IRS 5500-EZ 2020 free printable template

Show details

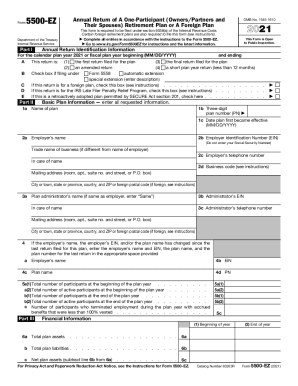

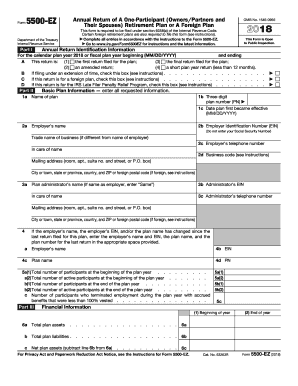

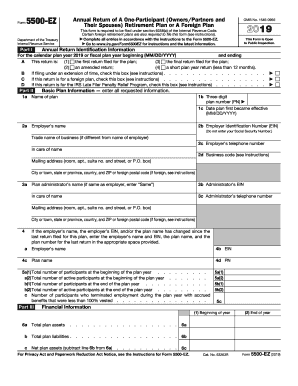

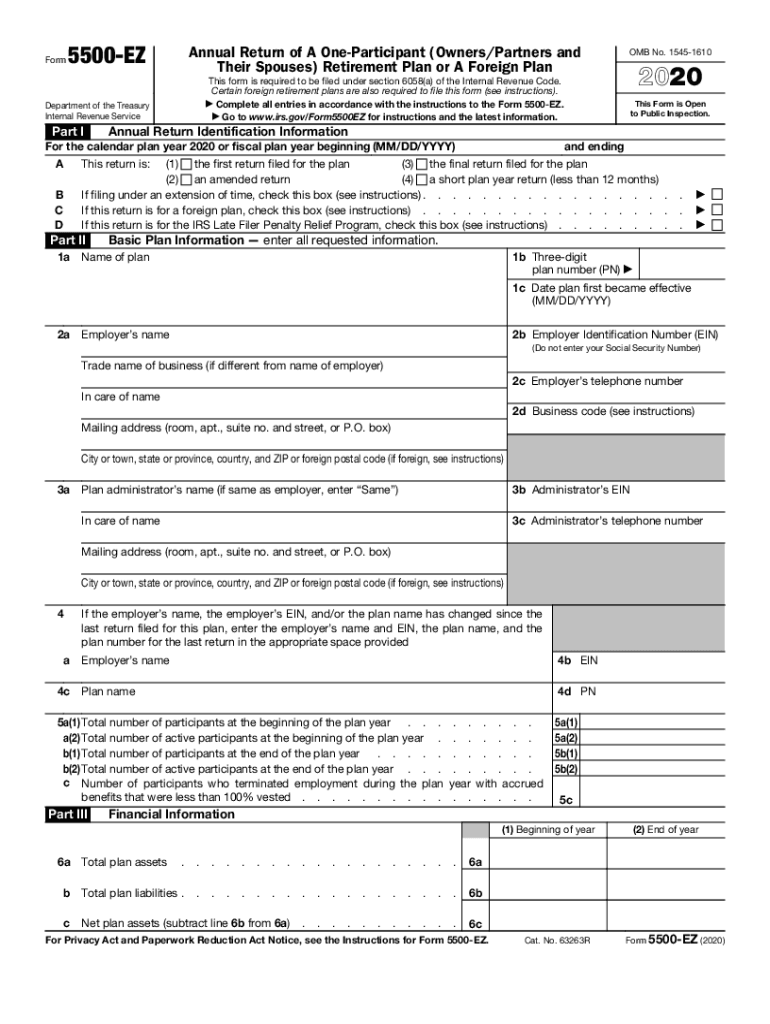

Cat. No. 63263R 2 End of year Form 5500-EZ 2018 Page Amount Contributions received or receivable from 7a b Participants. 6b Net plan assets subtract line 6b from 6a 6c c Total plan assets For Privacy Act and Paperwork Reduction Act Notice see the Instructions for Form 5500-EZ. Certain foreign retirement plans are also required to file this form see instructions. Complete all entries in accordance with the instructions to the Form 5500-EZ. See instructions. Enter the unpaid minimum required...contributions for all years from Schedule SB Form 5500 line 40. Form 5500-EZ Annual Return of A One-Participant Owners/Partners and Their Spouses Retirement Plan or A Foreign Plan This form is required to be filed under section 6058 a of the Internal Revenue Code. Is this a defined benefit plan that is subject to minimum funding requirements If Yes complete Schedule SB Form 5500 and line 10a below. 11e Caution A penalty for the late or incomplete filing of this return will be assessed unless...reasonable cause is established. e Under penalties of perjury I declare that I have examined this return including if applicable any related Schedule MB Form 5500 or Schedule SB Form 5500 signed by an enrolled actuary and to the best of my knowledge and belief it is true correct and complete. Go to www*irs*gov/Form5500EZ for instructions and the latest information* Department of the Treasury Internal Revenue Service Part I OMB No* 1545-0956 This Form is Open to Public Inspection* Annual Return...Identification Information For the calendar plan year 2018 or fiscal plan year beginning MM/DD/YYYY and ending A This return is 1 the first return filed for the plan 3 the final return filed for the plan 2 an amended return 4 a short plan year return less than 12 months. B If filing under an extension of time check this box see instructions. C If this return is for a foreign plan check this box see instructions. D 1a. Basic Plan Information enter all requested information* 1b Three-digit plan...number PN Name of plan 1c Date plan first became effective MM/DD/YYYY 2a 2b Employer Identification Number EIN Employer s name Do not enter your Social Security Number Trade name of business if different from name of employer 2c Employer s telephone number In care of name 2d Business code see instructions Mailing address room apt. suite no. and street or P. O. box City or town state or province country and ZIP or foreign postal code if foreign see instructions 3a Plan administrator s name If...same as employer enter Same 3b Administrator s EIN If the employer s name the employer s EIN and/or the plan name has changed since the last return filed for this plan enter the employer s name and EIN the plan name and the plan number for the last return in the appropriate space provided* a 4c 4b EIN Plan name 4d PN 5a 1 Total number of participants at the beginning of the plan year. b 2 Total number of active participants at the end of the plan year. c Number of participants who terminated...employment during the plan benefits that were less than 100 vested.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 5500-EZ

How to edit IRS 5500-EZ

How to fill out IRS 5500-EZ

Instructions and Help about IRS 5500-EZ

How to edit IRS 5500-EZ

To edit the IRS 5500-EZ tax form, ensure you have the latest version of the form which can be obtained from the IRS website. Use pdfFiller to upload the form, where you can easily input the required changes. After making edits, be sure to save the edited document securely for submission or future reference.

How to fill out IRS 5500-EZ

Filling out the IRS 5500-EZ involves a few structured steps:

01

