NY DTF CT-13 2020 free printable template

Show details

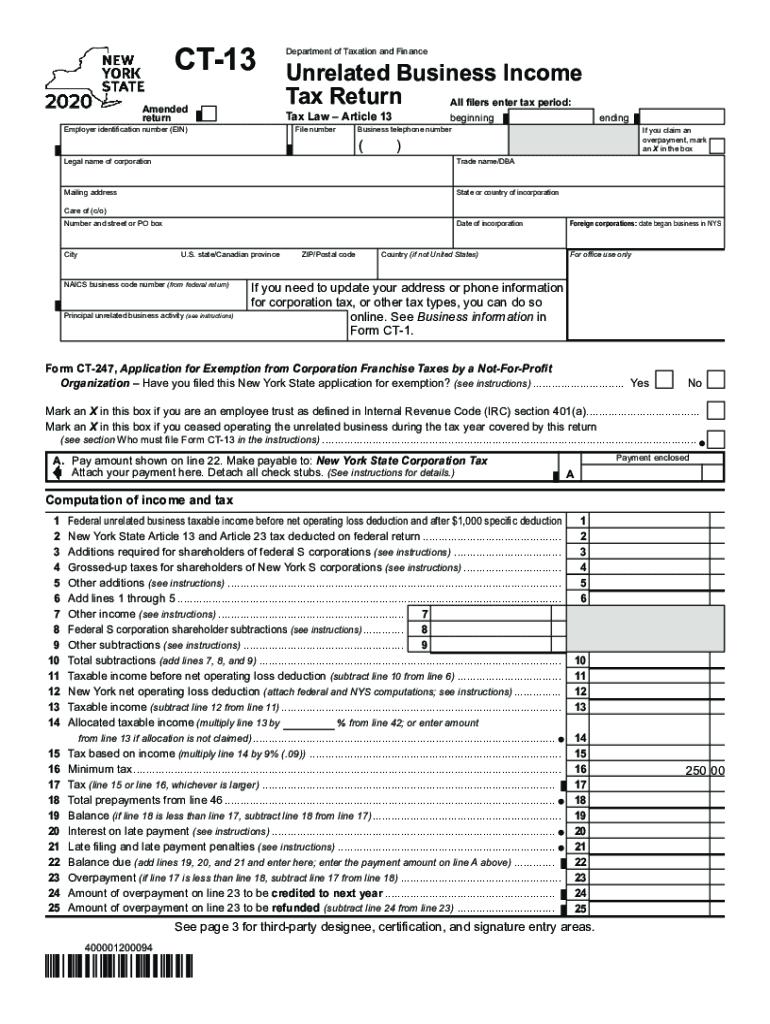

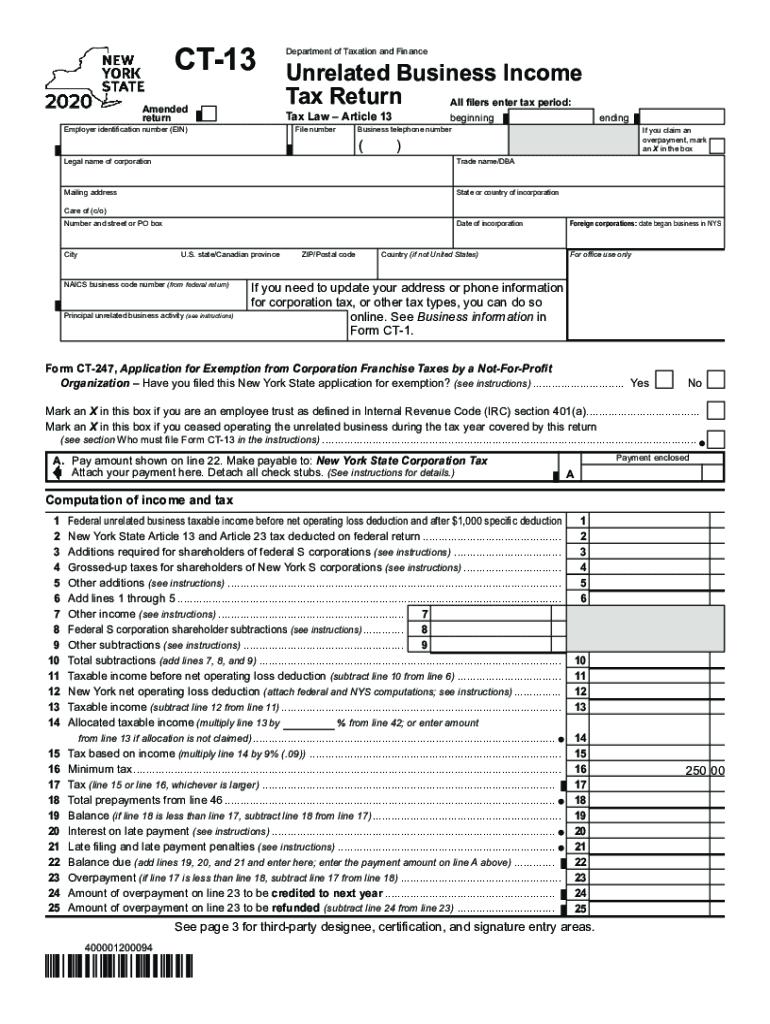

See section Who must file Form CT-13 in the instructions. A. Pay amount shown on line 22. Make payable to New York State Corporation Tax Attach your payment here. 400001180094 250 00 Page 2 of 3 CT-13 2018 Have you been audited by the Internal Revenue Service in the past 5 years Yes Federal return was filed on 990-T Other If Yes list years Attach a complete copy of your federal return. Schedule A Unrelated business allocation If you did not maintain a regular place of business outside New...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF CT-13

Edit your NY DTF CT-13 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF CT-13 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF CT-13 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit NY DTF CT-13. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF CT-13 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF CT-13

How to fill out NY DTF CT-13

01

Obtain the NY DTF CT-13 form from the New York State Department of Taxation and Finance website or relevant office.

02

Read the instructions included with the form carefully to understand the requirements.

03

Fill in the taxpayer information section, including your name, address, and taxpayer identification number.

04

Indicate the type of tax you are reporting, along with the period for which you are filing.

05

Complete the income and expense sections accurately, providing supporting documentation if necessary.

06

Review all entries for accuracy and completeness before signing and dating the form.

07

Submit the completed form by the due date either electronically or by mailing it to the designated address.

Who needs NY DTF CT-13?

01

Individuals or businesses who have gain or loss from the sale of a business asset.

02

Taxpayers who need to report certain types of income for state tax purposes.

03

Anyone required to claim a credit for taxes paid to another jurisdiction.

Fill

form

: Try Risk Free

People Also Ask about

What is the New York CT 3 form?

Corporate tax filing requirements. All New York C corporations subject to tax under Tax Law Article 9-A must file using the following returns, as applicable: Form CT-3, General Business Corporation Franchise Tax Return.

What is the NYS DTF CT charge?

What is NYS DTF sales tax? The City Sales Tax rate is 4.5%, NY State Sales and Use Tax is 4% and the Metropolitan Commuter Transportation District surcharge of 0.375% for a total Sales and Use Tax of 8.875 percent.

What does NYS DTF CT tax payment mean?

What does NYS DTF CT mean? New York State Department of Tax Finance. If youre seeing it as an ACH withdrawal from your checking, its a tax payment. Possibly your NYS Sales Tax, but it could be some other tax that NYS is grabbing.

