Get the free Long-term disability insurance (unpaid leave only ...

Show details

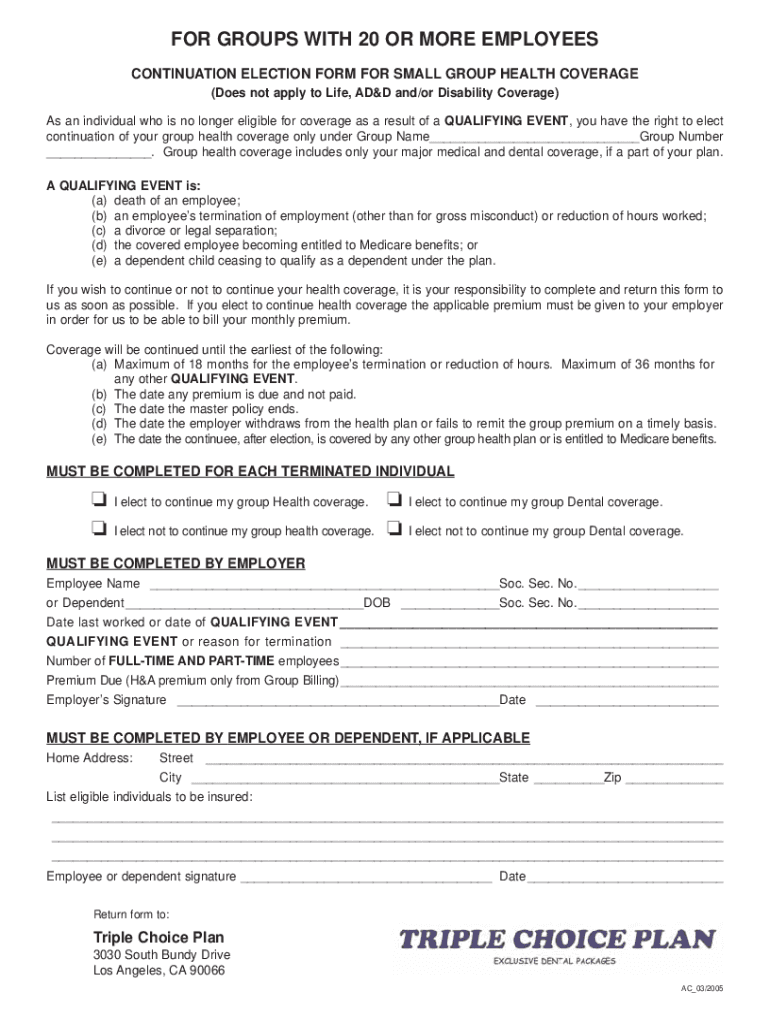

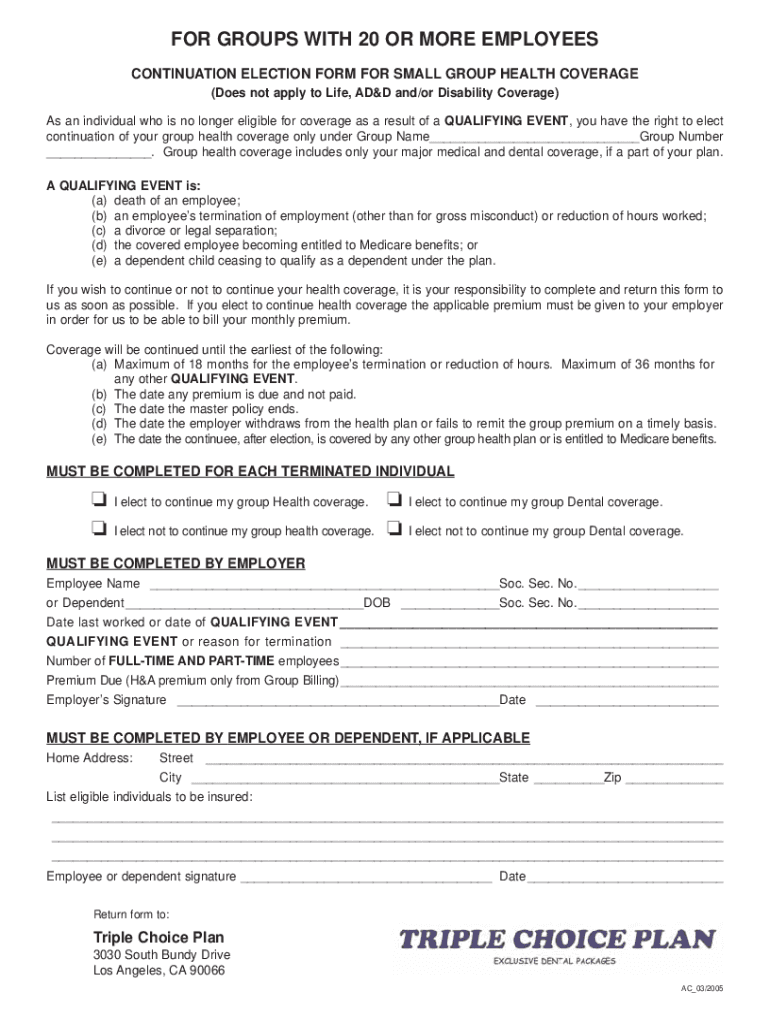

FOR GROUPS WITH 20 OR MORE EMPLOYEES CONTINUATION ELECTION FORM FOR SMALL GROUP HEALTH COVERAGE (Does not apply to Life, ADD and/or Disability Coverage) As an individual who is no longer eligible

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign long-term disability insurance unpaid

Edit your long-term disability insurance unpaid form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your long-term disability insurance unpaid form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing long-term disability insurance unpaid online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit long-term disability insurance unpaid. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out long-term disability insurance unpaid

How to fill out long-term disability insurance unpaid

01

Start by obtaining the long-term disability insurance application form. This can typically be found on the insurance provider's website or by contacting their customer service.

02

Carefully read through the entire application form to understand the information required and any specific instructions provided.

03

Begin filling out the personal information section, including your full name, address, contact details, Social Security number, and other requested details.

04

Provide details about your current employment status, including the name of your employer, job title, and duration of employment.

05

Include information about your medical history, including any pre-existing conditions or disabilities that may impact your eligibility for long-term disability insurance.

06

Fill in the section related to your income, providing details about your salary, bonuses, commissions, and other sources of income.

07

If required, attach any supporting documents requested by the insurance provider, such as medical records or income verification documents.

08

Review the completed application form thoroughly to ensure all information provided is accurate and complete.

09

Sign and date the application form wherever required.

10

Follow the instructions provided by the insurance provider for submitting the filled-out application form. This can usually be done online, by mail, or through a designated agent or broker.

11

Keep a copy of the filled-out application form and any supporting documents for your records.

12

Wait for the insurance provider to process your application and provide you with a decision regarding your long-term disability insurance coverage.

Who needs long-term disability insurance unpaid?

01

Long-term disability insurance unpaid is beneficial for individuals who rely on their income to cover essential living expenses and support themselves or their dependents.

