Get the free Short Form 2017 - Foundation Center

Show details

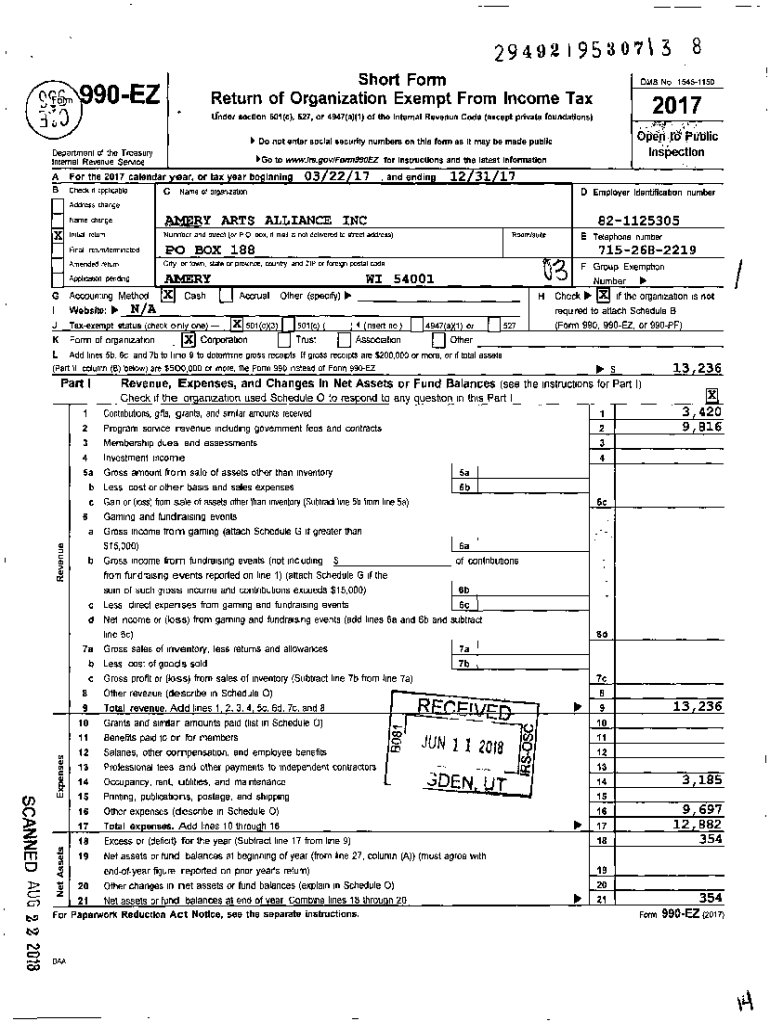

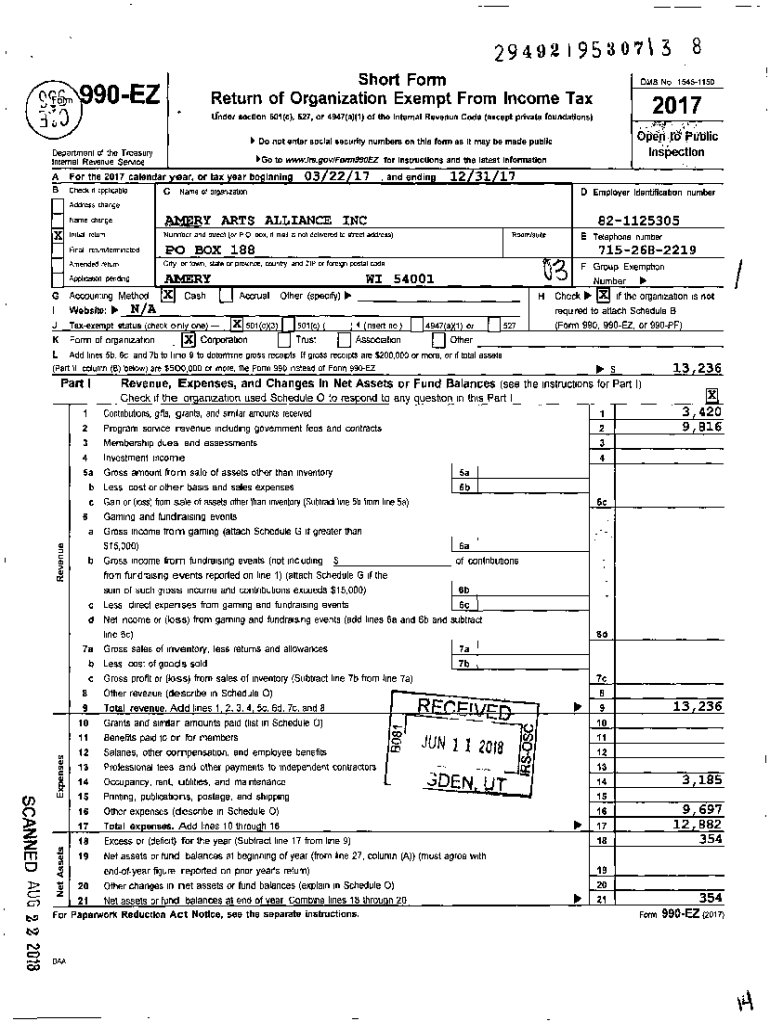

29492 f 953071 3 F, 190EZShort Form Return of Organization Exempt From Income Tax OMB No 154511502017t)under section 601(c), 627, or 4947 (a)(1) of the Internal Revenue Code (except private foundations).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign short form 2017

Edit your short form 2017 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your short form 2017 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing short form 2017 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit short form 2017. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out short form 2017

How to fill out short form 2017

01

Start by obtaining a copy of the short form 2017. This can usually be found online on the official government website or you can visit your nearest tax office to pick up a physical copy.

02

Begin by providing your personal information at the top of the form. This includes your full name, Social Security number, address, and contact information.

03

If applicable, fill out the information regarding your spouse and dependents.

04

Move on to the income section. This is where you will report your earnings for the year, including wages, salaries, tips, and any other sources of income.

05

Deduct any eligible expenses or deductions from your income. These may include medical expenses, mortgage interest, or student loan interest, among others.

06

Calculate your taxable income by subtracting the deductions from your total income.

07

Report any tax credits or payments you've already made throughout the year.

08

Determine your final tax liability or refund by using the tax tables or tax software provided by the government.

09

Sign and date the form. If filing jointly, make sure your spouse also signs.

10

Make a copy of the completed form for your records and submit the original to the appropriate tax authority.

Who needs short form 2017?

01

The short form 2017 is typically used by individuals and families with simple tax situations. It is designed for taxpayers who have a straightforward financial situation and do not require the use of itemized deductions.

02

Anyone who meets the following criteria may be eligible to use the short form 2017:

03

