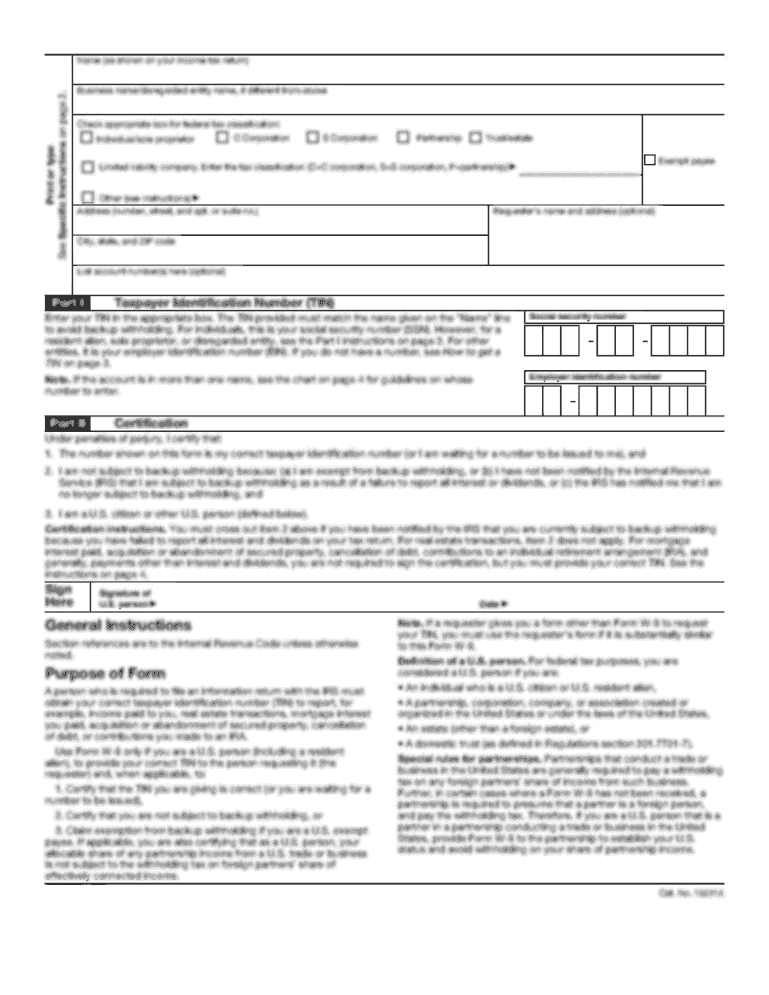

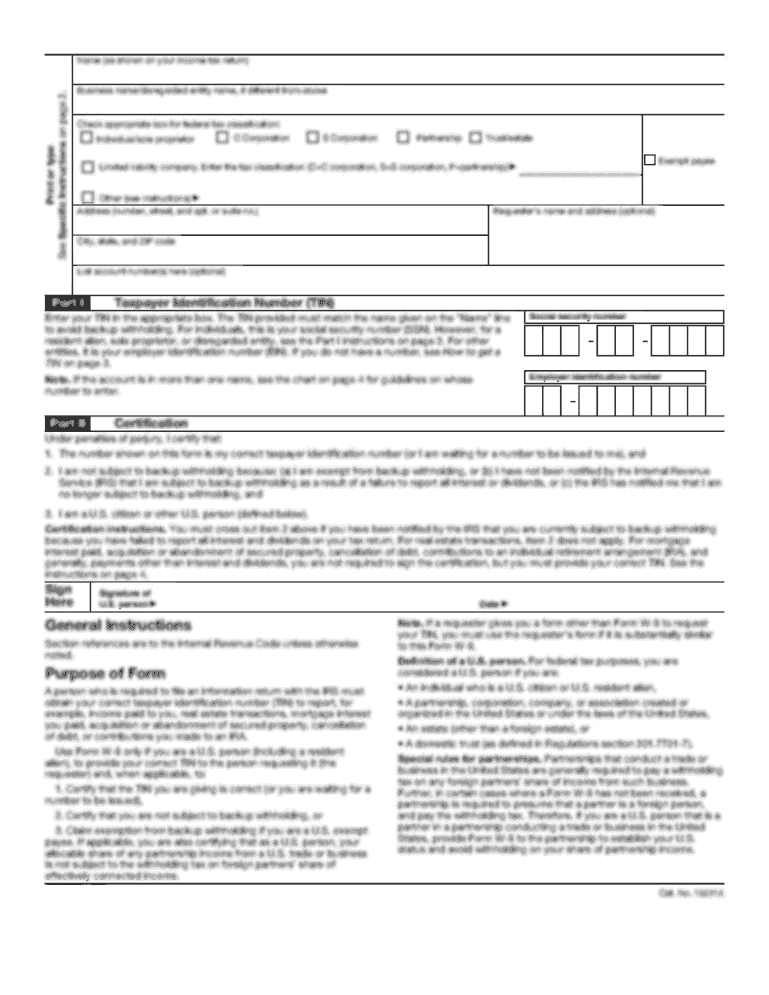

Get the free PARTNERSHIP ENROLLMENT FORM

Show details

Formulario para la inscripción de la asociación, que incluye información sobre la organización, contacto, dirección, tarifas de asociación, beneficios y opciones adicionales de publicidad.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign partnership enrollment form

Edit your partnership enrollment form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your partnership enrollment form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit partnership enrollment form online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit partnership enrollment form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out partnership enrollment form

How to fill out PARTNERSHIP ENROLLMENT FORM

01

Obtain the Partnership Enrollment Form from the relevant authority or website.

02

Carefully read the instructions provided on the form.

03

Fill out the basic information section, including your name, address, and contact details.

04

Provide details about your partnership, including the names of partners and their roles.

05

Include any required documentation, such as agreements or identification.

06

Review the form for accuracy and completeness.

07

Sign and date the form where required.

08

Submit the completed form to the designated office or online portal.

Who needs PARTNERSHIP ENROLLMENT FORM?

01

Individuals or groups forming a partnership seeking official recognition or benefits.

02

Businesses that require partnership documentation for legal or operational purposes.

03

Organizations applying for grants or funding that necessitate a formal partnership agreement.

Fill

form

: Try Risk Free

People Also Ask about

What are the partnership forms?

General partnerships are easy to set up as you are not required to file any registration documents. Unlike a corporate structure, there are also no ongoing compliance requirements, like annual reports.

Is form 1065 for a partnership?

IRS Form 1065 is used to declare profits, losses, deductions, and credits of a business partnership for tax filing purposes. The form is filed by domestic partnerships, foreign partnerships with income in the U.S., and nonprofit religious organizations.

Does an LLC partnership get a 1099?

LLCs taxed as partnerships or sole proprietorships: If the LLC is treated as a partnership or is a single-member LLC (disregarded entity), you must file a 1099 form and provide a copy to the LLC. These payments are reportable and are considered income for the LLC's individual or partnership tax filings.

