IRS 843 2009 free printable template

Instructions and Help about IRS 843

How to edit IRS 843

How to fill out IRS 843

About IRS previous version

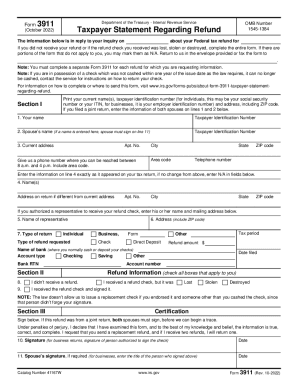

What is IRS 843?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 843

What should I do if I made an error after submitting the irs 2009 form 843?

If you've made a mistake on the irs 2009 form 843 after submission, you can submit an amended version or a correction. Ensure to clearly indicate the changes made in the amended form and retain records of the original submission. If your correction causes a delay or rejection, contact the IRS for guidance on your specific situation.

How can I verify if my irs 2009 form 843 has been received and is being processed?

To check the status of your irs 2009 form 843 submission, you can contact the IRS directly for assistance. They may provide you with confirmation of receipt or processing status. Keep your submission details ready for a smoother inquiry, and be aware of common rejection codes that might affect your form.

What are some common errors when filing the irs 2009 form 843 and how can I avoid them?

Common errors on the irs 2009 form 843 include incorrect personal information and failing to sign the form. To avoid these mistakes, double-check all entered data against your official documents and ensure your signature is on the form where required. Reviewing submission guidelines can also help minimize errors.

What should I do if I receive a notice from the IRS after submitting the irs 2009 form 843?

Upon receiving a notice from the IRS regarding your irs 2009 form 843, review the letter for specifics on what actions are required. Depending on the notice, you may need to provide additional documentation, correct any filing errors, or respond within a set time frame to avoid penalties.

Are there any specific technical requirements for e-filing the irs 2009 form 843 that I should be aware of?

When e-filing the irs 2009 form 843, ensure that your software is compatible with IRS e-file standards. It's important to have a reliable internet connection and check if your browser meets the technical specifications outlined by the IRS. Using the latest software version can also mitigate technical issues during submission.

See what our users say