- Single individuals or married couples filing jointly with no dependents

04

- Individuals or couples who take the standard deduction rather than itemizing deductions

05

- Taxpayers who have only one job, have no self-employment income, and do not receive income from rental properties or investments

06

- Individuals or couples who have minimal or no additional sources of income or deductions

07

It is important to note that eligibility for using the short form may vary depending on the specific tax laws in your country. It is recommended to consult with a tax professional or refer to the official government guidelines to determine if you qualify for using the short form 2017.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit short form 2017 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including short form 2017, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send short form 2017 to be eSigned by others?

When you're ready to share your short form 2017, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I complete short form 2017 on an Android device?

Use the pdfFiller Android app to finish your short form 2017 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is short form - foundation?

The short form - foundation refers to a simplified tax reporting form used by certain foundations to provide the IRS with essential financial information.

Who is required to file short form - foundation?

Typically, small private foundations, which meet specific criteria regarding assets and income, are required to file the short form - foundation.

How to fill out short form - foundation?

To fill out the short form - foundation, you need to provide accurate financial data, including income, expenses, and distribution information, as outlined in the form's instructions.

What is the purpose of short form - foundation?

The purpose of the short form - foundation is to simplify the reporting process for small foundations, ensuring compliance with IRS requirements while reducing administrative burden.

What information must be reported on short form - foundation?

The short form - foundation must report information such as total income, expenses, grants made, and net assets, along with necessary schedules as required.

Fill out your short form 2017 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Short Form 2017 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.