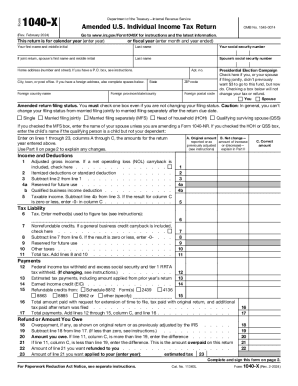

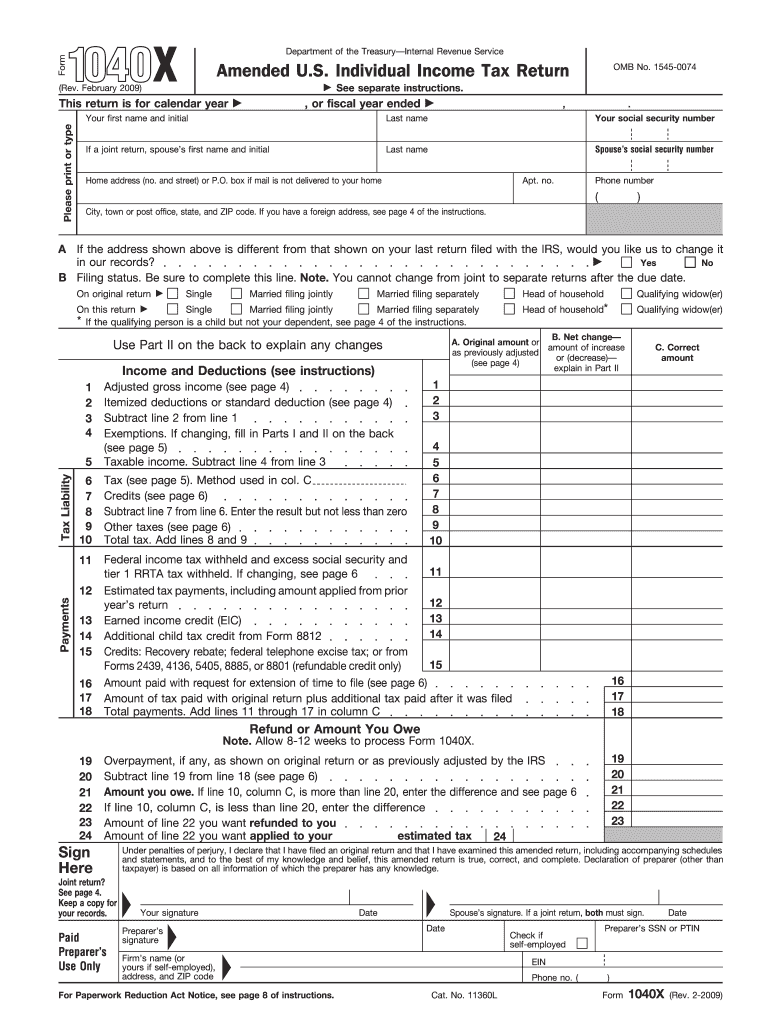

IRS 1040-X 2009 free printable template

Instructions and Help about IRS 1040-X

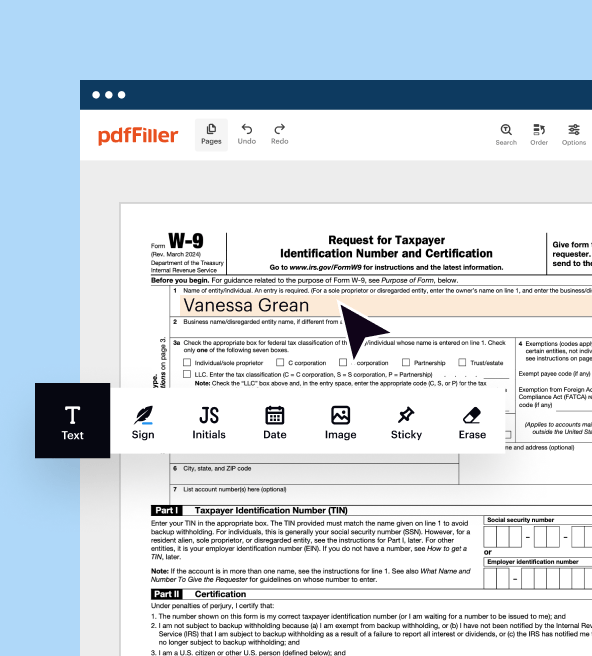

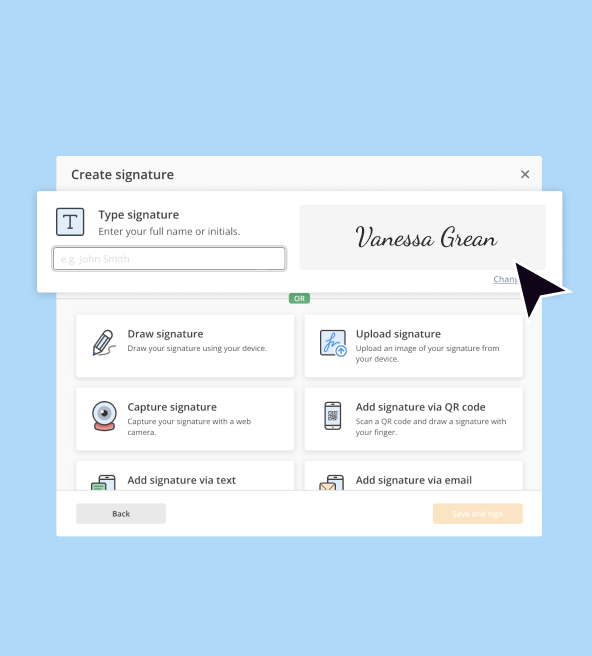

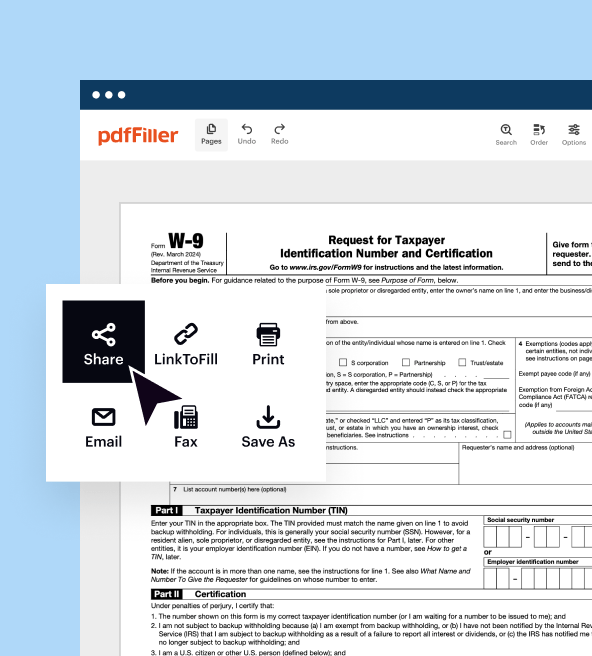

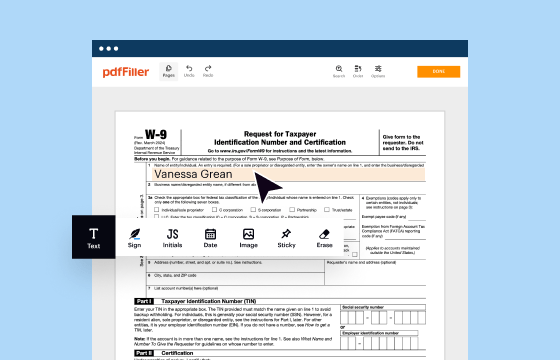

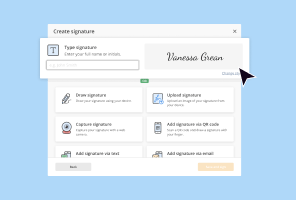

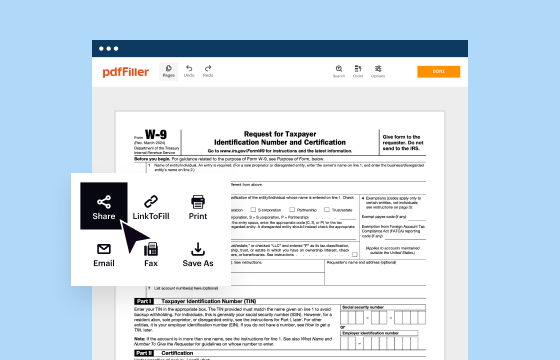

How to edit IRS 1040-X

How to fill out IRS 1040-X

About IRS 1040-X 2009 previous version

What is IRS 1040-X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040-X

What should I do if my IRS 1040-X is rejected after filing?

If your IRS 1040-X is rejected, you will need to review the rejection codes provided by the IRS, which typically indicate the issue with your submission. Ensure that you correct the identified errors, then resubmit the amended return using the same method you chose initially, whether it’s e-filing or mailing a paper form.

How can I verify the receipt of my IRS 1040-X?

To verify the receipt of your IRS 1040-X, you can check the IRS 'Where's My Amended Return?' tool available on their website. This tool will provide updates on the status of your amended return, allowing you to track the processing timeline.

What are common mistakes to avoid when filing IRS 1040-X?

Common mistakes when filing IRS 1040-X include failing to sign the form, not providing the correct information for the changes being made, and submitting the form without the necessary documentation. Double-checking each entry before submission can help mitigate these errors.

Can I e-file my IRS 1040-X, and are there any special requirements?

Yes, you can e-file your IRS 1040-X, but you must use software that supports the amended return. It's crucial to ensure that you follow the specific guidance provided by the software regarding e-signatures and document attachments to avoid issues with acceptance.

What steps should I take if I receive a notice from the IRS regarding my 1040-X?

If you receive a notice from the IRS regarding your 1040-X, carefully read the contents to understand the nature of the inquiry or issue. Gather any requested documentation or information and respond accordingly within the specified time frame, ensuring that your response is clear and thorough.

See what our users say