What is form CT 225 A?

Form CT-225-A provides a column A for the group designated agent (Article 9-A) or parent (Article 33) and a total group member column B for the other members of the group (if the combined group consists of more than one member, then the amounts in column B are obtained from Forms CT-225-A/B).

Where can I get Connecticut state income tax forms?

Request a U.S. mailed copy of a CONNECTICUT TAX FORM from the CT DRS: Click here. You can also call the CT DRS, Monday - Friday, 8:30 a.m. - 4:30 p.m. at 860-297-5962 to order forms by U.S. mail. Request a U.S. mailed copy of a FEDERAL TAX FORM from the IRS: Click here.

How do I cancel my NYS tax payment?

To cancel your scheduled monthly payment, you must call us at 518-457-5772 during regular business hours and speak to a representative. Please note, we submit the request for your monthly payment to your bank three days prior to your due date and it cannot be canceled once submitted.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NY DTF CT-13?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the NY DTF CT-13 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an eSignature for the NY DTF CT-13 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your NY DTF CT-13 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

Can I edit NY DTF CT-13 on an Android device?

You can make any changes to PDF files, like NY DTF CT-13, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is NY DTF CT-13?

NY DTF CT-13 is a form used by the New York State Department of Taxation and Finance for reporting the credit for qualified solar electric generating equipment.

Who is required to file NY DTF CT-13?

Taxpayers who have installed qualified solar electric generating equipment and are claiming a credit against their personal income tax or business tax are required to file NY DTF CT-13.

How to fill out NY DTF CT-13?

To fill out NY DTF CT-13, taxpayers must provide information about the solar equipment installation, including the qualified costs, the type of system installed, and other relevant details as specified in the form's instructions.

What is the purpose of NY DTF CT-13?

The purpose of NY DTF CT-13 is to allow taxpayers to claim a tax credit for the installation of qualified solar electric generating equipment, promoting the use of renewable energy sources.

What information must be reported on NY DTF CT-13?

The information that must be reported on NY DTF CT-13 includes the taxpayer's name and identification number, installation details, the nature of the solar equipment, costs related to installation, and any other applicable information as required by the tax law.

Fill out your NY DTF CT-13 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF CT-13 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.