What is form F 1065?

A corporate taxpayer filing Florida Form F-1120 may use Florida Form F-1065 to report the distributive share of its partnership income and apportionment factors from a partnership or joint venture that is not a Florida partnership. Save Time and Paperwork with Electronic Filing.

How to fill out a partnership form?

Contents of Partnership Deed The agreed name of the Partnership Firm. The nature of the business will also be mentioned in the deed. Date of commencement of such business. The place of business, i.e addresses of main office or branch offices if any, where communication can be sent.

What is the most basic form of partnership?

General partnership A general partnership is the most basic form of partnership. It does not require forming a business entity with the state. In most cases, partners form their business by signing a partnership agreement.

How to form a partnership agreement?

There are three relatively common partnership types: general partnership (GP), limited partnership (LP) and limited liability partnership (LLP). A fourth, the limited liability limited partnership (LLLP), is not recognized in all states.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PARTNERSHIP ENROLLMENT FORM?

The Partnership Enrollment Form is a document used by partnerships to establish and register their business structure with the relevant authorities, ensuring they comply with regulatory requirements.

Who is required to file PARTNERSHIP ENROLLMENT FORM?

Any business entity that operates as a partnership is required to file a Partnership Enrollment Form, including general partnerships and limited partnerships.

How to fill out PARTNERSHIP ENROLLMENT FORM?

To fill out a Partnership Enrollment Form, provide accurate information about the partnership, including names and addresses of partners, business name, business address, and other relevant details as required by the governing authority.

What is the purpose of PARTNERSHIP ENROLLMENT FORM?

The purpose of the Partnership Enrollment Form is to officially register the partnership with the appropriate authorities and to ensure compliance with tax and legal obligations.

What information must be reported on PARTNERSHIP ENROLLMENT FORM?

The Partnership Enrollment Form typically requires the names and addresses of all partners, partnership name, business address, type of partnership, and any other pertinent information needed for legal and tax purposes.

Fill out your partnership enrollment form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Partnership Enrollment Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.