NC NC-1099-ITIN 2011 free printable template

Show details

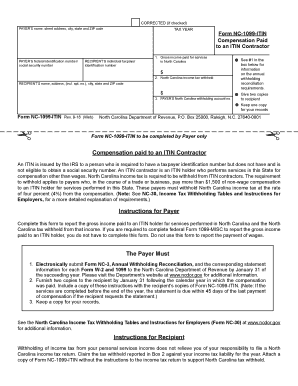

CORRECTED (if checked) PAYER'S name, street address, city, state and ZIP code TAX YEAR Form NC-1099-ITIN Compensation Paid to an ITIN Contractor See #1 in the box below for information on the annual

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC NC-1099-ITIN

Edit your NC NC-1099-ITIN form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC NC-1099-ITIN form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NC NC-1099-ITIN online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NC NC-1099-ITIN. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC NC-1099-ITIN Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC NC-1099-ITIN

How to fill out NC NC-1099-ITIN

01

Obtain the NC NC-1099-ITIN form from the North Carolina Department of Revenue website or your tax professional.

02

Fill in the payer's name, address, and taxpayer identification number (TIN) in the appropriate fields.

03

Enter the recipient's name, address, and ITIN in the designated sections.

04

Specify the type of income being reported in the 'Income Type' box.

05

Input the total amount of income paid to the recipient during the tax year in the 'Income Amount' field.

06

Provide any applicable state withholding amounts in the 'State Withholding' field, if required.

07

Check for any additional instructions or requirements specific to your situation provided by the state.

08

Sign and date the form where required.

09

Submit the form by the due date to the North Carolina Department of Revenue, and provide a copy to the recipient.

Who needs NC NC-1099-ITIN?

01

Individuals or businesses that have made payments to non-resident aliens during the tax year.

02

Payors who are required to report certain types of income, such as rent, services, or royalties.

03

Entities that must comply with North Carolina tax regulations regarding foreign individuals receiving income.

Fill

form

: Try Risk Free

People Also Ask about

How much is IRS revenue?

During Fiscal Year (FY) 2022, the IRS collected more than $4.9 trillion in gross taxes, processed more than 262.8 million tax returns and other forms, and issued more than $641.7 billion in tax refunds. In FY 2022, nearly 58.2 million taxpayers were assisted by calling or visiting an IRS office.

What if you owe the IRS over $100 000?

Owing over $100,000 in taxes can be terrifying. If you don't take any action, the IRS will issue a tax lien, and you will lose your passport. The agency may also garnish your wages, seize your bank account, and start levying your assets.

Where does the money the IRS collects go to?

As you might have expected, the majority of your Federal income tax dollars go to Social Security, health programs, defense and interest on the national debt.

How many taxpayers owe the IRS?

Some 11.23 million Americans owe a total of more than $125 billion in back taxes to the IRS.

What does IRS do with the money?

The Internal Revenue Service is a federal agency responsible for collecting federal taxes and enforcing U.S. tax laws. Most of the work of the IRS involves individual and corporate income taxes.

How much revenue does the IRS collect each year?

Fiscal Year 2019 State federal district or territoryGross collections (thousands of dollars)California472,027,235Colorado59,961,429Connecticut57,092,781Delaware20,073,97951 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify NC NC-1099-ITIN without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your NC NC-1099-ITIN into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find NC NC-1099-ITIN?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific NC NC-1099-ITIN and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete NC NC-1099-ITIN online?

pdfFiller has made it easy to fill out and sign NC NC-1099-ITIN. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

What is NC NC-1099-ITIN?

The NC NC-1099-ITIN is a form used in North Carolina for reporting income earned by individuals who have an Individual Taxpayer Identification Number (ITIN) and are not eligible for a Social Security Number.

Who is required to file NC NC-1099-ITIN?

Employers and businesses that pay to non-resident individuals or entities who have an ITIN and earn income in North Carolina are required to file the NC NC-1099-ITIN.

How to fill out NC NC-1099-ITIN?

To fill out the NC NC-1099-ITIN, you need to provide details such as the payer's information, the payee's ITIN, the amount paid, and the type of income. Ensure all fields are accurately completed and follow any specific instructions provided by the North Carolina Department of Revenue.

What is the purpose of NC NC-1099-ITIN?

The purpose of the NC NC-1099-ITIN is to report income paid to individuals with ITINs in order to ensure proper tax reporting and compliance with North Carolina tax laws.

What information must be reported on NC NC-1099-ITIN?

The information that must be reported on NC NC-1099-ITIN includes the payer's name, address, and identification number, the payee's name, address, and ITIN, the total amount paid, and any withholding taxes, if applicable.

Fill out your NC NC-1099-ITIN online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC NC-1099-ITIN is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.