Get the free Fidelity Growth and Guaranteed Income Trustee Statement and Agreement Form

Show details

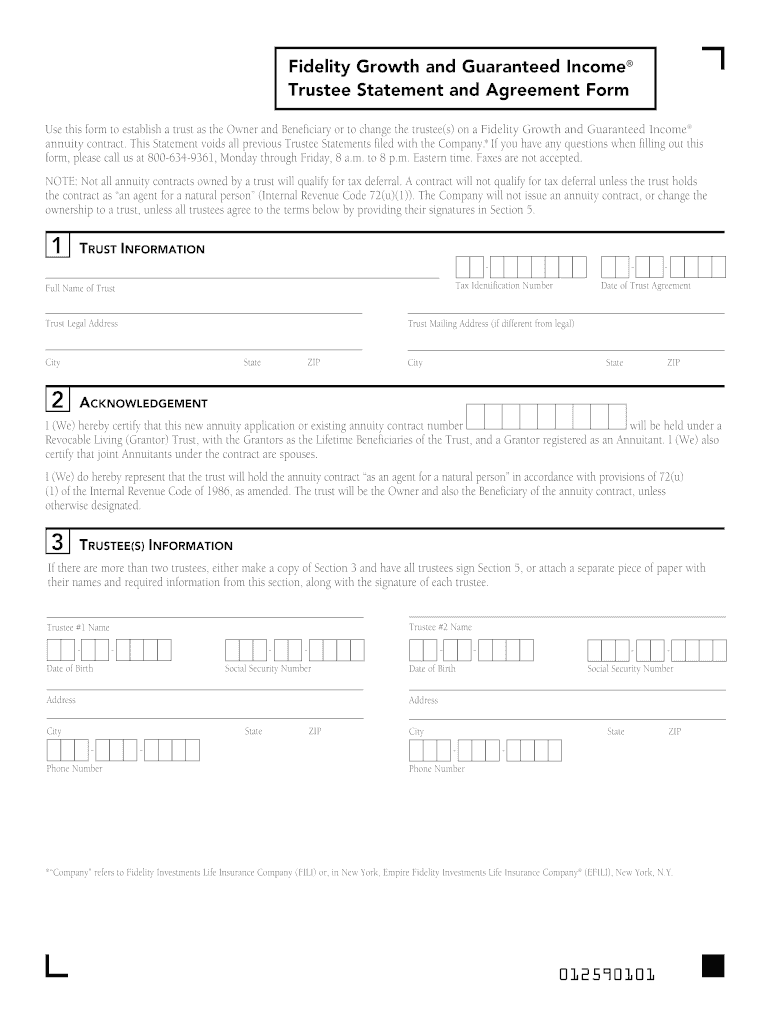

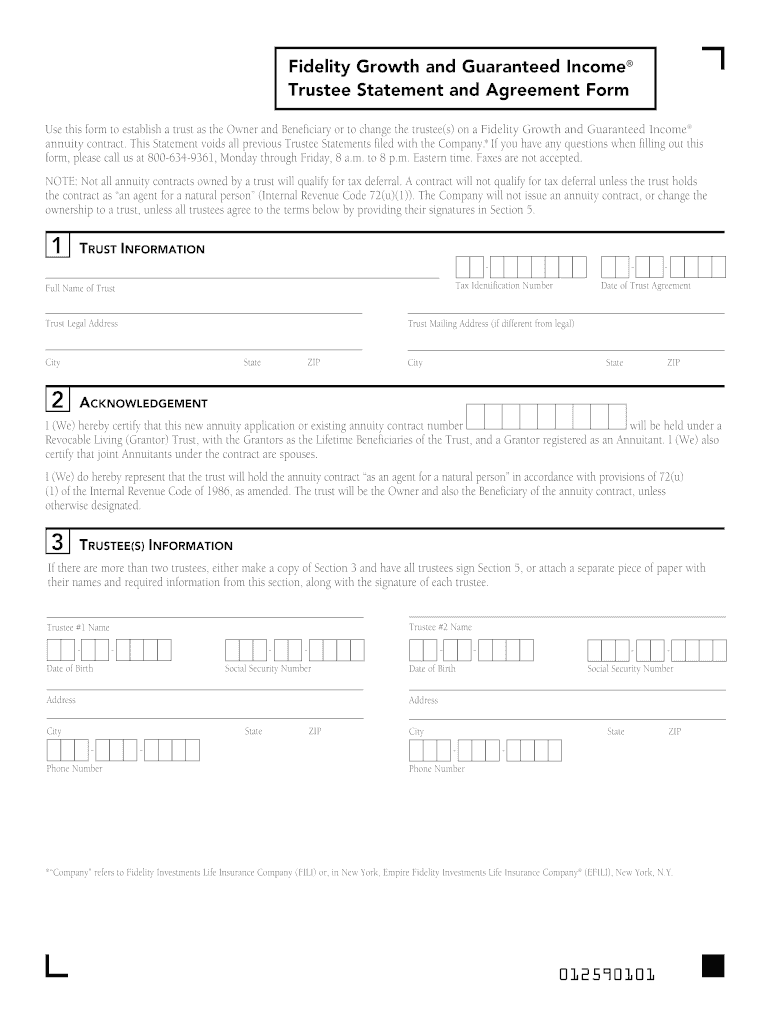

Use this form to establish a trust as the Owner and Beneficiary or to change the trustee(s) on a Fidelity Growth and Guaranteed Income® annuity contract. This Statement voids all previous Trustee

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fidelity growth and guaranteed

Edit your fidelity growth and guaranteed form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity growth and guaranteed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fidelity growth and guaranteed online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fidelity growth and guaranteed. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fidelity growth and guaranteed

How to fill out Fidelity Growth and Guaranteed Income Trustee Statement and Agreement Form

01

Obtain the Fidelity Growth and Guaranteed Income Trustee Statement and Agreement Form from the Fidelity website or your financial advisor.

02

Read the instructions provided with the form carefully to understand the requirements.

03

Fill in your personal information, including your name, address, and contact details in the designated fields.

04

Provide account details, such as your account number and the type of account you are trustee for.

05

Detail the trust information, including the name of the trust, date it was established, and the names of the beneficiaries.

06

Complete any sections regarding the investment strategy or preferences for the trust funds.

07

Sign and date the form where indicated, ensuring that all information is accurate.

08

Submit the completed form to Fidelity either online or through the mail as instructed.

Who needs Fidelity Growth and Guaranteed Income Trustee Statement and Agreement Form?

01

Individuals acting as trustees for a trust that includes Fidelity investment products.

02

Beneficiaries of a trust who require formal documentation to manage trust assets with Fidelity.

03

Financial advisors administering trust accounts for clients who have Fidelity investments.

Fill

form

: Try Risk Free

People Also Ask about

Is Fidelity considered a trustee?

With Fidelity as corporate trustee, you may have more time to build a better relationship with your client: Financial Representative can focus on relationships

Can Fidelity act as a trustee?

Fidelity's Trustee Services Whether you choose to work with Fidelity Personal Trust Company1, as your trustee or co-trustee, we bring objectivity, continuity, and experience to the management of your trust.

