Get the free Mortgage Commitment Letter: An Exciting StepQuicken Loans

Show details

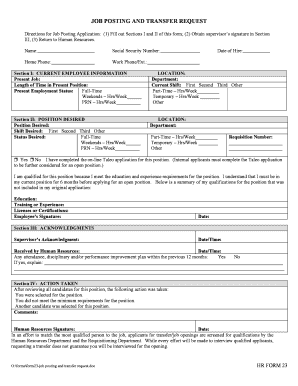

Commitment Form A program is only as good as your commitment to it. If you are ready to begin, print the following commitment letter, and post it wherever you will see it daily. It will serve as a

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage commitment letter an

Edit your mortgage commitment letter an form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage commitment letter an form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage commitment letter an online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit mortgage commitment letter an. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage commitment letter an

How to fill out mortgage commitment letter an

01

To fill out a mortgage commitment letter, follow these steps:

02

Start by entering the date at the top of the letter.

03

Include your full name, contact information, and address.

04

Address the letter to the appropriate recipient, such as the mortgage lender or loan officer.

05

Begin the letter with a formal salutation, such as 'Dear [Recipient's Name],' or 'To whom it may concern.'

06

Clearly state the purpose of the letter and your intention to commit to the mortgage agreement.

07

Provide relevant details about the mortgage, such as the loan amount, interest rate, and repayment terms.

08

Include any additional documentation or supporting materials required by the lender.

09

Express your willingness to provide any further information or documentation necessary for the completion of the mortgage process.

10

End the letter with a polite closing, such as 'Sincerely,' or 'Thank you for your attention.'

11

Sign the letter using your full name and include your contact information.

12

Proofread the letter for any errors or typos before sending it.

13

Send the filled-out mortgage commitment letter to the designated recipient via mail, email, or any other preferred method.

14

Note: It's always a good idea to consult with a professional or seek legal advice when necessary during the mortgage application process.

Who needs mortgage commitment letter an?

01

A mortgage commitment letter is needed by individuals or entities involved in the mortgage application process. This includes:

02

- Homebuyers who are applying for a mortgage to purchase a property.

03

- Borrowers who are refinancing their existing mortgage.

04

- Real estate investors who are seeking financing for an investment property.

05

- Builders or developers who require a mortgage to fund construction projects.

06

- Mortgage brokers or loan officers who facilitate the mortgage application process for their clients.

07

A mortgage commitment letter serves as a formal declaration of commitment to the mortgage terms and conditions and is typically required by lenders as part of the loan approval process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in mortgage commitment letter an?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your mortgage commitment letter an to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I sign the mortgage commitment letter an electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your mortgage commitment letter an and you'll be done in minutes.

How do I fill out mortgage commitment letter an using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign mortgage commitment letter an and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is mortgage commitment letter an?

A mortgage commitment letter is a document issued by a lender stating that they are willing to lend a specified amount of money to a borrower under certain conditions.

Who is required to file mortgage commitment letter an?

Typically, the lender is responsible for sending the mortgage commitment letter to the borrower, but in some cases, the borrower may need to provide it to the seller in a real estate transaction.

How to fill out mortgage commitment letter an?

To fill out a mortgage commitment letter, the lender must provide details such as the borrower's name, property address, loan amount, interest rate, terms of the loan, and any conditions that must be met.

What is the purpose of mortgage commitment letter an?

The purpose of a mortgage commitment letter is to provide assurance to the borrower that they will receive the loan, as long as certain conditions are satisfied, and to outline the terms of that loan.

What information must be reported on mortgage commitment letter an?

The commitment letter must report the loan amount, interest rate, duration of the loan, property address, borrower’s details, and any contingencies or conditions that apply.

Fill out your mortgage commitment letter an online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Commitment Letter An is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.