Get the free CREDIT UNIONS CHARTERED IN COLORADO

Show details

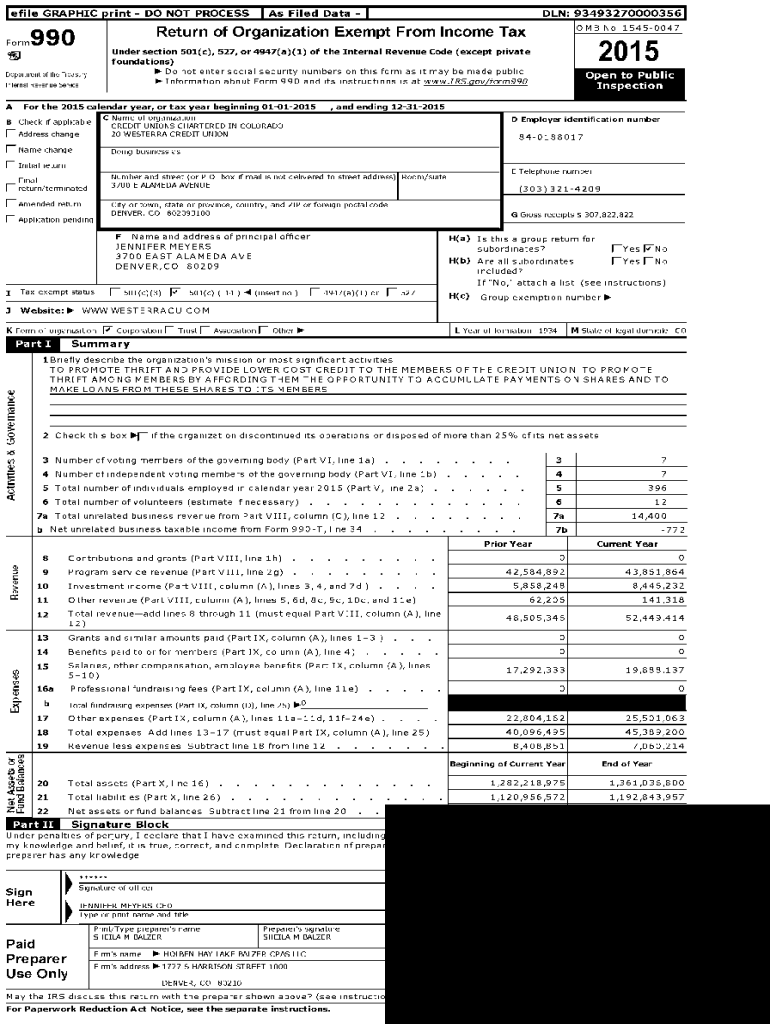

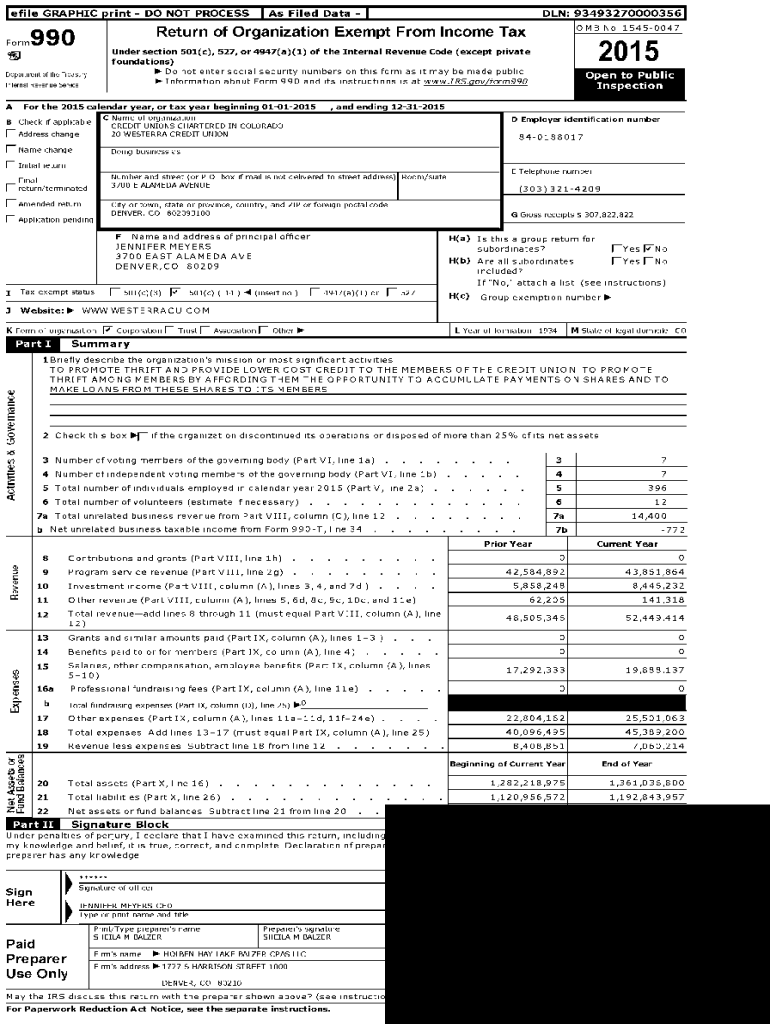

Defile GRAPHIC print DO NOT PROCESS990I As Filed Data IDLE: 934932700003561 OMB No 15450047Return of Organization Exempt From Income TaxForm2015Under section 501 (c), 527, or 4947 (a)(1) of the Internal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit unions chartered in

Edit your credit unions chartered in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit unions chartered in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit unions chartered in online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit credit unions chartered in. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit unions chartered in

How to fill out credit unions chartered in

01

To fill out credit unions chartered in, you can follow these steps:

02

Gather all necessary information, such as the credit union's name, address, and contact information.

03

Review the application requirements and forms provided by the regulatory authority responsible for chartering credit unions in your jurisdiction.

04

Complete the application forms accurately and thoroughly, ensuring all required fields are filled out.

05

Attach any supporting documents or information that may be required, such as financial statements, business plans, or organizational documents.

06

Review and double-check all the information provided in the application before submitting it.

07

Submit the completed application and any required fees to the regulatory authority in charge of chartering credit unions.

08

Await a response from the regulatory authority regarding the status of your application.

09

If approved, follow any additional instructions provided by the regulatory authority to finalize the chartering process.

10

It is recommended to consult with legal or financial professionals specializing in credit unions to ensure compliance with all applicable laws and regulations.

Who needs credit unions chartered in?

01

Credit unions chartered in are mainly needed by individuals and organizations looking to establish a financial cooperative to serve a specific group or community.

02

Examples of who may need credit unions chartered in include:

03

- Employees of a particular company or industry seeking to create a financial institution tailored to their needs.

04

- Residents of a specific neighborhood or community desiring a local banking option that focuses on their interests and concerns.

