Get the free DA-63 - Monthly Reconciliation of Financial Institution Account

Show details

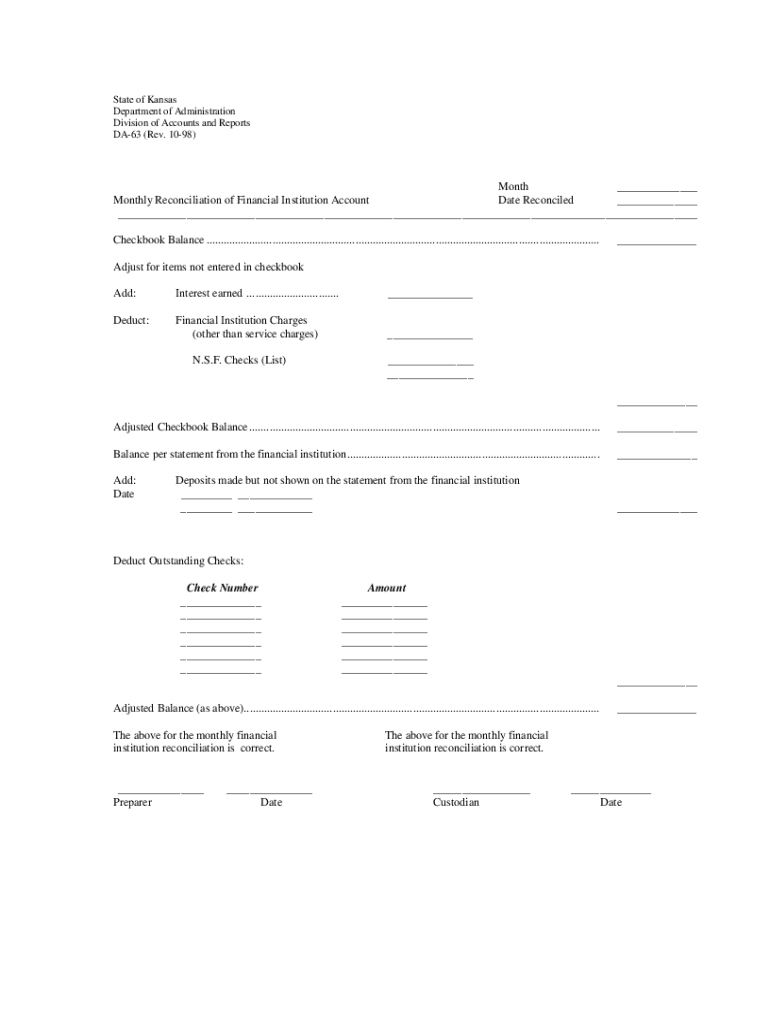

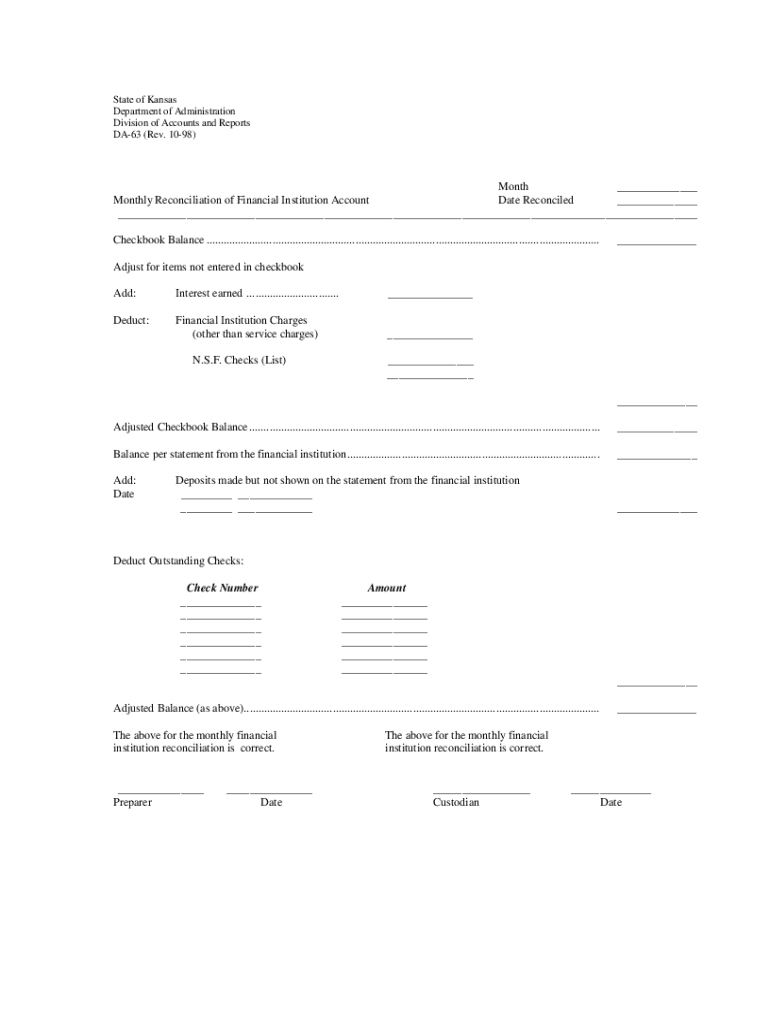

State of KansasDepartment of AdministrationDivision of Accounts and ReportsDA63 (Rev. 1098)Month Monthly Reconciliation of Financial Institution Account Date Reconciled Checkbook Balance .........................................................................................................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign da-63 - monthly reconciliation

Edit your da-63 - monthly reconciliation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your da-63 - monthly reconciliation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing da-63 - monthly reconciliation online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit da-63 - monthly reconciliation. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out da-63 - monthly reconciliation

How to fill out da-63 - monthly reconciliation

01

Gather all relevant financial documents and records for the period that needs to be reconciled.

02

Start by comparing the beginning balances on the statement with the ending balances from the previous reconciliation period.

03

Identify any discrepancies or errors and investigate the reasons behind them.

04

Make adjustments and corrections as necessary to ensure accuracy.

05

Proceed to reconcile each individual item or account listed on the statement, comparing it with the corresponding records in your own books.

06

Document any reconciling items or adjustments made during the process.

07

Once all items have been reconciled, calculate the ending balance and ensure it matches the ending balance on the statement.

08

Prepare a summary or report detailing the reconciliation process and any necessary explanations or notes.

09

Review and validate the accuracy of the reconciliation before finalizing it.

10

Keep a copy of the completed reconciliation report for future reference and audit purposes.

Who needs da-63 - monthly reconciliation?

01

DA-63 - Monthly Reconciliation is typically required by businesses, organizations, and individuals who need to ensure the accuracy and integrity of their financial records.

02

Accountants, bookkeepers, or financial professionals often utilize this form as part of their regular accounting and auditing processes.

