Get the free Common Insurance Plan Types: HMO, PPO, EPO - Cigna - fhdafiles fhda

Show details

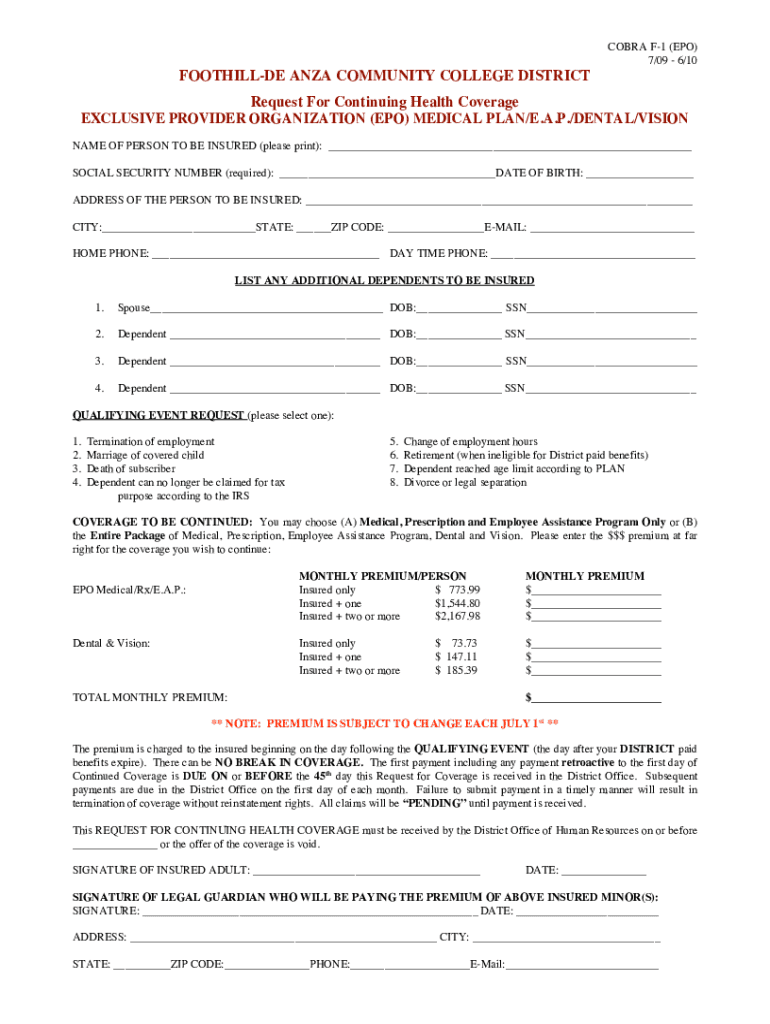

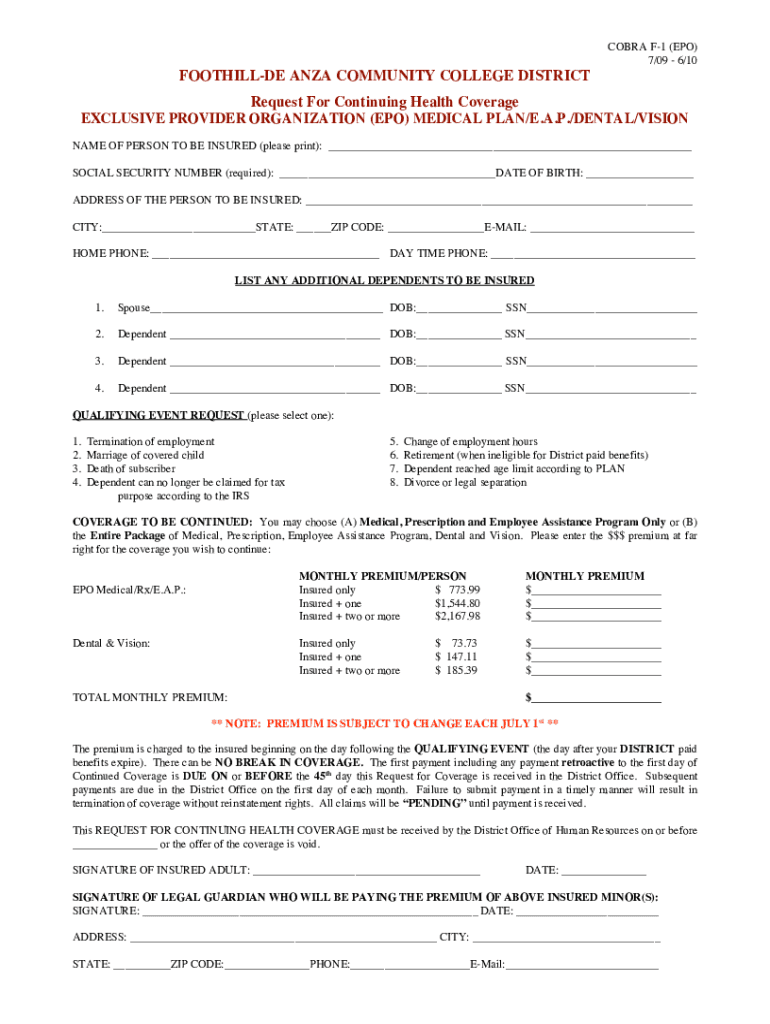

COBRA F1 (EPO) 7/09 6/10FOOTHILLDE ANNA COMMUNITY COLLEGE DISTRICT Request For Continuing Health Coverage EXCLUSIVE PROVIDER ORGANIZATION (EPO) MEDICAL PLAN/E.A.P./DENTAL/VISION NAME OF PERSON TO

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign common insurance plan types

Edit your common insurance plan types form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your common insurance plan types form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit common insurance plan types online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit common insurance plan types. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out common insurance plan types

How to fill out common insurance plan types

01

Understand the different types of insurance plans, such as health insurance, life insurance, auto insurance, home insurance, etc.

02

Identify the specific plan you need based on your circumstances. For example, if you want health insurance, determine whether you need an individual plan or a family plan.

03

Research different insurance providers to compare their offerings. Look for factors like coverage limit, premium cost, deductibles, and network of healthcare providers.

04

Gather the necessary information and documents required for the application process. This may include personal identification, employment details, medical history, and other relevant records.

05

Fill out the insurance application form accurately and completely. Pay attention to any specific instructions or requirements mentioned in the form.

06

Review the filled-out form carefully before submission, ensuring all information is correct and there are no errors or omissions.

07

Submit the completed insurance application along with any required supporting documents, such as proof of income, address, or medical examination reports.

08

Wait for the insurance provider to review your application. This may involve a pre-approval process, verification of information, and underwriting.

09

If your application is approved, carefully review the terms and conditions of the insurance plan before accepting it. Understand the coverage details, premiums, and any limitations or exclusions.

10

Make the necessary premium payments as per the agreed schedule to activate and maintain your insurance coverage.

11

Keep track of any updates or changes to your insurance plan, such as renewal dates, policy modifications, or claims procedures. Stay informed and adjust your coverage as needed.