Who Cannot act as a trustee?

The reasons which disqualify a person from being a charity trustee are: Unspent conviction for an offence involving dishonesty or deception. Unspent conviction for specified terrorism offences. Unspent conviction for a specified money laundering offence.

How much does Fidelity charge for trustees?

Fees for trust administration when FPTC serves as trustee or co-trustee start at 0.45% for the first $2 million of trust assets, with additional breakpoints for larger trusts. There is a minimum annual fee of $4,500 for trust administration. Additional advisory fees apply for investment management service.

Can a financial advisor act as a trustee?

Attorneys, accountants and financial advisors often have unique relationships with their clients and may be suited to serve as the trustee of your trust, as they should understand you and your estate nearly as well as you do.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fidelity Growth and Guaranteed Income Trustee Statement and Agreement Form?

The Fidelity Growth and Guaranteed Income Trustee Statement and Agreement Form is a document used to establish and maintain a trust account with Fidelity, allowing for investments and financial planning within a structured framework.

Who is required to file Fidelity Growth and Guaranteed Income Trustee Statement and Agreement Form?

Individuals or entities acting as trustees for a trust account that invests in growth and guaranteed income products through Fidelity are required to file this form.

How to fill out Fidelity Growth and Guaranteed Income Trustee Statement and Agreement Form?

To fill out the form, provide accurate information regarding the trust, including the trustee's details, trust purpose, beneficiaries, and investment options, ensuring all fields are completed as per the guidelines provided by Fidelity.

What is the purpose of Fidelity Growth and Guaranteed Income Trustee Statement and Agreement Form?

The purpose of this form is to formalize the trust relationship, outline the terms of investment, and ensure compliance with regulatory requirements related to trust accounts.

What information must be reported on Fidelity Growth and Guaranteed Income Trustee Statement and Agreement Form?

The form must report information including the name of the trust, trustee identification, trust beneficiaries, the purpose of the trust, and the specifics of the investment strategy or products chosen.

Fill out your fidelity growth and guaranteed online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Growth And Guaranteed is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.