SSA-753 2011 free printable template

Show details

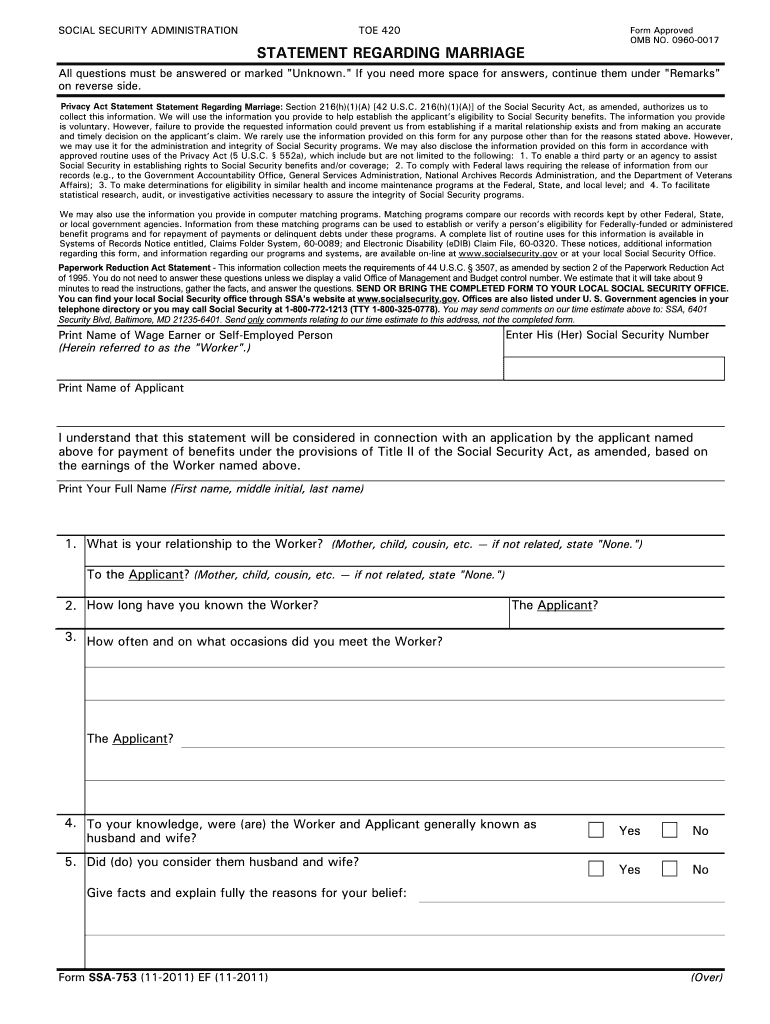

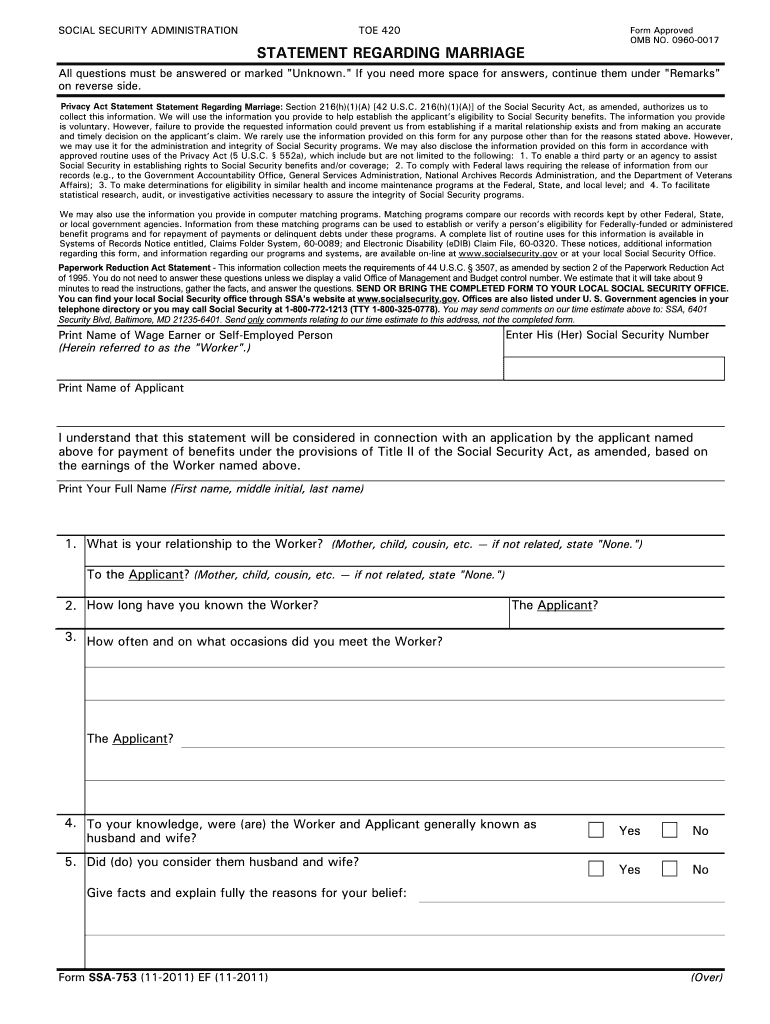

SOCIAL SECURITY ADMINISTRATION TOE 420 STATEMENT REGARDING MARRIAGE Form Approved OMB NO. 0960-0017 All questions must be answered or marked Unknown. If you need more space for answers continue them under Remarks on reverse side. Privacy Act Statement Statement Regarding Marriage Section 216 h 1 A 42 U.S.C. 216 h 1 A of the Social Security Act as amended authorizes us to collect this information. We will use the information you provide to help establish the applicant s eligibility to Social...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SSA-753

Edit your SSA-753 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SSA-753 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SSA-753 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit SSA-753. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SSA-753 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SSA-753

How to fill out SSA-753

01

Obtain the SSA-753 form from the Social Security Administration's website or local office.

02

Read the instructions carefully to understand the required information.

03

Fill out your personal information in Section 1, including name, Social Security number, and date of birth.

04

Provide information about your medical condition in Section 2, including dates, locations, and types of treatments received.

05

Complete Section 3, which may require details about your work history and how your condition affects your ability to work.

06

Review all entries to ensure accuracy and completeness.

07

Sign and date the form.

08

Submit the completed form to the Social Security Administration, either online, by mail, or in person.

Who needs SSA-753?

01

Individuals who are applying for Social Security disability benefits.

02

People who have been asked to provide additional information about their medical condition or work history.

03

Beneficiaries who are undergoing a review of their disability status.

04

Those who need to substantiate their claims of disability with medical evidence.

Fill

form

: Try Risk Free

People Also Ask about

What are the new rules for SSI for 2023?

For 2023, the Supplemental Security Income (SSI) FBR is $914 per month for an eligible individual and $1,371 per month for an eligible couple. For 2023, the amount of earnings that will have no effect on eligibility or benefits for SSI beneficiaries who are students under age 22 is $8,950 a year.

What is a SSA 753 form?

Form SSA 753 Statement Regarding Marriage.

What happens if you marry someone on SSI?

