Get the free Paycheck Protection Program: Loan Necessity Questionnaire ...

Show details

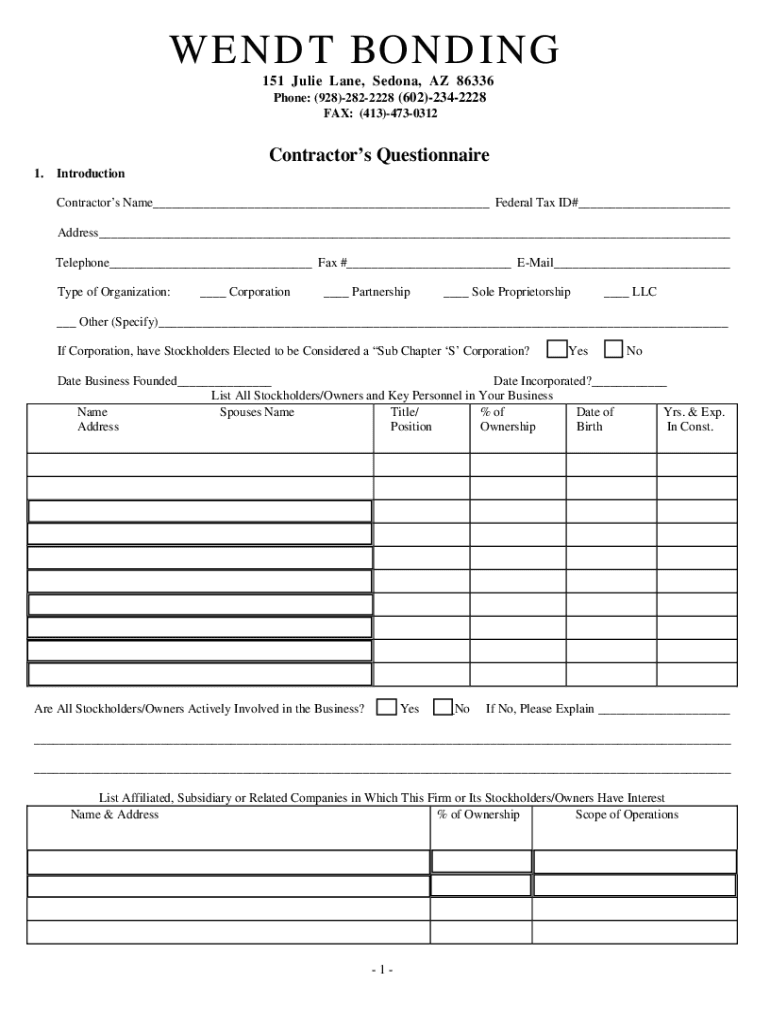

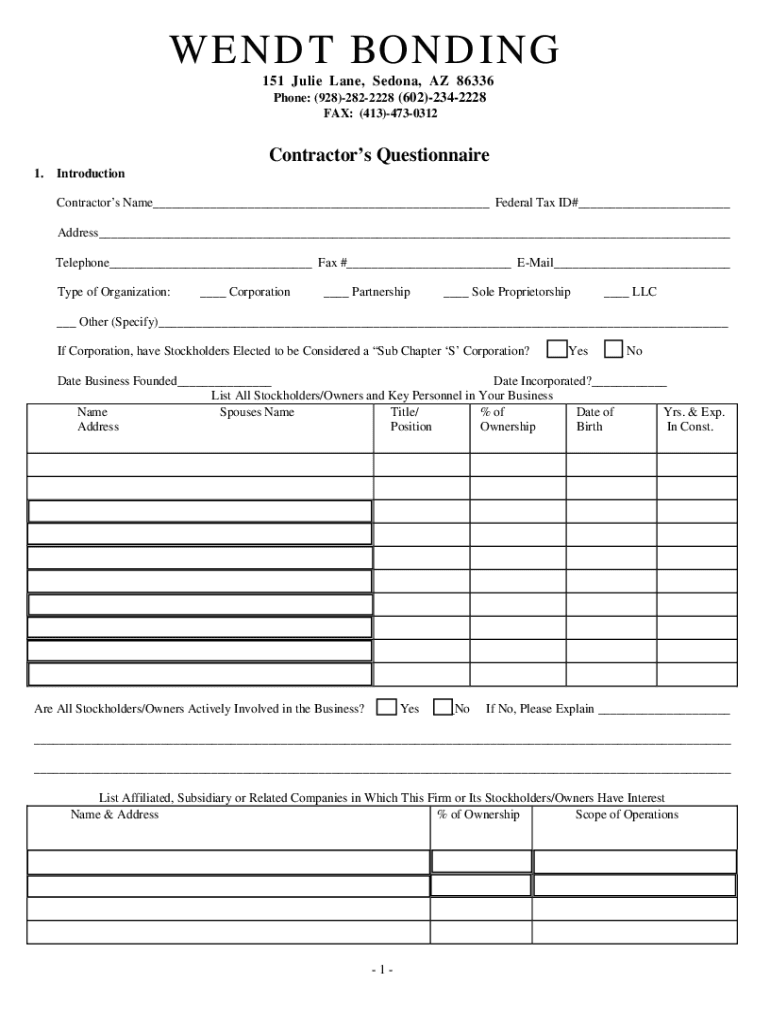

WENT BONDING 151 Julie Lane, Sedna, AZ 86336 Phone: (928)2822228 (602)2342228 FAX: (413)4730312Contractors Questionnaire 1. Introduction Contractors Name Federal Tax ID# Address Telephone Fax # Email

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign paycheck protection program loan

Edit your paycheck protection program loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your paycheck protection program loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit paycheck protection program loan online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit paycheck protection program loan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out paycheck protection program loan

How to fill out paycheck protection program loan

01

Step 1: Gather all the necessary information and documents required to fill out the paycheck protection program loan application.

02

Step 2: Visit the Small Business Administration's website and navigate to the paycheck protection program loan application portal.

03

Step 3: Create an account or log in to an existing account on the paycheck protection program loan application portal.

04

Step 4: Fill out the application form with accurate information, including the borrower's personal details, business information, loan amount requested, and other relevant details.

05

Step 5: Provide the required supporting documents, such as payroll reports, tax filings, and bank statements, to validate the loan application.

06

Step 6: Review the application thoroughly to ensure all information is accurate and complete.

07

Step 7: Submit the completed application and wait for confirmation or further instructions from the Small Business Administration.

08

Step 8: Stay in touch with the lender or the Small Business Administration for any additional documentation or information they may require during the loan processing period.

09

Step 9: Once approved, carefully read and understand the terms and conditions of the loan agreement before accepting the funds.

10

Step 10: Utilize the paycheck protection program loan funds according to the guidelines provided and keep track of the eligible expenses for potential loan forgiveness.

Who needs paycheck protection program loan?

01

Small business owners who have been financially impacted by the COVID-19 pandemic and are struggling to cover payroll costs and essential business expenses.

02

Self-employed individuals, independent contractors, gig economy workers, and sole proprietors who have experienced a significant decline in income due to the pandemic.

