MI UIA 1920 2012 free printable template

Show details

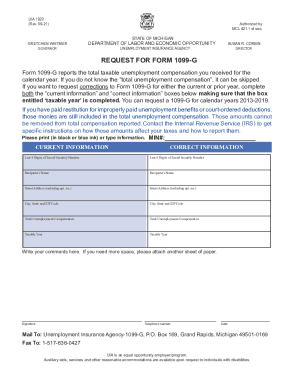

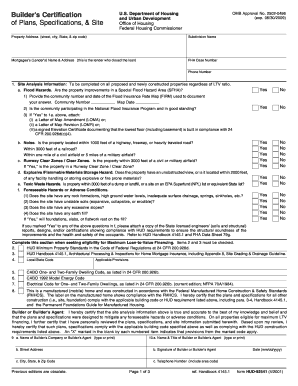

UIA 1920 (Rev 08-11) State of Michigan Department of Energy, Licensing and Regulatory Affairs Authorized by MCL 421.1, et seq UNEMPLOYMENT INSURANCE AGENCY Request for Form 1099-G Reset Form Mail

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI UIA 1920

Edit your MI UIA 1920 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI UIA 1920 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI UIA 1920 online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MI UIA 1920. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI UIA 1920 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI UIA 1920

How to fill out MI UIA 1920

01

Obtain the MI UIA 1920 form from the official Michigan Unemployment Insurance Agency website or your local office.

02

Fill in your personal information, including your name, address, date of birth, and Social Security number.

03

Provide details about your employment history, including names of employers, dates of employment, and reasons for unemployment.

04

Indicate your availability for work and the type of work you are seeking.

05

Review the form for accuracy and completeness.

06

Sign and date the form.

07

Submit the form as directed, either online or via mail.

Who needs MI UIA 1920?

01

Individuals who have lost their job through no fault of their own and are seeking unemployment benefits in Michigan.

02

Workers who are temporarily laid off and expect to return to work.

03

Part-time workers who meet the eligibility requirements for unemployment benefits.

Instructions and Help about MI UIA 1920

Fill

form

: Try Risk Free

People Also Ask about

Is Michigan 1099-G available?

Workers who received unemployment benefits in 2022 can now view or download their 1099-G tax statements through the Michigan Web Account Manager (MiWAM). A paper copy of the form will be sent to everyone through U.S. mail by the end of January.

What's the difference between UC 1099G and 1099-G?

The UC-1099G is used to report income from regular Unemployment Compensation. The PUA-1099G is used to report income from the Pandemic Unemployment Assistance program. Both forms are created by the Pennsylvania Department of Labor & Industry.

Do I have to report income if I didn't receive a 1099?

Taxpayers must report any income even if they did not receive their 1099 form. However, taxpayers do not need to send the 1099 form to the IRS when they file their taxes. In other words, the IRS receives the 1099, containing the taxpayer's Social Security number, from the issuer or payer.

How do I get my 1099-G form in Michigan?

Request Your Unemployment Benefit Statement Online 1 – Log into MiWAM. 2 – Under Account Alerts, click “Please select a delivery preference for your 1099 Form. 3 – Under Delivery Preference for Form 1099-G, click Electronic. Your email address will be displayed. 4 - Review and Submit.

How do I get my 1099-G online in Michigan?

To receive your 1099-G online: 1 – Log into MiWAM. 2 – Under Account Alerts, click “Please select a delivery preference for your 1099 Form. 3 – Under Delivery Preference for Form 1099-G, click Electronic. Your email address will be displayed. 4 - Review and Submit.

Where do I get a 1099-G form in Michigan?

Workers who received unemployment benefits in 2022 can now view or download their 1099-G tax statements through the Michigan Web Account Manager (MiWAM). A paper copy of the form will be sent to everyone through U.S. mail by the end of January.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get MI UIA 1920?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the MI UIA 1920 in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make edits in MI UIA 1920 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit MI UIA 1920 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit MI UIA 1920 on an iOS device?

You certainly can. You can quickly edit, distribute, and sign MI UIA 1920 on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is MI UIA 1920?

MI UIA 1920 is a form used in Michigan for reporting unemployment insurance claims and taxable wages.

Who is required to file MI UIA 1920?

Employers who have employees in Michigan and are liable for unemployment insurance contributions are required to file MI UIA 1920.

How to fill out MI UIA 1920?

To fill out MI UIA 1920, provide the necessary information about your business, employee wages, and the appropriate calculations as per the instructions provided with the form.

What is the purpose of MI UIA 1920?

The purpose of MI UIA 1920 is to report employee wages and calculate the unemployment insurance contributions owed by employers.

What information must be reported on MI UIA 1920?

The information that must be reported includes employer information, employee wages, the number of employees, and the total taxable wages for the reporting period.

Fill out your MI UIA 1920 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI UIA 1920 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.