SSA-4111 2010 free printable template

Show details

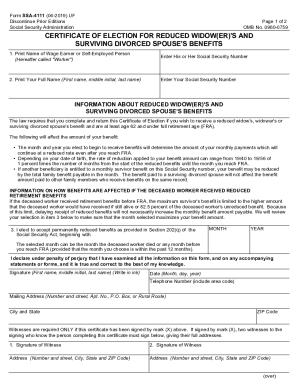

1. Signature of Witness Address Number and street City State and ZIP Code Form SSA-4111 12-2013 EF 12-2013 Destroy Prior Editions over Privacy Act Statement Collection and Use of Personal Information Sections 202 e f and q 3 of the Social Security Act as amended authorize us to collect this information. We will use the information you provide to determine your eligibility for reduced benefits as a widow er or a surviving divorced spouse. Form Approved OMB No* 0960-0759 Social Security...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SSA-4111

Edit your SSA-4111 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SSA-4111 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit SSA-4111 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SSA-4111. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SSA-4111 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out SSA-4111

How to fill out ssa 4111:

01

Gather all necessary information and documents, such as your Social Security number, proof of identity, and any supporting documents related to your request.

02

Start by carefully reading the instructions provided on the form to ensure you understand the requirements and any additional documents needed.

03

Begin filling out the form by providing your personal information, including your full name, date of birth, and address.

04

Follow the instructions for each section of the form and provide accurate and complete information. This may include details related to your work history, income, and medical conditions.

05

If there are any sections that are not applicable to your situation, mark them as "N/A" or follow the specific instructions on how to handle those sections.

06

Double-check all the information you have provided to ensure its accuracy and completeness.

07

Sign and date the form, certifying that all the information provided is true and accurate to the best of your knowledge.

08

Make a copy of the completed form for your records before submitting it.

Who needs ssa 4111:

01

Individuals who need to request specific information or services from the Social Security Administration.

02

Individuals who are applying for or receiving Social Security benefits, or those who need to update their existing information.

03

Employers or third-party organizations who require verification of an individual's Social Security information for employment or other purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do you qualify for widow's benefits?

Who is eligible for this program? Be at least age 60. Be the widow or widower of a fully insured worker. Meet the marriage duration requirement. Be unmarried, unless the marriage can be disregarded. Not be entitled to an equal or higher Social Security retirement benefit based on your own work.

How do I get the $16728 Social Security bonus?

How do I get the $16 728 Social Security bonus? Option 1: Increase Your Earnings. Option 2: Wait Until Age 70 to Claim Social Security Benefits. Option 3: Be Strategic With Spousal Benefits. Option 4: Make the Most of COLA Increases.

Will I lose my deceased husband's pension if I remarry?

What will happen if I remarry? When a surviving spouse remarries, this will often prevent them from continuing to receive their late spouse's pension. This means that if you are collecting your deceased spouse's pension and you choose to remarry, you may lose the right to get your former spouse's pension.

Can a widow remarry and still collect her deceased husband's Social Security?

If you remarry before age 60 (age 50 if you have a disability), you cannot receive benefits as a surviving spouse while you are married. If you remarry after age 60 (age 50 if you have a disability), you will continue to qualify for benefits on your deceased spouse's Social Security record.

What happens to a pension when you remarry?

Under most circumstances, a remarriage will not change how or if an ex-spouse continues to receive a portion of the military pension. Generally speaking, a pension will end only if the service member dies.

What is Form SSA 4111?

Use the SSA-4111 for claims on the records of NHs who die on or after 12/1/1988 in order to entitle reduced widow(er) insurance benefit (WIB) for any month before the month the widow(er) or surviving divorced spouse attains FRA.

Can a widow get pension after remarriage?

What will happen if I remarry? When a surviving spouse remarries, this will often prevent them from continuing to receive their late spouse's pension. This means that if you are collecting your deceased spouse's pension and you choose to remarry, you may lose the right to get your former spouse's pension.

Will I lose my late husband's pension if I remarry?

A widow(er) is eligible to receive benefits if she or he is at least age 60. If a widow(er) remarries before age 60, she or he forfeits the benefit and, therefore, faces a marriage penalty.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send SSA-4111 for eSignature?

Once your SSA-4111 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit SSA-4111 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your SSA-4111, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

How can I fill out SSA-4111 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your SSA-4111 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is SSA-4111?

SSA-4111 is a form used by the Social Security Administration (SSA) to provide a record of earnings and self-employment income for the purpose of determining benefits.

Who is required to file SSA-4111?

Individuals who are self-employed or have income from other sources that need to report for benefit calculation are required to file SSA-4111.

How to fill out SSA-4111?

To fill out SSA-4111, individuals should provide their personal information, report their earnings and self-employment income, include relevant tax information, and sign the form.

What is the purpose of SSA-4111?

The purpose of SSA-4111 is to collect accurate income information from self-employed individuals to ensure appropriate Social Security benefits are calculated and awarded.

What information must be reported on SSA-4111?

The information that must be reported on SSA-4111 includes personal identification details, earnings from self-employment, dates of income received, and tax filing details.

Fill out your SSA-4111 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SSA-4111 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.