If you get Social Security disability or retirement benefits and you marry, your benefit will stay the same. However, other benefits such as SSI, Survivors, Divorced Spouses, and Child's benefits may be affected.

What is the loophole for married couples on Social Security?

While you can start getting Social Security benefits as early as 62, married couples can get 100% of their Social Security benefits by waiting to collect Social Security until they each reach full retirement age. And if you have the option wait longer, you can get even more benefits over the rest of your life.

What is the marriage penalty for SSI in 2023?

Eligible couples and the 'marriage penalty' In 2023, this maximum benefit is $914 a month. However, if two beneficiaries are married to each other, they are considered an eligible couple and don't get their own separate benefits.

What is the Social Security 5 year rule?

You must have worked and paid Social Security taxes in five of the last 10 years. • If you also get a pension from a job where you didn't pay Social Security taxes (e.g., a civil service or teacher's pension), your Social Security benefit might be reduced.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get SSA-753?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the SSA-753 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I execute SSA-753 online?

Completing and signing SSA-753 online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

Can I create an eSignature for the SSA-753 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your SSA-753 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is SSA-753?

SSA-753 is a form used by the Social Security Administration for individuals to provide information about their eligibility for benefits.

Who is required to file SSA-753?

Individuals who are applying for Social Security benefits or those whose benefits are being reviewed may be required to file SSA-753.

How to fill out SSA-753?

To fill out SSA-753, follow the provided instructions carefully, ensuring all required sections are completed accurately, and include any necessary documentation.

What is the purpose of SSA-753?

The purpose of SSA-753 is to collect relevant information needed to determine an individual's eligibility and entitlement for Social Security benefits.

What information must be reported on SSA-753?

The information required on SSA-753 includes personal identification details, income, residency, and any relevant medical information affecting eligibility.

Fill out your SSA-753 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SSA-753 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.