03

It is commonly used by company finance departments, governmental agencies, and financial institutions.

04

Any entity that maintains financial records and wants to identify errors, discrepancies, or fraudulent activities may benefit from performing monthly reconciliations using DA-63.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my da-63 - monthly reconciliation directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your da-63 - monthly reconciliation and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get da-63 - monthly reconciliation?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the da-63 - monthly reconciliation in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit da-63 - monthly reconciliation on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign da-63 - monthly reconciliation right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is da-63 - monthly reconciliation?

DA-63 is a form used for monthly reconciliation of financial transactions, typically required for certain reporting purposes within an organization to ensure accuracy in financial records.

Who is required to file da-63 - monthly reconciliation?

Organizations or individuals involved in financial activities that require reconciliation of monthly transactions are typically required to file DA-63.

How to fill out da-63 - monthly reconciliation?

To fill out DA-63, gather all financial transaction data for the month, ensure all amounts are accurate, and complete each section of the form as specified, providing the necessary details for reconciliation.

What is the purpose of da-63 - monthly reconciliation?

The purpose of DA-63 is to provide a systematic approach to reconciling financial transactions, ensuring that records are accurate and discrepancies are identified and addressed.

What information must be reported on da-63 - monthly reconciliation?

The information that must be reported on DA-63 includes details of all financial transactions, discrepancies found, adjustments made, and a summary of the reconciliation process for the month.

Fill out your da-63 - monthly reconciliation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Da-63 - Monthly Reconciliation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.