Get the free Retirement Planning Course

Show details

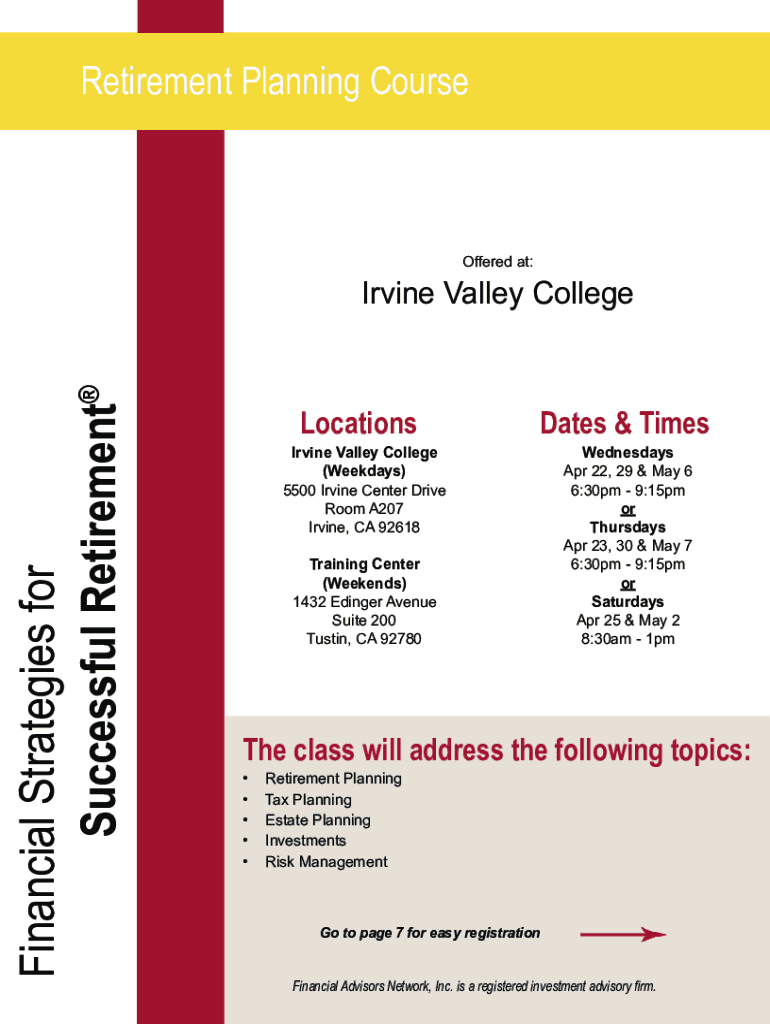

Retirement Planning CourseOffered at:Financial Strategies successful Retirement Irvine Valley CollegeLocationsIrvine Valley College (Weekdays) 5500 Irvine Center Drive Room A207 Irvine, CA 92618Dates

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement planning course

Edit your retirement planning course form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement planning course form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit retirement planning course online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit retirement planning course. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement planning course

How to fill out retirement planning course

01

Start by gathering all necessary financial information, including your current income, expenses, savings, investments, and debts.

02

Determine your retirement goals and objectives. Consider factors such as the age at which you plan to retire, desired lifestyle, and estimated retirement expenses.

03

Evaluate your current financial situation and determine any gaps between your current savings and your desired retirement savings. This will help you understand how much you need to save and invest in order to achieve your retirement goals.

04

Develop a retirement savings plan. Consider various retirement savings vehicles such as employer-sponsored retirement plans (e.g., 401(k) or pension plans), individual retirement accounts (IRAs), and other investment options.

05

Implement your retirement savings plan by regularly contributing to retirement accounts and investments. Consider automating contributions to ensure consistent savings.

06

Monitor and review your retirement plan regularly to track progress and make necessary adjustments. Consider consulting with a financial advisor to ensure your plan remains on track.

07

Continuously educate yourself about retirement planning strategies, investment options, and potential tax implications to make informed decisions.

08

Take advantage of any employer-sponsored retirement benefits, such as matching contributions or retirement planning resources, that may be available to you.

09

Consider seeking professional advice from a retirement planning specialist or financial advisor to ensure you are making the most appropriate decisions for your individual circumstances.

10

Review and update your retirement plan periodically as your financial situation and goals may change over time.

Who needs retirement planning course?

01

Individuals who are approaching retirement age and need help creating a solid retirement plan.

02

Young professionals who want to start saving for retirement early and maximize their retirement savings.

03

Individuals who are not confident in their current retirement savings strategy and need guidance to catch up.

04

People who have experienced significant life events, such as a job change, marriage, divorce, or inheritance, that may impact their retirement planning.

05

Individuals who want to ensure a comfortable and financially secure retirement by making informed decisions about savings, investments, and expected expenses.

06

New retirees who need assistance in managing their retirement funds and making the most of their savings.

07

Entrepreneurs and self-employed individuals who need help establishing retirement plans outside of traditional employer-sponsored options.

08

Anyone who wants to have peace of mind and confidence in their financial future by having a well-designed retirement plan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get retirement planning course?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the retirement planning course in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I edit retirement planning course on an iOS device?

Use the pdfFiller mobile app to create, edit, and share retirement planning course from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I edit retirement planning course on an Android device?

The pdfFiller app for Android allows you to edit PDF files like retirement planning course. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is retirement planning course?

A retirement planning course is an educational program designed to help individuals understand the financial, legal, and lifestyle aspects of planning for retirement.

Who is required to file retirement planning course?

Typically, individuals who are nearing retirement age or looking to plan their finances for retirement are encouraged to participate in a retirement planning course.

How to fill out retirement planning course?

To fill out a retirement planning course, individuals should complete any required registration forms, provide necessary financial information, and participate in course activities and discussions.

What is the purpose of retirement planning course?

The purpose of a retirement planning course is to educate participants on how to make informed decisions regarding their financial planning to ensure a secure and comfortable retirement.

What information must be reported on retirement planning course?

Participants may need to report information related to their current financial situation, future income sources, savings goals, and investment strategies.

Fill out your retirement planning course online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Planning Course is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.