WA DoR Multi-Purpose Combined Excise Tax Return 2022 free printable template

Show details

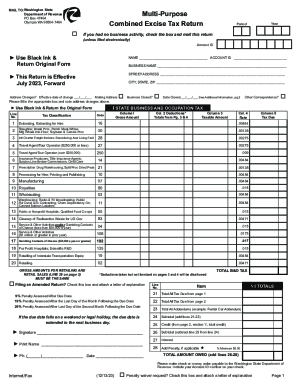

MAIL TO:Washington State Department of Revenue PO Box 47464 Olympia WA 985047464MultiPurpose Combined Excise Tax Return oYearPeriodIf you had no business activity, check the box and mail this return

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign WA DoR Multi-Purpose Combined Excise Tax

Edit your WA DoR Multi-Purpose Combined Excise Tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your WA DoR Multi-Purpose Combined Excise Tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing WA DoR Multi-Purpose Combined Excise Tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit WA DoR Multi-Purpose Combined Excise Tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WA DoR Multi-Purpose Combined Excise Tax Return Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out WA DoR Multi-Purpose Combined Excise Tax

How to fill out WA DoR Multi-Purpose Combined Excise Tax Return

01

Obtain the WA DoR Multi-Purpose Combined Excise Tax Return form from the Washington Department of Revenue website or your local office.

02

Fill out your business information, including name, address, and the Business Identification Number (BIN).

03

Select the appropriate tax classification(s) for your business activities from the options provided.

04

For each classification, report your gross income earned during the reporting period.

05

Calculate the tax due for each classification based on the reported income and applicable tax rate.

06

Complete any necessary schedules or attachments required for your specific activities.

07

Review the entire form for accuracy before submitting.

08

Submit the completed form by the due date, along with payment for any taxes owed.

Who needs WA DoR Multi-Purpose Combined Excise Tax Return?

01

Businesses operating in Washington State that have activities subject to Washington State excise taxes.

02

Individuals or companies engaged in activities like retail sales, service provisions, and other business operations that fall under the state's tax jurisdiction.

03

Any entity required to report and remit taxes related to their business activities as defined by the Washington Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

What is tax form 720 used for?

Purpose of Form Use Form 720 and attachments to report your liability by IRS No. and pay the excise taxes listed on the form. If you report a liability on Part I or Part II, you may be eligible to use Schedule C to claim a credit.

Who files Form 720 excise tax?

Often, the retailer, manufacturer or importer must pay the excise tax to the IRS and file the Form 720. They may pass the cost of the excise tax on to the buyer. Some excise taxes are collected by a third party. The third party then sends the tax to the IRS and files the Form 720.

What is Washington Combined excise Tax Return?

Combined Excise Tax This return is used for reporting your business income, sales tax, and use tax.

Why would I need a form 720?

If your small business deals in goods and services subject to excise tax — such as air transportation, fishing equipment or gasoline — then you may have to file IRS Form 720 on a quarterly basis to report and pay your federal excise tax.

Who is required to file IRS form 720?

Who files Form 720? Whether you are a manufacturer, retailer, airline or any other business that deals in goods for which excise taxes are due, you have a responsibility to file a Quarterly Federal Excise Tax Return on Form 720 up to four times per year, depending on the circumstances.

What is an excise tax return?

Excise taxes are taxes imposed on certain goods, services, and activities. Taxpayers include importers, manufacturers, retailers, and consumers, and vary depending on the specific tax. Excise taxes may be imposed at the time of: Entry into the United States, or sale or use after importation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my WA DoR Multi-Purpose Combined Excise Tax in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your WA DoR Multi-Purpose Combined Excise Tax and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify WA DoR Multi-Purpose Combined Excise Tax without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including WA DoR Multi-Purpose Combined Excise Tax, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make edits in WA DoR Multi-Purpose Combined Excise Tax without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your WA DoR Multi-Purpose Combined Excise Tax, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is WA DoR Multi-Purpose Combined Excise Tax Return?

The WA DoR Multi-Purpose Combined Excise Tax Return is a tax form used by businesses in Washington State to report and pay various state taxes, including excise taxes for different business activities.

Who is required to file WA DoR Multi-Purpose Combined Excise Tax Return?

Businesses engaged in activities subject to Washington State excise taxes are required to file the WA DoR Multi-Purpose Combined Excise Tax Return, including but not limited to retailers, wholesalers, and service providers.

How to fill out WA DoR Multi-Purpose Combined Excise Tax Return?

To fill out the WA DoR Multi-Purpose Combined Excise Tax Return, businesses should complete all sections of the form, accurately report their gross receipts and tax amounts, and ensure all calculations are correct before submitting to the Washington Department of Revenue.

What is the purpose of WA DoR Multi-Purpose Combined Excise Tax Return?

The purpose of the WA DoR Multi-Purpose Combined Excise Tax Return is to facilitate the reporting and payment of multiple taxes owed by a business in a single submission, streamlining the tax compliance process.

What information must be reported on WA DoR Multi-Purpose Combined Excise Tax Return?

The information that must be reported on the WA DoR Multi-Purpose Combined Excise Tax Return includes the business's name, address, tax reporting period, gross income, deductions, and the calculated tax due for each applicable tax classification.

Fill out your WA DoR Multi-Purpose Combined Excise Tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

WA DoR Multi-Purpose Combined Excise Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.