02

People who work in physically demanding jobs that have a higher risk of disability may find long-term disability insurance particularly valuable.

03

Those with existing health conditions or disabilities can also benefit as it provides income protection in the event they are unable to work due to their condition.

04

Self-employed individuals who do not have access to employer-sponsored disability insurance may also consider obtaining long-term disability insurance unpaid.

05

Ultimately, anyone who wishes to safeguard their financial stability and ensure they have a source of income in case of long-term disability should consider getting this type of insurance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute long-term disability insurance unpaid online?

Easy online long-term disability insurance unpaid completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I edit long-term disability insurance unpaid on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing long-term disability insurance unpaid.

How do I fill out long-term disability insurance unpaid on an Android device?

Use the pdfFiller mobile app and complete your long-term disability insurance unpaid and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is long-term disability insurance unpaid?

Long-term disability insurance unpaid refers to a situation where an individual may be eligible for long-term disability benefits but has not received payments or has not claimed them within a specified period.

Who is required to file long-term disability insurance unpaid?

Individuals who are eligible for long-term disability benefits and have not received payments due to filing issues or an appeal process are typically required to file for long-term disability insurance unpaid.

How to fill out long-term disability insurance unpaid?

To fill out long-term disability insurance unpaid, you generally need to gather necessary documents, including medical records, proof of income, and complete the appropriate claim forms specifying the reasons for unpaid status and the dates involved.

What is the purpose of long-term disability insurance unpaid?

The purpose of long-term disability insurance unpaid is to ensure that individuals who are unable to work due to disability can receive the financial support they need, while addressing any unpaid claims or benefits owed.

What information must be reported on long-term disability insurance unpaid?

Information that must be reported includes personal identification details, employment history, medical information relating to the disability, and documentation of any attempts to resolve unpaid benefits.

Fill out your long-term disability insurance unpaid online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Long-Term Disability Insurance Unpaid is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.