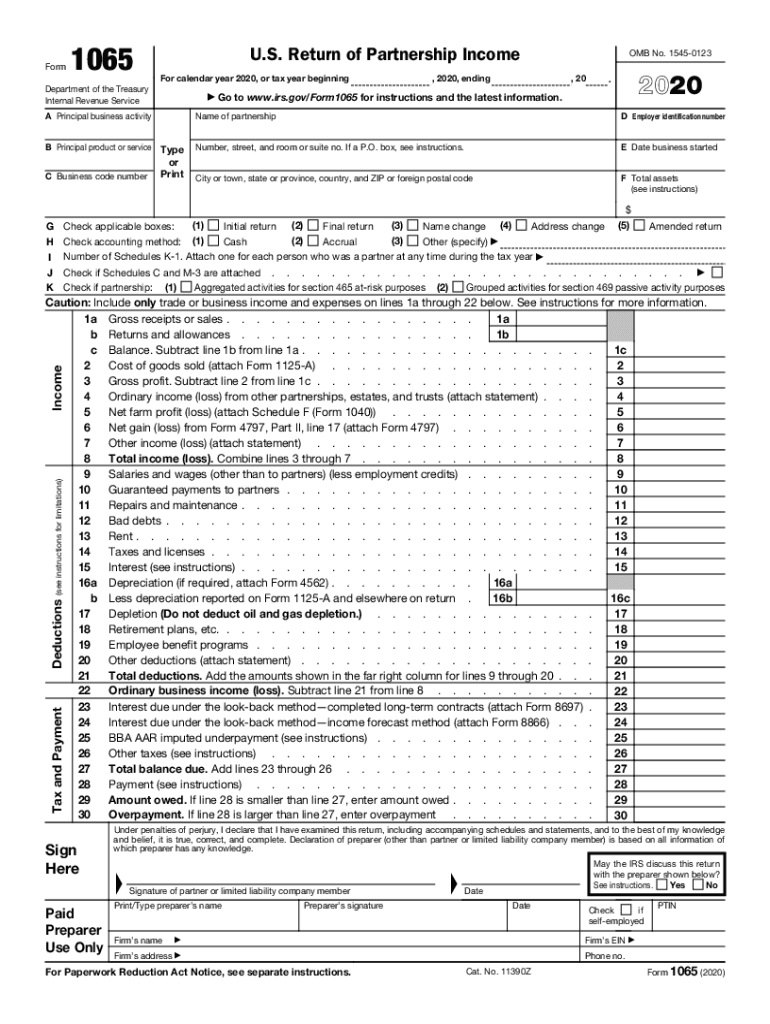

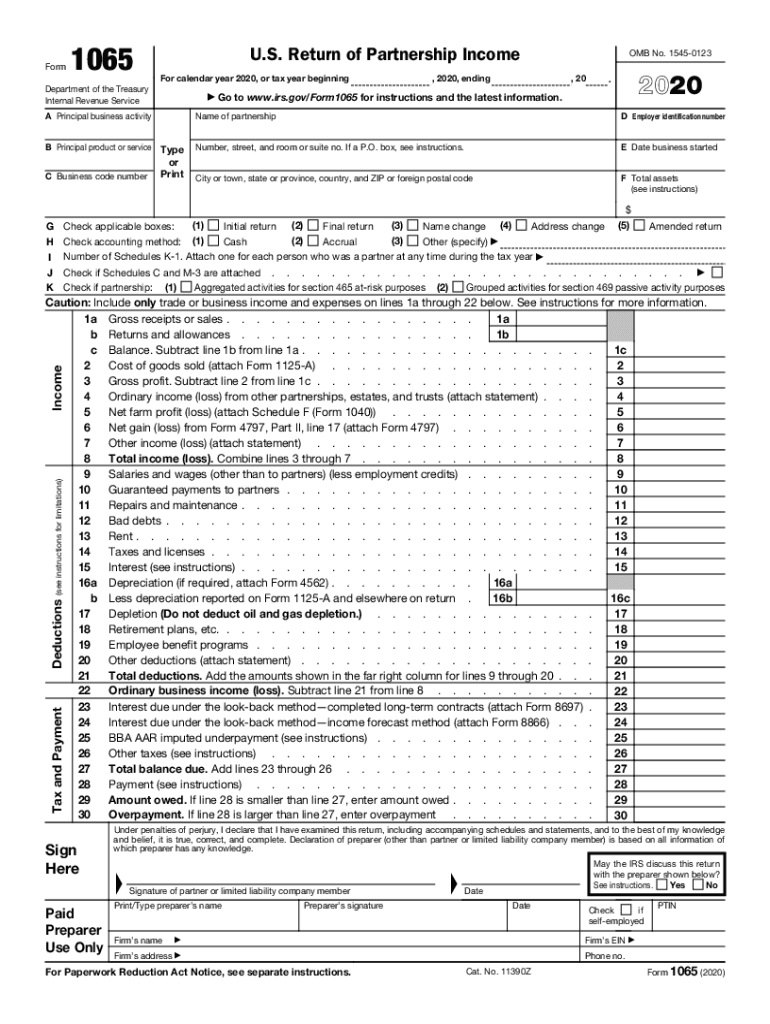

IRS 1065 2020 free printable template

Get, Create, Make and Sign IRS 1065

How to edit IRS 1065 online

Uncompromising security for your PDF editing and eSignature needs

IRS 1065 Form Versions

How to fill out IRS 1065

How to fill out IRS 1065

Who needs IRS 1065?

Instructions and Help about IRS 1065

Form 1065 also known as the u.s return of partnership income is an informational tax form used to report the income gains losses deductions credits and other applicable information concerning the operations of a partnership pdf filler provides you with an up-to-date fillable template of form 1065 that you can easily complete sign and submit online begin by filling boxes a through k at the top of the form and include information on principal business activity principal product or service business code number employer identification number the date your business was founded total assets as shown by your books type of tax return accounting method and the number of schedule k ones you're attaching proceed to complete the rest of the boxes on page one you'll find that these boxes are separated into three categories income deductions and tax and payment once finished fill out schedule b on pages two and three provide detailed information on your company's ownership percentages partnership debts partnership investments and foreign partners proceed to schedule k on page 4 and indicate each partner's share of the partnership's income credit and deductions next you'll need to fill out the remaining sections of form 1065 which includes schedule l schedule m1 and schedule m2 once every field has been completed and checked off date and sign your form 1065 directly in the pdf filler editor then click done to save the changes you've made choose what you would like to do with your document next print out the resulting document share it with anybody via email fax sms usps or shareable link send it out for signature save it to your device convert it into a template or continue editing your document online give pdf filler a try and start saving your time and resources today you.

People Also Ask about

What is a K-1 Form 1065?

What is the difference between a K-1 and a 1065?

Does everyone have a Form 1065?

What is the difference between a K-1 and a 1065?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IRS 1065 from Google Drive?

Where do I find IRS 1065?

How can I fill out IRS 1065 on an iOS device?

What is IRS 1065?

Who is required to file IRS 1065?

How to fill out IRS 1065?

What is the purpose of IRS 1065?

What information must be reported on IRS 1065?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.