Get the free Council Tax - Change of Circumstances - Tunbridge Wells - tunbridgewells gov

Show details

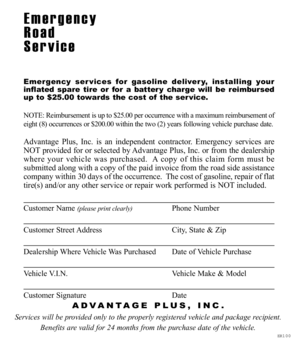

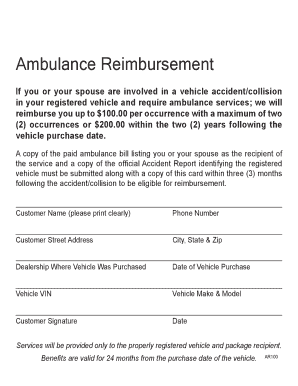

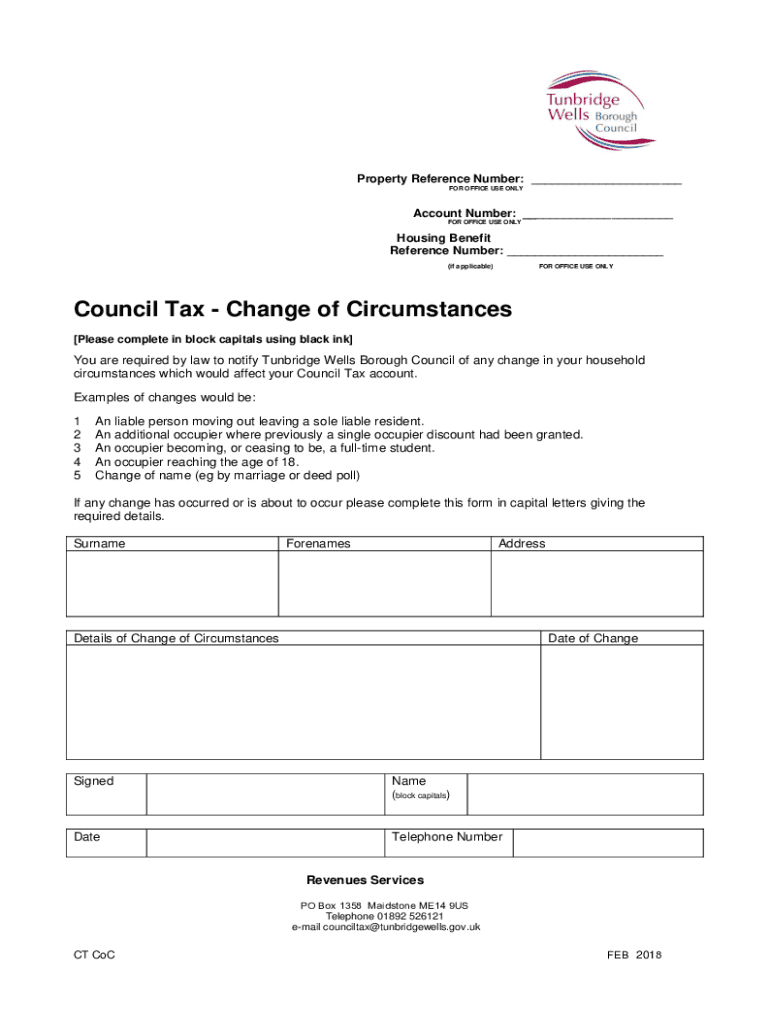

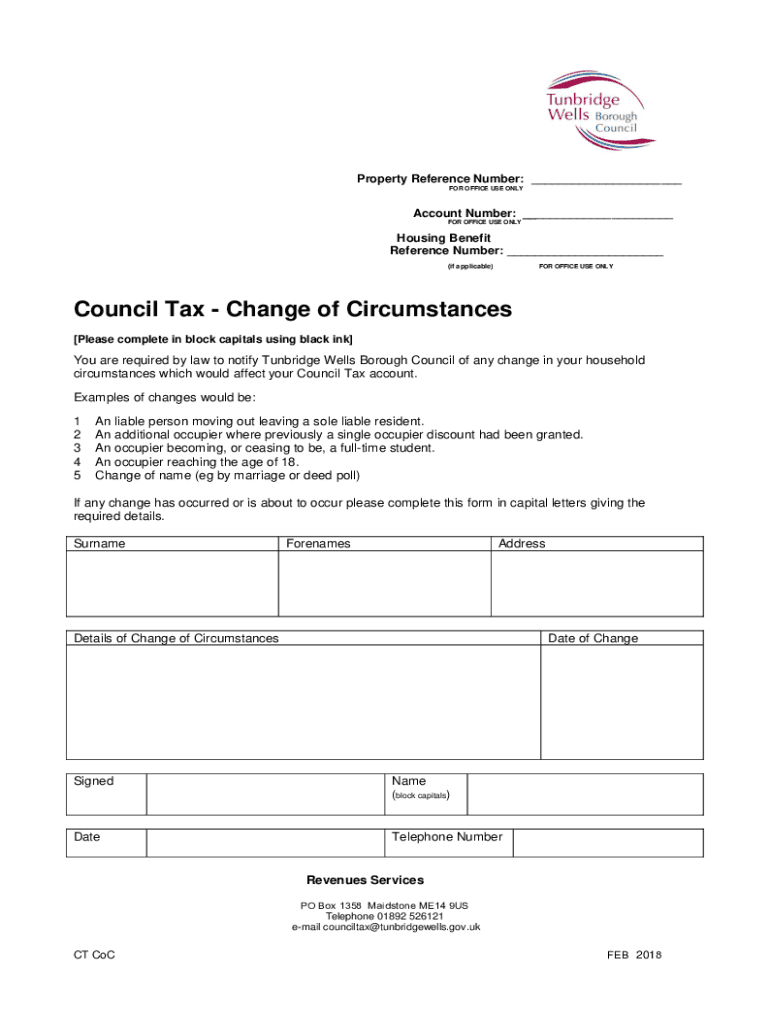

Property Reference Number: FOR OFFICE USE ONLYAccount Number: FOR OFFICE USE ONLYHousing Benefit Reference Number: (if applicable)FOR OFFICE USE ONLYCouncil Tax Change of Circumstances Please complete

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign council tax - change

Edit your council tax - change form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your council tax - change form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit council tax - change online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit council tax - change. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out council tax - change

How to fill out council tax - change

01

To fill out council tax - change form, follow these steps:

02

Start by obtaining the council tax - change form. This can usually be done by contacting your local council or visiting their website.

03

Read the instructions carefully to ensure you understand the process and the information you need to provide.

04

Fill in your personal details, including your name, address, and contact information.

05

Clearly indicate the change you want to make in the appropriate section of the form. This could include changes in occupancy, discounts or exemptions, or changes in your financial circumstances.

06

Provide supporting documents, if required. This could include proof of residency, income, or any other documentation relevant to the change you are requesting.

07

Review the completed form and ensure all the information is accurate and complete.

08

Submit the form to the designated council office. You may need to mail it, drop it off in person, or submit it electronically, depending on the council's preferred method.

09

Keep a copy of the submitted form for your records.

10

Wait for the council to process your request. They may contact you for further information or clarification if necessary.

11

Once the change has been processed, you will receive confirmation from the council, and any adjustments to your council tax will be reflected in future bills.

Who needs council tax - change?

01

Council tax - change is needed by individuals or households who experience changes in their circumstances that affect their council tax liability or entitlement. Some common scenarios where council tax - change may be required include:

