Get the free Changein Accounting Period - Foundation Center

Show details

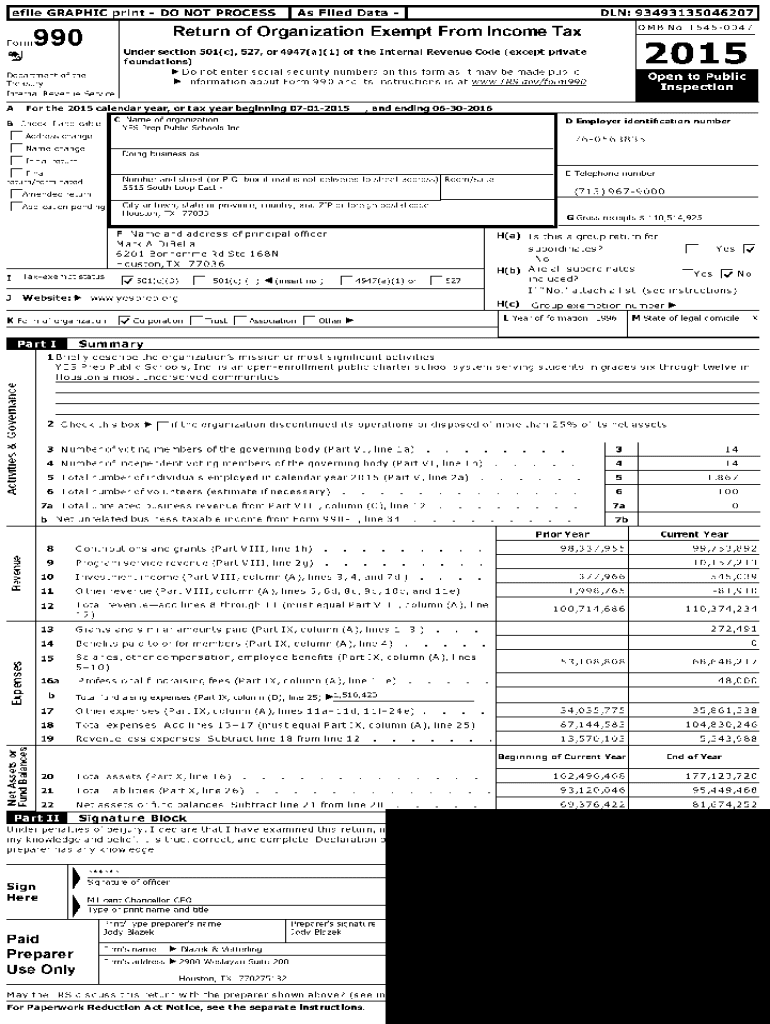

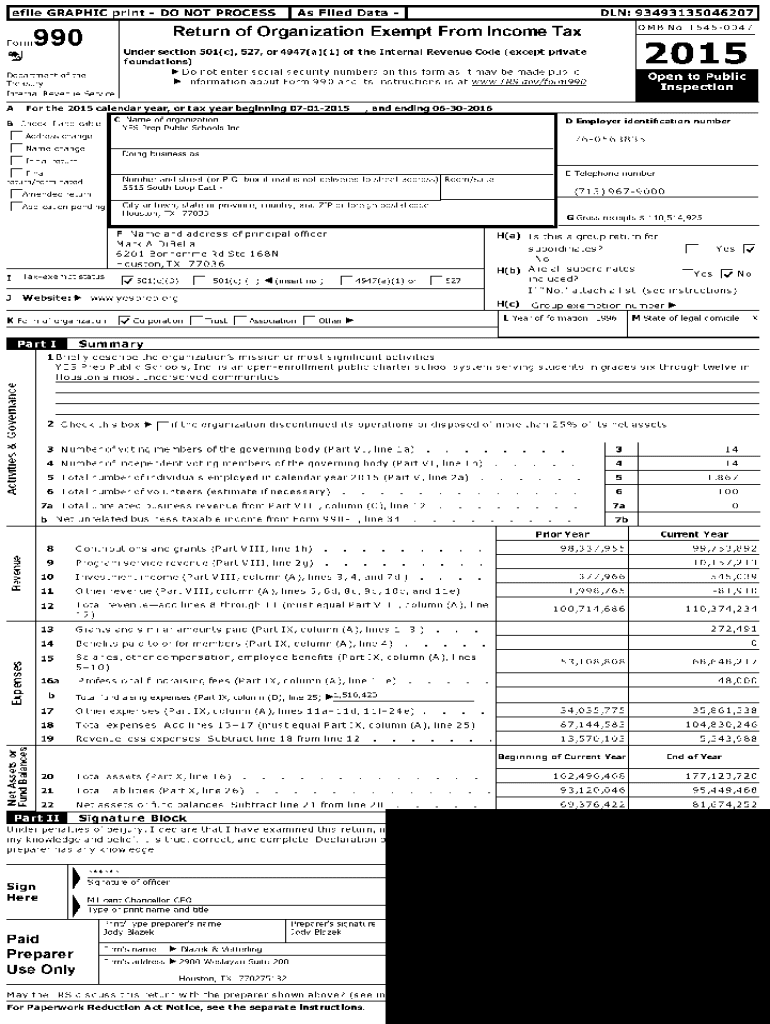

Le file GRAPHIC print DO NOT Processor As Filed Data IDLE: 93493135046207 OMB No 15450047Return of Organization Exempt From Income Tax990Under section 501 (c), 527, or 4947 (a)(1) of the Internal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign changein accounting period

Edit your changein accounting period form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your changein accounting period form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing changein accounting period online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit changein accounting period. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out changein accounting period

How to fill out changein accounting period

01

To fill out the change in accounting period, follow these steps:

02

Determine the reason for the change in accounting period. It could be due to business restructuring, change in fiscal year-end, or other valid reasons.

03

Review the current accounting records and financial statements to ensure accuracy and completeness.

04

Prepare an application or request for a change in accounting period. This may involve completing a specific form provided by the tax authority or writing a formal letter with all the necessary details.

05

Include a detailed explanation of the reason for the change and any supporting documents, such as financial statements, tax returns, or legal documentation.

06

Submit the application or request to the relevant tax authority or governing body responsible for approving accounting period changes.

07

Await a response from the tax authority or governing body. They may request additional information or documentation to support the change.

08

Once the change in accounting period is approved, update the books and records accordingly. This includes adjusting the financial statements and accounting records to reflect the new accounting period's start and end dates.

09

Inform all relevant parties, such as shareholders, stakeholders, and financial institutions, about the change in accounting period to ensure alignment and accurate reporting.

10

Maintain proper documentation of the change, including copies of the approval, updated financial statements, and any correspondence related to the change.

11

Continuously monitor and comply with any additional reporting or filing requirements imposed by the tax authority or governing body as a result of the change in accounting period.

Who needs changein accounting period?

01

The change in accounting period may be needed by various entities or individuals, including:

02

- Businesses undergoing restructuring or changes in ownership.

03

