Get the free Non-Tax Payment Offset Hardship Refund Request. Required ...

Show details

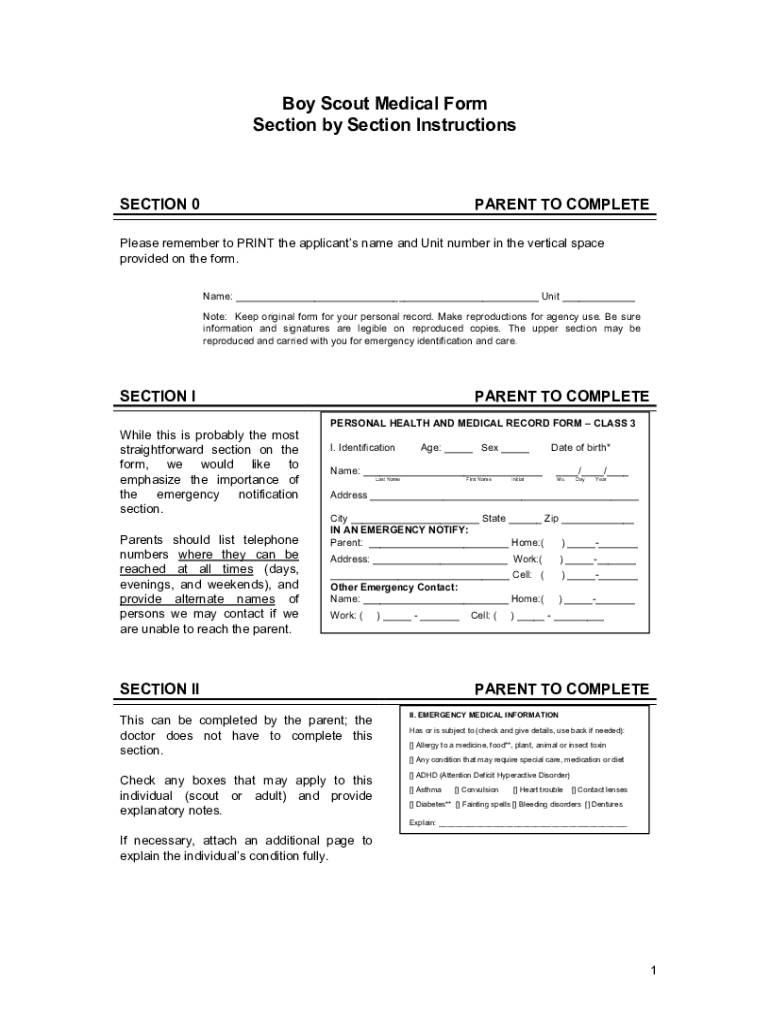

Boy Scout Medical Form Section by Section InstructionsSECTION 0PARENT TO COMPLETEPlease remember to PRINT the applicants name and Unit number in the vertical space provided on the form. Name: Unit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-tax payment offset hardship

Edit your non-tax payment offset hardship form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-tax payment offset hardship form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing non-tax payment offset hardship online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit non-tax payment offset hardship. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-tax payment offset hardship

How to fill out non-tax payment offset hardship

01

To fill out a non-tax payment offset hardship form, follow these steps:

02

Obtain the non-tax payment offset hardship form from the appropriate government agency or department.

03

Read the instructions and information provided on the form carefully.

04

Fill in your personal details, such as your name, contact information, and identification number.

05

Provide detailed information about the non-tax payment offset you are experiencing hardship with.

06

Explain the reasons for your hardship and any supporting evidence you may have.

07

If required, attach any necessary supporting documents, such as financial statements or medical reports.

08

Review the completed form and make sure all information is accurate and complete.

09

Submit the form to the designated government agency or department either by mail or through an online submission portal.

10

Keep a copy of the completed form and any supporting documents for your records.

11

Follow up with the government agency or department to ensure your non-tax payment offset hardship claim is being processed.

Who needs non-tax payment offset hardship?

01

Individuals or businesses who are experiencing financial hardship due to non-tax payment offsets may need to fill out the non-tax payment offset hardship form.

02

This form is typically required by government agencies or departments to assess the eligibility of individuals or businesses for potential relief or assistance programs.

03

Some examples of non-tax payment offsets that may require the completion of a non-tax payment offset hardship form include unpaid fines, penalties, or other government-related debts.

04

People or businesses who are unable to pay these offsets due to financial difficulties can utilize this form to provide information about their situation and potentially receive assistance or relief.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit non-tax payment offset hardship in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your non-tax payment offset hardship, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the non-tax payment offset hardship in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your non-tax payment offset hardship right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit non-tax payment offset hardship on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute non-tax payment offset hardship from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is non-tax payment offset hardship?

Non-tax payment offset hardship refers to a situation where individuals face financial difficulties due to offsets against their federal payments (like social security or federal benefits) for non-tax debts, leading to hard financial situations.

Who is required to file non-tax payment offset hardship?

Individuals who are experiencing significant financial hardship due to non-tax payment offsets are required to file for non-tax payment offset hardship to seek relief from these offsets.

How to fill out non-tax payment offset hardship?

To fill out the non-tax payment offset hardship application, individuals must provide personal information, details about their financial situation, the nature of the hardship, and supporting documentation to substantiate their claims.

What is the purpose of non-tax payment offset hardship?

The purpose of non-tax payment offset hardship is to provide relief to individuals who are negatively impacted by the offsetting of their federal payments due to non-tax debts, allowing them to continue receiving necessary benefits.

What information must be reported on non-tax payment offset hardship?

On the non-tax payment offset hardship form, individuals must report their personal information, the type and amount of debt, details of the hardship situation, and any other financial information relevant to their case.

Fill out your non-tax payment offset hardship online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Tax Payment Offset Hardship is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.