MI Lottery Form BSL-S-685A 2013 free printable template

Show details

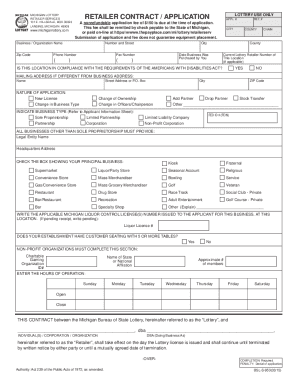

RETAILER APPLICATION Rev. 07/13 MICHIGAN LOTTERY RETAILER SERVICES 101 E. HILLSDALE BOX 30023 LANSING MICHIGAN 48909 www. This requirement excludes sole proprietorships. W-9 Form 150 Nonrefundable Application Fee check made payable to State of Michigan or pay on-line at https //www. thepayplace. com/mi/lottery/retailerserv Make sure all forms are signed and dated. A nonrefundable application fee of 150. BSL-S-2044 5/13 Number and Street Phone Number CITY COUNTY City Fax Number RET. APPL. This...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI Lottery Form BSL-S-685A

Edit your MI Lottery Form BSL-S-685A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI Lottery Form BSL-S-685A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI Lottery Form BSL-S-685A online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit MI Lottery Form BSL-S-685A. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI Lottery Form BSL-S-685A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI Lottery Form BSL-S-685A

How to fill out MI Lottery Form BSL-S-685A

01

Obtain the MI Lottery Form BSL-S-685A from the official Michigan Lottery website or a local lottery office.

02

At the top of the form, provide your personal information, including your name, address, and contact details.

03

Indicate your Social Security number in the designated field.

04

Fill in the details of the lottery game you wish to claim your winnings for.

05

Specify the amount of the winnings you are claiming.

06

Sign and date the form at the bottom to certify that the information provided is accurate.

07

Submit the completed form along with any required identification or documentation, as instructed.

Who needs MI Lottery Form BSL-S-685A?

01

Anyone who has won a cash prize from the Michigan Lottery and needs to claim their winnings.

Fill

form

: Try Risk Free

People Also Ask about

Can I remain anonymous if I win the lottery in Michigan?

Winners of state-level games in Michigan who score more than $10,000 are granted anonymity, but for multi-state games like Mega Millions, the state lottery defers to the game's rules, which say winners can be named publicly.

How do I claim my lottery winnings in Michigan?

Please call the Lottery Player Relations office at [844-887-6836](tel:+8448876836 "844-887-6836"), option 2 to schedule an appointment. Each winner must present originals of their valid government-issued photo ID (typically a driver's license or state ID) and Social Security card in order to claim a prize.

How much taxes do you pay on lottery winnings in Michigan?

The same tax liability applies, whether you win a Michigan Lottery game or multi-state lotteries such as Powerball or Mega Millions. That means 24% in federal taxes and 4.25% in Michigan taxes, whether the prize is claimed in a lump sum or 30-year annuity.

How much are lottery winnings taxed in Michigan?

The Michigan Lottery does not withhold any taxes on lottery prizes from $601 to $5,000, but is required to report the winnings to the IRS and Michigan Department of Treasury. Winnings of more than $5,000 are subject to automatic withholding of 24% federal tax and 4.25% state tax.

What happens with unclaimed lottery winnings Michigan?

For smaller prizes of these games or for state lottery games, the states have different rules for unclaimed prize winnings. In both California and Michigan, the money goes to a school aid fund, as do other lottery profits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MI Lottery Form BSL-S-685A directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your MI Lottery Form BSL-S-685A and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify MI Lottery Form BSL-S-685A without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your MI Lottery Form BSL-S-685A into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I fill out MI Lottery Form BSL-S-685A on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your MI Lottery Form BSL-S-685A. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is MI Lottery Form BSL-S-685A?

MI Lottery Form BSL-S-685A is a form used for reporting lottery winnings and conducting tax withholding for individuals who have won prizes in the Michigan Lottery.

Who is required to file MI Lottery Form BSL-S-685A?

Individuals who have received lottery winnings above a certain threshold are required to file MI Lottery Form BSL-S-685A to report their earnings for tax purposes.

How to fill out MI Lottery Form BSL-S-685A?

To fill out MI Lottery Form BSL-S-685A, individuals must provide personal information such as name, address, social security number, and details regarding the lottery winnings, including the amount won and any taxes withheld.

What is the purpose of MI Lottery Form BSL-S-685A?

The purpose of MI Lottery Form BSL-S-685A is to report lottery winnings for tax purposes and ensure compliance with state and federal tax regulations.

What information must be reported on MI Lottery Form BSL-S-685A?

The information that must be reported on MI Lottery Form BSL-S-685A includes the winner's personal details, the lottery game played, the amount won, any taxes withheld, and any other relevant financial information related to the winnings.

Fill out your MI Lottery Form BSL-S-685A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI Lottery Form BSL-S-685a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.