- Companies looking to align their fiscal year-end with the end of a specific industry's peak season or to conform to industry norms.

04

- Startups or newly established businesses that wish to align their fiscal year-end with the calendar year.

05

- Companies experiencing significant changes in their business operations or financial reporting requirements.

06

- Entities seeking to optimize tax planning strategies or manage financial performance more effectively.

07

- Organizations undergoing mergers, acquisitions, or other significant corporate transactions.

08

- Businesses operating in countries or regions with specific regulations or requirements related to accounting period changes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit changein accounting period on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing changein accounting period right away.

Can I edit changein accounting period on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign changein accounting period on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Can I edit changein accounting period on an Android device?

You can make any changes to PDF files, like changein accounting period, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is change in accounting period?

A change in accounting period refers to a modification in the reporting time frame that a business uses to prepare its financial statements. This could involve changing from a calendar year to a fiscal year or altering the length of the reporting period.

Who is required to file change in accounting period?

Taxpayers who wish to change their accounting period from one method to another or from one year-end to another are required to file a change in accounting period. This generally applies to businesses that follow specific tax regulations as dictated by the IRS.

How to fill out change in accounting period?

To fill out a change in accounting period, taxpayers typically need to file Form 1128 with the IRS. This form requires details about the current accounting period, the desired accounting period, and the reason for the change.

What is the purpose of change in accounting period?

The purpose of a change in accounting period is to better align the accounting practices of a business with its operational or reporting needs, provide consistency in financial reporting, or gain tax advantages.

What information must be reported on change in accounting period?

The information that must be reported includes the current accounting period, the new accounting period to be adopted, the effective date of the change, a description of the reason for the change, and any relevant financial statements.

Fill out your changein accounting period online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Changein Accounting Period is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.