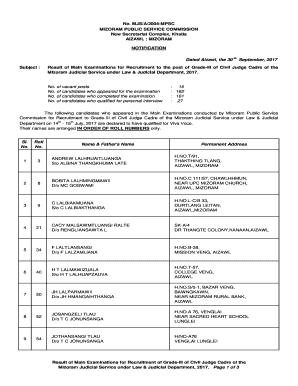

Get the free N288C Application for Tentative Refund of Withholding on ...

Show details

FORM N-288C (REV. 2013) STATE OF HAWAII DEPARTMENT OF TAXATION ? APPLICATION FOR TENTATIVE REFUND OF WITHHOLDING THIS SPACE FOR DATE RECEIVED STAMP Clear Form ON DISPOSITIONS BY NONRESIDENT PERSONS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign n288c application for tentative

Edit your n288c application for tentative form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your n288c application for tentative form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing n288c application for tentative online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit n288c application for tentative. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out n288c application for tentative

How to fill out an N288C application for tentative?

N288C is an application form used for requesting a tentative determination of qualification as a tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code. Here's a step-by-step guide on how to fill out the N288C application:

01

Begin by obtaining a copy of the N288C form. You can find it on the official website of the Internal Revenue Service (IRS) or by contacting their office directly.

02

Fill in the general information section of the form. This includes providing the organization's name, address, and contact details. Make sure to double-check the accuracy of the information entered.

03

Indicate the organization's legal structure and the date it was established. Provide details regarding any prior or pending applications for tax-exempt status.

04

Answer each question under Part I - Qualification for Exemption. This section requires information on the organization's purposes, activities, sources of support, and any lobbying or political activities. Provide clear and concise responses, ensuring they are consistent with the requirements outlined by the IRS.

05

Move on to Part II - Organizational Structure. Here, you'll be required to describe the organization's governing body, officers, and directors. Include their names, addresses, and positions held within the organization.

06

Part III - Financial Data requires the submission of financial information such as assets, liabilities, revenues, and expenses. Provide accurate details and attach the necessary financial documentation as requested by the form.

07

Complete Part IV - Required Statements. This section addresses additional statements required by specific organizations, depending on their activities or exemptions sought. Follow the instructions carefully and provide all necessary details.

08

Review the completed form to ensure accuracy and completeness. Double-check all the information provided and make any necessary corrections before submitting the application.

Who needs an N288C application for tentative?

Organizations seeking tax-exempt status under Section 501(c)(3) of the Internal Revenue Code need to fill out an N288C application for tentative. This includes charitable, religious, educational, scientific, literary, testing for public safety, and organizations involved in the prevention of cruelty to children or animals. It is crucial to determine if your organization falls within this category before completing the application to avoid unnecessary paperwork and delays in the process.

Please note that this is a general guide, and it is recommended to consult with a qualified tax professional or refer to the official IRS instructions for the N288C form to ensure accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find n288c application for tentative?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the n288c application for tentative in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete n288c application for tentative online?

Easy online n288c application for tentative completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

Can I create an electronic signature for the n288c application for tentative in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your n288c application for tentative in seconds.

What is n288c application for tentative?

The n288c application for tentative is a form used to request a temporary reduction in property taxes.

Who is required to file n288c application for tentative?

Property owners who believe their property's value has decreased or been damaged by a calamity.

How to fill out n288c application for tentative?

The n288c application for tentative can be filled out online or by mail with detailed property information and reasons for requesting the reduction.

What is the purpose of n288c application for tentative?

The purpose of n288c application for tentative is to temporarily lower property taxes based on current market conditions.

What information must be reported on n288c application for tentative?

Information such as property details, reasons for requesting reduction, and supporting documentation must be reported on the n288c application for tentative.

Fill out your n288c application for tentative online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

n288c Application For Tentative is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.