Gather the necessary information about your plan, including the plan name, year, and identifying details.

02

Complete all required sections of the form, providing accurate financial data.

03

Verify all entries for accuracy to avoid future penalties.

04

Sign and date the form before submitting it.

About IRS 5500-EZ 2020 previous version

What is IRS 5500-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 5500-EZ 2020 previous version

What is IRS 5500-EZ?

IRS 5500-EZ is a tax form designed for use by one-participant retirement plans that meet specific criteria. This form is primarily filed by owners of a business or a self-employed individual to report financial information about their retirement plans. It serves as a simplified reporting requirement compared to the full IRS Form 5500.

What is the purpose of this form?

The purpose of the IRS 5500-EZ is to satisfy the reporting requirements set by the Employee Retirement Income Security Act (ERISA). It provides the IRS and the Department of Labor with essential information about retirement plans, ensuring compliance and transparency in employee benefits administration.

Who needs the form?

The form is required to be filed by any qualified plan that falls under the one-participant retirement plan designation. This generally includes plans covering solely the business owner and their spouse, without additional participants. If you manage a larger plan with multiple participants, IRS Form 5500 would be necessary instead.

When am I exempt from filling out this form?

You may be exempt from filing the IRS 5500-EZ if your one-participant plan meets specific criteria, such as having less than $250,000 in assets at the end of the plan year, or if you are eligible for the IRS’ Form 5500-SF. Being exempt doesn’t alter your obligation to maintain records of the plan's operations and financials, even without filing.

Components of the form

The IRS 5500-EZ consists of several key sections, including identification information, financial information about the plan's assets and funding, as well as any additional notes that indicate compliance issues or exceptions. It is essential to complete all relevant sections to ensure accurate submission.

Due date

The due date for filing the IRS 5500-EZ is July 31st of the year following the end of the plan year. If this date falls on a weekend or holiday, the due date extends to the next business day. Late filings can incur penalties, so it is crucial to be aware of this deadline.

What are the penalties for not issuing the form?

Failing to file the IRS 5500-EZ can result in significant penalties imposed by the IRS, which can escalate to $1,100 per day of non-filing. Additionally, there may be consequences related to compliance enforcement, potentially affecting the tax status of your plan. Filing in a timely manner is therefore critical.

What information do you need when you file the form?

When filing the IRS 5500-EZ, you will need various pieces of information, including your plan's name, tax identification number, the number of participants, and financial statements such as assets and income. Preparing this documentation in advance will ensure a smoother filing process.

Is the form accompanied by other forms?

The IRS 5500-EZ is typically submitted independently; however, it may be beneficial to accompany it with additional schedules if your plan has specific reportable events or issues that need clarification. Always verify current IRS guidelines for comprehensive reporting requirements.

Where do I send the form?

The IRS 5500-EZ should be sent directly to the IRS at the appropriate address indicated in the instructions for the form. Be sure to check that you are using the latest mailing address, as this can change. Ensure that you send it via a method that provides delivery confirmation to avoid issues of non-receipt.

See what our users say