Get the free Corporate Tax Conference - LexisNexis - lexisnexis com

Show details

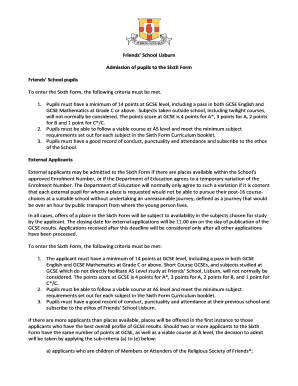

Early bird expires 23rd July CPD points applicable Book 2 and 3rd attends FREE! Corporate Tax Conference At the threshold of tax competitiveness for corporate Australia: Gaining strategic advantage

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign corporate tax conference

Edit your corporate tax conference form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your corporate tax conference form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit corporate tax conference online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit corporate tax conference. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out corporate tax conference

How to fill out a corporate tax conference?

01

Begin by determining the purpose and objective of the conference. Is it to educate attendees about corporate tax laws and regulations? Or is it focused on providing updates on recent changes in tax codes? Clarifying the goal will help in planning the content accordingly.

02

Create an agenda that covers various aspects of corporate tax. Include sessions or workshops on topics such as tax planning strategies, deductions and credits, international tax considerations, and compliance requirements. The agenda should be well-balanced, covering both basics and advanced topics.

03

Invite knowledgeable and experienced speakers who can deliver informative and engaging presentations. Look for tax professionals or experts in the field who can provide insights, real-life examples, and practical advice. Consider having a mix of industry professionals, government representatives, and tax consultants as speakers.

04

Incorporate interactive sessions to enhance participant engagement. Include activities like case studies, group discussions, and Q&A sessions to encourage active learning and networking opportunities among attendees. These interactive elements can offer valuable insights and foster a collaborative learning environment.

05

Stay up-to-date with the latest tax regulations and changes. Incorporate any recent updates or developments into the conference content. This will ensure that participants are receiving relevant and timely information that they can immediately apply to their corporate tax strategies.

Who needs a corporate tax conference?

01

Business owners and entrepreneurs: Corporate tax conferences can provide valuable information to business owners and entrepreneurs who need to stay updated on tax laws to ensure compliance and optimize their tax planning strategies.

02

Accountants and tax professionals: Tax conferences offer a platform for accountants and tax professionals to deepen their knowledge, enhance their expertise, and stay current with changes in tax regulations. These events serve as a resource to help them better serve their clients and provide accurate guidance.

03

Financial advisors: Corporate tax affects various aspects of financial planning, including investment decisions and business strategies. Financial advisors can benefit from attending tax conferences to understand the implications of tax laws on their clients' financial plans.

04

Legal professionals: Lawyers specializing in taxation or corporate law can gain insights from corporate tax conferences to better advise their clients on legal matters related to tax compliance and optimization.

In conclusion, organizing a corporate tax conference involves planning a well-structured agenda, inviting knowledgeable speakers, incorporating interactive sessions, and targeting audiences such as business owners, accountants, financial advisors, and legal professionals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is corporate tax conference?

A corporate tax conference is a meeting or event focused on discussing corporate tax laws, regulations, and strategies.

Who is required to file corporate tax conference?

Corporate entities are required to file corporate tax conference.

How to fill out corporate tax conference?

Corporate tax conference can be filled out by gathering all relevant financial information and completing the necessary forms as per tax regulations.

What is the purpose of corporate tax conference?

The purpose of corporate tax conference is to accurately report corporate income and ensure compliance with tax laws.

What information must be reported on corporate tax conference?

Information such as company income, deductions, credits, and any other financial transactions must be reported on corporate tax conference.

How do I complete corporate tax conference online?

pdfFiller makes it easy to finish and sign corporate tax conference online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in corporate tax conference without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your corporate tax conference, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit corporate tax conference on an iOS device?

Use the pdfFiller mobile app to create, edit, and share corporate tax conference from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your corporate tax conference online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Corporate Tax Conference is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.