Get the free Coordinating Charitable Trusts and Private Foundations for the...

Show details

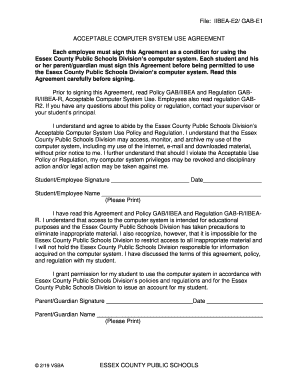

Return of Private Foundation Department of the Treasury OMB No 15450052 or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation 990PF Form 01 O Note The foundation may be

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign coordinating charitable trusts and

Edit your coordinating charitable trusts and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your coordinating charitable trusts and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit coordinating charitable trusts and online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit coordinating charitable trusts and. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out coordinating charitable trusts and

How to fill out coordinating charitable trusts and:

01

Begin by gathering all the necessary documentation, such as the trust agreement, contact information of the trust creator, trustees, and beneficiaries, as well as any relevant financial statements.

02

Review the trust agreement thoroughly to understand its terms and conditions. Pay particular attention to any provisions related to coordinating charitable trusts and, such as provisions regarding the distribution of charitable assets or the involvement of charitable organizations.

03

Determine the specific details of the charitable trusts you will be coordinating. This includes identifying the charitable organizations involved, the purpose of the trusts, and any specific instructions or restrictions outlined in the trust agreement.

04

Communicate with the trustees and beneficiaries of the trust to ensure their understanding and agreement with the coordination of charitable trusts. Seek their input and cooperation in fulfilling the objectives of the trusts.

05

Contact the designated charitable organizations to discuss the coordination of the trusts. This may involve initiating a formal relationship, communicating the intentions of the trusts, and establishing a plan of action.

06

Follow the necessary legal procedures to ensure compliance with applicable laws and regulations. This may involve obtaining approval or permits from relevant authorities or filing specific documents.

07

Implement the coordination of charitable trusts according to the agreed-upon plan, ensuring transparency and accountability throughout the process. This may include transferring assets, facilitating communication between trustees and charitable organizations, and managing ongoing administrative tasks.

08

Monitor the progress and impact of the coordinated charitable trusts regularly. Assess whether the objectives of the trusts are being met and make any necessary adjustments or improvements.

09

Maintain proper records and documentation of all activities related to the coordinating charitable trusts. This includes tracking financial transactions, correspondence, and any other relevant information.

Who needs coordinating charitable trusts and:

01

Individuals who have created multiple charitable trusts and wish to consolidate or coordinate their efforts in supporting charitable causes.

02

Trustees responsible for managing charitable trusts that have similar or related objectives and aim to achieve a more effective and impactful outcome through coordination.

03

Charitable organizations that receive support from multiple trusts and seek to streamline their resources and activities.

It is important to consult with legal and financial professionals experienced in trust law and charitable giving to ensure compliance with applicable regulations and maximize the benefits of coordinating charitable trusts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is coordinating charitable trusts and?

Coordinating charitable trusts and involves overseeing and managing charitable trusts to ensure they are in compliance with regulations and fulfilling their intended purposes.

Who is required to file coordinating charitable trusts and?

Charitable organizations and trusts that have been set up to support charitable causes are required to file coordinating charitable trusts and.

How to fill out coordinating charitable trusts and?

Coordinating charitable trusts and can be filled out by providing detailed information about the charitable organization or trust, its purpose, finances, and activities.

What is the purpose of coordinating charitable trusts and?

The purpose of coordinating charitable trusts and is to ensure that charitable funds are managed effectively, used for their intended purposes, and in compliance with legal requirements.

What information must be reported on coordinating charitable trusts and?

Information such as the organization's mission, finances, activities, and any grants or donations made must be reported on coordinating charitable trusts and.

How do I modify my coordinating charitable trusts and in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your coordinating charitable trusts and as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get coordinating charitable trusts and?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific coordinating charitable trusts and and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I execute coordinating charitable trusts and online?

With pdfFiller, you may easily complete and sign coordinating charitable trusts and online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Fill out your coordinating charitable trusts and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Coordinating Charitable Trusts And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.