CO CR 0100 2006 free printable template

Show details

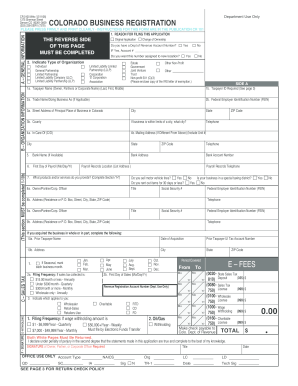

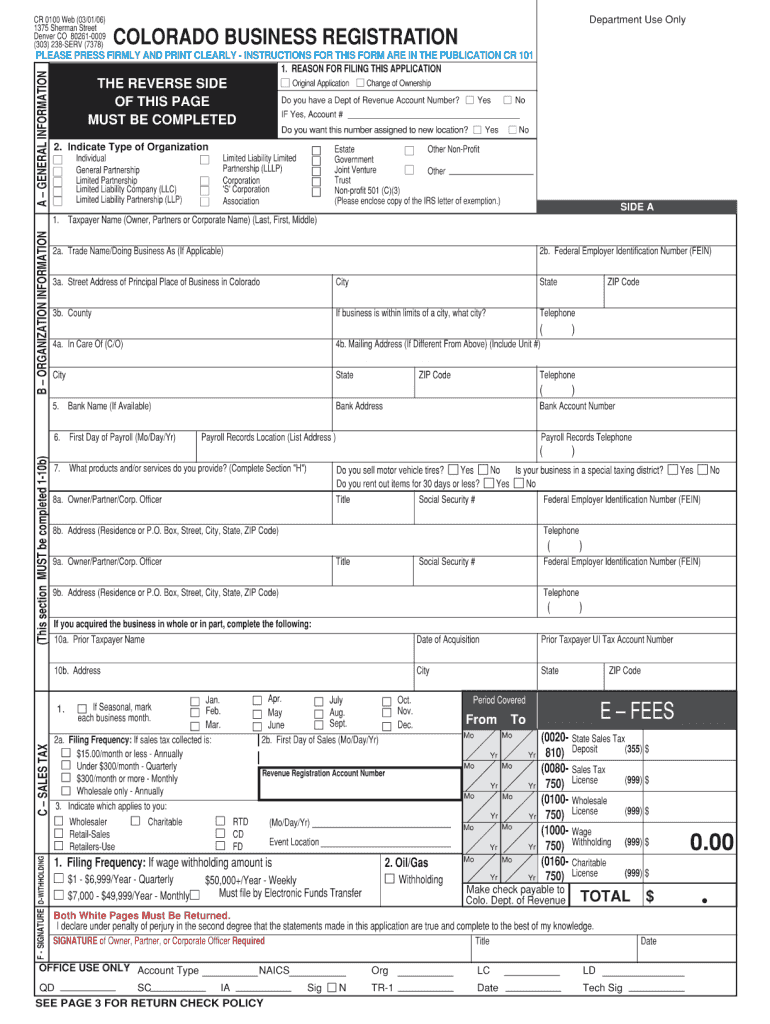

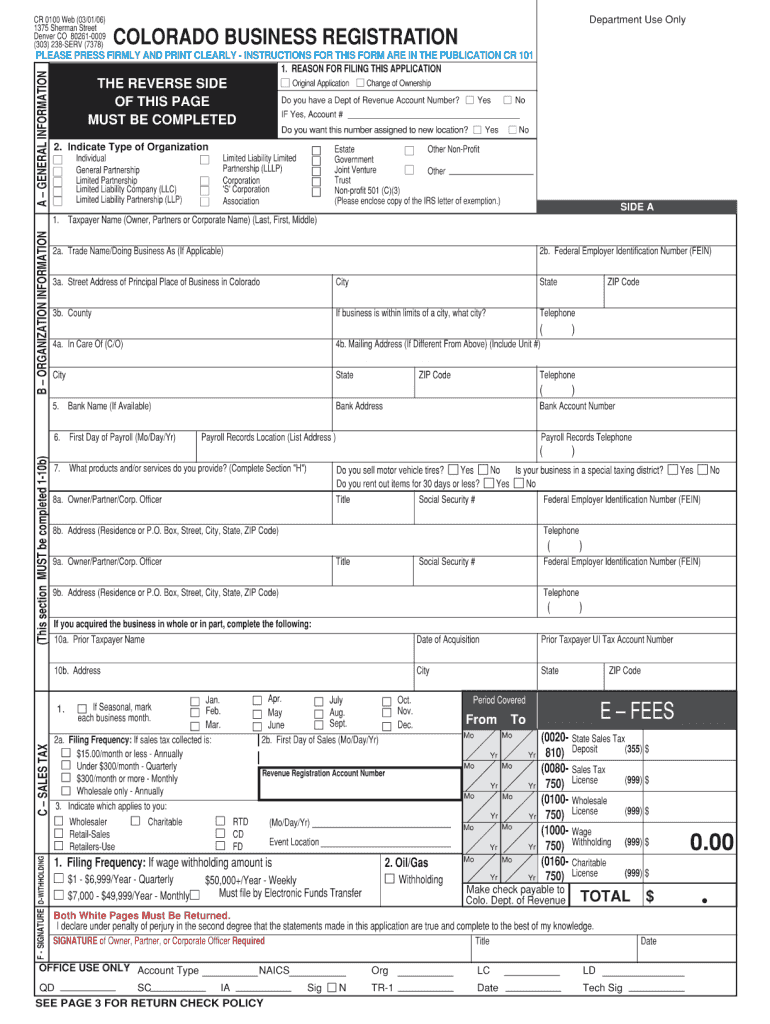

CR 0100 Web (03/01/06) 1375 Sherman Street Denver CO 80261-0009 (303) 238-SERV (7378) Department Use Only COLORADO BUSINESS REGISTRATION Original Application Change of Ownership Yes Yes No No Do you

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO CR 0100

Edit your CO CR 0100 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO CR 0100 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO CR 0100 online

Follow the steps down below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CO CR 0100. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO CR 0100 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO CR 0100

How to fill out CO CR 0100

01

Obtain a blank copy of the CO CR 0100 form from the appropriate agency website or office.

02

Read the instructions carefully to understand the requirements and sections of the form.

03

Start with Section 1: Fill in your personal information, including your name, address, and contact details.

04

Proceed to Section 2: Provide the relevant details related to the subject matter of the form, such as dates and related documents.

05

Section 3 may require you to explain your case or reason for submitting the form; ensure this is concise and clear.

06

Complete any additional sections as instructed, ensuring all necessary fields are filled out accurately.

07

Review the completed form for any errors or omissions.

08

Sign and date the form as required.

09

Submit the form through the specified channels (mail, in-person, online) as per the guidelines.

Who needs CO CR 0100?

01

Individuals or entities who need to report specific information or apply for a particular status as defined by the CO CR 0100 form.

02

Administrators or representatives of organizations that require documentation for compliance or legal purposes.

03

Any person seeking information or results related to the process that CO CR 0100 addresses.

Instructions and Help about CO CR 0100

Fill

form

: Try Risk Free

People Also Ask about

What is the form for a Colorado extension?

You must pay at least 90% of your tax liability with Form DR 0158-I by April 18 and the remainder by October 17 to avoid delinquent payment penalties. To calculate any tax due with Form DR 0158-I, visit Menu Path: Personal > 2022 Extension > Start your 2022 Extension.

What is the Colorado sales tax refund?

Qualifying resident individuals may claim a refundable state sales tax refund credit on their 2021 and 2022 Colorado income tax returns. The credit is a mechanism to refund tax revenue in excess of limits established by the Taxpayer's Bill of Rights amendment added to the Colorado Constitution in 1992.