02

- Moving into a new property

03

- Moving out of a property

04

- Changing the number of people living in a property

05

- Changes in income or financial circumstances

06

- Changes in eligibility for discounts or exemptions

07

- Changes in entitlement to certain benefits or allowances

08

It is important to contact your local council and inform them of any changes to ensure your council tax is calculated correctly and you are not overpaying or underpaying.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find council tax - change?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific council tax - change and other forms. Find the template you need and change it using powerful tools.

How do I fill out the council tax - change form on my smartphone?

Use the pdfFiller mobile app to fill out and sign council tax - change on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How can I fill out council tax - change on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your council tax - change. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is council tax - change?

Council tax - change refers to the process of updating or modifying the council tax information regarding a property, such as changes in occupancy, ownership, or exemptions.

Who is required to file council tax - change?

Homeowners, tenants, and individuals responsible for property duties are required to file council tax - change when there are alterations in their property status.

How to fill out council tax - change?

To fill out council tax - change, individuals need to access the relevant local council's website, complete the provided forms with accurate information, and submit them according to the council's instructions.

What is the purpose of council tax - change?

The purpose of council tax - change is to ensure that the local council has up-to-date information for accurate billing and allocation of local services in response to changes in property ownership or occupancy.

What information must be reported on council tax - change?

Information that must be reported includes the name and contact details of the occupants or owners, the date of the change, and details about the property and its current status.

Fill out your council tax - change online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Council Tax - Change is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.