05

- Students, alumni, or faculty members of a university or educational institution wanting a credit union dedicated to supporting their financial needs.

06

- Any group of individuals with common affiliations, interests, or goals that can benefit from the services and benefits offered by a credit union.

07

Credit unions chartered in can provide personalized banking services, competitive interest rates, lower fees, and community-focused initiatives, making them a valuable option for those seeking an alternative to traditional banks.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my credit unions chartered in directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your credit unions chartered in and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I fill out credit unions chartered in using my mobile device?

Use the pdfFiller mobile app to fill out and sign credit unions chartered in on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete credit unions chartered in on an Android device?

Complete credit unions chartered in and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is credit unions chartered in?

Credit unions are usually chartered in accordance with either federal or state laws, which authorize them to operate as cooperative financial institutions.

Who is required to file credit unions chartered in?

Credit unions that are receiving or maintaining their charter are required to file necessary documentation with the respective regulatory authority.

How to fill out credit unions chartered in?

Filling out the application for a credit union charter involves completing specific forms provided by the regulatory authority, providing required documentation, and demonstrating compliance with legal requirements.

What is the purpose of credit unions chartered in?

The purpose of chartering credit unions is to allow them to operate as not-for-profit entities that provide financial services to their members, promoting financial inclusion and community development.

What information must be reported on credit unions chartered in?

Credit unions must report information including their financial condition, member services provided, compliance with regulations, and any changes in governance or membership structure.

Fill out your credit unions chartered in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Unions Chartered In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.