03

Non-profit organizations and tribal businesses that have been adversely affected by the economic crisis caused by the pandemic.

04

Businesses located in low-income communities or historically underutilized business zones (HUBZones) that require financial assistance to sustain their operations.

05

Businesses with less than 500 employees (including full-time, part-time, and those employed on other bases), as well as certain businesses with more than 500 employees that meet specific criteria.

06

Employers who commit to using the loan funds to retain employees and maintain salary levels, thus ensuring the loan forgiveness eligibility.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit paycheck protection program loan online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your paycheck protection program loan to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for signing my paycheck protection program loan in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your paycheck protection program loan directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete paycheck protection program loan on an Android device?

Complete your paycheck protection program loan and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is paycheck protection program loan?

The Paycheck Protection Program (PPP) loan is a loan designed to provide a direct incentive for small businesses to keep their workers on the payroll during the COVID-19 pandemic.

Who is required to file paycheck protection program loan?

Small businesses, including sole proprietorships, independent contractors, and self-employed individuals, are required to file for the Paycheck Protection Program loan.

How to fill out paycheck protection program loan?

To fill out a Paycheck Protection Program loan application, a business must complete the application form provided by the lender, including details such as the business's average monthly payroll costs, business type, and personal information of the applicant.

What is the purpose of paycheck protection program loan?

The purpose of the Paycheck Protection Program loan is to help small businesses maintain their workforce during the economic disruption caused by the COVID-19 pandemic by providing funds for payroll, rent, utilities, and other essential expenses.

What information must be reported on paycheck protection program loan?

Applicants must report information such as the number of employees, payroll costs, number of self-employed individuals, business structure, and how the loan funds will be used.

Fill out your paycheck protection program loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Paycheck Protection Program Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.