WA DoR Multi-Purpose Combined Excise Tax Return 2020 free printable template

Show details

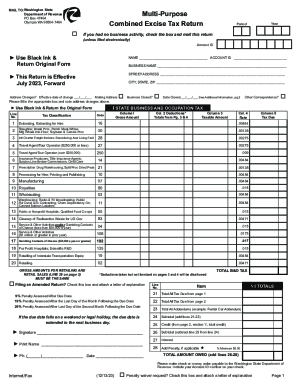

MAIL TO:Washington State Department of Revenue PO Box 47464 Olympia WA 985047464MultiPurpose Combined Excise Tax Return oYearPeriodIf you had no business activity, check the box and mail this return

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WA DoR Multi-Purpose Combined Excise Tax

Edit your WA DoR Multi-Purpose Combined Excise Tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WA DoR Multi-Purpose Combined Excise Tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit WA DoR Multi-Purpose Combined Excise Tax online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit WA DoR Multi-Purpose Combined Excise Tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WA DoR Multi-Purpose Combined Excise Tax Return Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WA DoR Multi-Purpose Combined Excise Tax

How to fill out WA DoR Multi-Purpose Combined Excise Tax Return

01

Obtain the WA DoR Multi-Purpose Combined Excise Tax Return form from the Washington State Department of Revenue website or your local office.

02

Fill in your business details, including name, address, and account number at the top of the form.

03

Indicate the reporting period for which you are filing the return.

04

Complete the relevant sections for the type of tax being reported (e.g., retail sales tax, use tax, etc.).

05

Calculate the total tax due based on your business's sales and services during the reporting period.

06

Include any applicable deductions or exemptions in the appropriate sections.

07

Review all entries for accuracy and completeness.

08

Sign and date the return to certify its authenticity.

09

Submit the completed form along with any payment due by the specified deadline.

Who needs WA DoR Multi-Purpose Combined Excise Tax Return?

01

Businesses operating in Washington State that collect or owe excise taxes.

02

Retailers, wholesalers, and service providers that must report sales tax.

03

Individuals or entities engaged in specific activities subject to excise tax, such as rental of property or public utility services.

Fill

form

: Try Risk Free

People Also Ask about

What is tax form 720 used for?

Purpose of Form Use Form 720 and attachments to report your liability by IRS No. and pay the excise taxes listed on the form. If you report a liability on Part I or Part II, you may be eligible to use Schedule C to claim a credit.

Who files Form 720 excise tax?

Often, the retailer, manufacturer or importer must pay the excise tax to the IRS and file the Form 720. They may pass the cost of the excise tax on to the buyer. Some excise taxes are collected by a third party. The third party then sends the tax to the IRS and files the Form 720.

What is Washington Combined excise Tax Return?

Combined Excise Tax This return is used for reporting your business income, sales tax, and use tax.

Why would I need a form 720?

If your small business deals in goods and services subject to excise tax — such as air transportation, fishing equipment or gasoline — then you may have to file IRS Form 720 on a quarterly basis to report and pay your federal excise tax.

Who is required to file IRS form 720?

Who files Form 720? Whether you are a manufacturer, retailer, airline or any other business that deals in goods for which excise taxes are due, you have a responsibility to file a Quarterly Federal Excise Tax Return on Form 720 up to four times per year, depending on the circumstances.

What is an excise tax return?

Excise taxes are taxes imposed on certain goods, services, and activities. Taxpayers include importers, manufacturers, retailers, and consumers, and vary depending on the specific tax. Excise taxes may be imposed at the time of: Entry into the United States, or sale or use after importation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete WA DoR Multi-Purpose Combined Excise Tax online?

pdfFiller has made filling out and eSigning WA DoR Multi-Purpose Combined Excise Tax easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the WA DoR Multi-Purpose Combined Excise Tax in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your WA DoR Multi-Purpose Combined Excise Tax.

How can I fill out WA DoR Multi-Purpose Combined Excise Tax on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your WA DoR Multi-Purpose Combined Excise Tax. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is WA DoR Multi-Purpose Combined Excise Tax Return?

The WA DoR Multi-Purpose Combined Excise Tax Return is a form used by businesses in Washington State to report and pay various types of excise taxes, including retail sales tax, use tax, and other specific taxes.

Who is required to file WA DoR Multi-Purpose Combined Excise Tax Return?

Any business operating in Washington State that engages in activities subject to excise tax, such as retail sales or other taxable transactions, is required to file the WA DoR Multi-Purpose Combined Excise Tax Return.

How to fill out WA DoR Multi-Purpose Combined Excise Tax Return?

To fill out the WA DoR Multi-Purpose Combined Excise Tax Return, a taxpayer needs to provide information on their total sales, deductions, and calculate the excise taxes owed based on the specific categories applicable to their business.

What is the purpose of WA DoR Multi-Purpose Combined Excise Tax Return?

The purpose of the WA DoR Multi-Purpose Combined Excise Tax Return is to streamline the reporting and payment of multiple types of excise taxes imposed on businesses in Washington State, ensuring compliance with state tax laws.

What information must be reported on WA DoR Multi-Purpose Combined Excise Tax Return?

The WA DoR Multi-Purpose Combined Excise Tax Return requires businesses to report total gross sales, any deductions, tax due for each category, and other relevant business information necessary for the tax calculation.

Fill out your WA DoR Multi-Purpose Combined Excise Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WA DoR Multi-Purpose Combined Excise Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.