Who needs common insurance plan types?

01

Anyone who wants financial protection against specific risks or unexpected events may need common insurance plan types.

02

Individuals who want to safeguard their health, personal belongings, vehicles, or loved ones can benefit from insurance coverage.

03

Working professionals, homeowners, parents, and individuals with valuable assets often require insurance plans to mitigate potential financial losses.

04

Insurance plans are also important for businesses to protect their assets, employees, and operations.

05

Depending on the country and legal requirements, certain types of insurance may be mandatory for individuals or organizations.

06

Ultimately, the decision to get insurance should be based on individual needs, risk tolerance, and affordability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my common insurance plan types directly from Gmail?

common insurance plan types and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find common insurance plan types?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific common insurance plan types and other forms. Find the template you need and change it using powerful tools.

How do I edit common insurance plan types straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing common insurance plan types.

What is common insurance plan types?

Common insurance plan types include Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) plans.

Who is required to file common insurance plan types?

Insurance providers, employers offering health plans, and certain organizations are required to file common insurance plan types.

How to fill out common insurance plan types?

To fill out common insurance plan types, gather the necessary information about the insured individuals, the coverage details, and the plan specifics, then complete the required forms as per the guidelines provided by the relevant insurance authority.

What is the purpose of common insurance plan types?

The purpose of common insurance plan types is to provide structured health coverage options that meet various needs, offering managed care to optimize healthcare delivery and expenses.

What information must be reported on common insurance plan types?

Information that must be reported includes the type of coverage offered, the number of individuals covered, benefits provided, premium amounts, deductibles, and any exclusions.

Fill out your common insurance plan types online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Common Insurance Plan Types is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.