Is the Colorado sales tax refund $153?

The amount you'll get depends on your income. Below is the refund, based on a modified adjusted gross income amount that tax programs/forms will help you determine. The first number is for single filers, and the second for joint filers: $48,000 or less: $153 / $306.

What is the property tax in Colorado for non residents?

Colorado 2% Tax If you don't live in Colorado and sell your Colorado property, the company handling the closing collects 2% of the sales price for the state of Colorado. 2% withholding can be a significant amount of money and Colorado knows it.

Who is eligible for the Colorado sales tax refund?

Full-year Colorado residents, who were 18 or older as of January 1, 2022, are eligible for the state sales tax refund. To claim the state sales tax refund, your return must be postmarked by April 18, 2023.

Is there a Colorado state tax form?

These 2021 forms and more are available: Colorado Form 104 – Personal Income Tax Return for Residents. Colorado Form 104PN – Personal Income Tax Return for Nonresidents and Part-Year Residents. Colorado Form 104CR – Individual Credit Schedule.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find CO CR 0100?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the CO CR 0100 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I complete CO CR 0100 online?

pdfFiller has made it simple to fill out and eSign CO CR 0100. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for the CO CR 0100 in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your CO CR 0100 and you'll be done in minutes.

What is CO CR 0100?

CO CR 0100 is a form used for reporting certain financial information to the Colorado Department of Revenue.

Who is required to file CO CR 0100?

Entities conducting business in Colorado that meet specific revenue thresholds or regulatory requirements are required to file CO CR 0100.

How to fill out CO CR 0100?

To fill out CO CR 0100, gather the necessary financial documents, complete the form with accurate revenue figures, and submit it to the Colorado Department of Revenue as per their guidelines.

What is the purpose of CO CR 0100?

The purpose of CO CR 0100 is to ensure transparency and compliance with Colorado state revenue regulations by providing a clear outline of business financial activities.

What information must be reported on CO CR 0100?

The information that must be reported on CO CR 0100 includes total revenues, types of income, deductions, and any applicable state taxes.

Fill out your CO CR 0100 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO CR 0100 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.