TIAA F11185 2018 free printable template

Show details

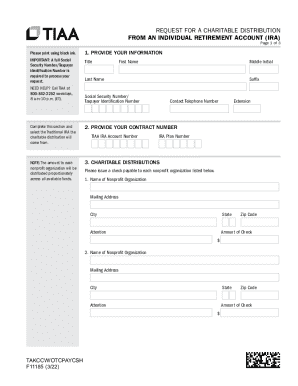

REQUEST FOR A CHARITABLE DISTRIBUTION FROM AN INDIVIDUAL RETIREMENT ACCOUNT (IRA) Page 1 of 3Print in upper case using black or dark blue ink and provide all information.1. PROVIDE YOUR INFORMATION

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tiaa qcd form 2018

Edit your tiaa qcd form 2018 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tiaa qcd form 2018 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tiaa qcd form 2018 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tiaa qcd form 2018. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TIAA F11185 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tiaa qcd form 2018

How to fill out TIAA F11185

01

Start by downloading the TIAA F11185 form from the TIAA website or obtain a physical copy.

02

Begin filling out your personal information at the top of the form, including your name, address, and Social Security number.

03

Provide details about your employment and the retirement accounts you are managing.

04

Carefully read the instructions for each section to ensure accurate completion.

05

Fill out the necessary financial information, including beneficiary details and investment choices.

06

Review all entered information for accuracy and completeness.

07

Sign and date the form at the designated area.

08

Submit the completed form as instructed, either online or via mail.

Who needs TIAA F11185?

01

Individuals who are participants in TIAA retirement plans need the TIAA F11185 form to manage their account.

02

Financial advisors may require the form to assist clients with their TIAA accounts.

03

Employers offering TIAA retirement benefits may need to provide this form to employees.

Fill

form

: Try Risk Free

People Also Ask about

Can I write a check from my IRA for a QCD?

QCDs can be made electronically, directly to the charity, or by check payable to the charity. An IRA distribution, such as an electronic payment made directly to the IRA owner, does not count as a QCD. Likewise, a check made payable to the IRA owner is not a QCD.

What is the IRS form for qualified charitable distribution?

The QCD will be reported to the IRS on Form 1099-R as a normal distribution (Code 7) based on your age. You must document the tax-free qualification to the Internal Revenue Service “IRS” on your Federal income tax return (Form 1040).

Does a QCD count towards itemized deductions?

All contributions and earnings that accumulate within a traditional IRA are eligible for QCDs. The IRS caps the amount that you can donate each year as a QCD directly from your IRA at $100,000. 8 Anything in excess of this amount must be taken as an itemized deduction.

Do you receive a 1099-R for QCD?

QCDs are reported along with other distributions from an IRA account on IRS Form 1099-R. They are aggregated with other taxable distributions and reported on Lines 1 and 2 on Form 1099-R. Nowhere on Form 1099-R is the amount of QCDs indicated.

How do I report a QCD on Form 1040?

To report a qualified charitable distribution on your Form 1040 tax return, you generally report the full amount of the charitable distribution on the line for IRA distributions. On the line for the taxable amount, enter zero if the full amount was a qualified charitable distribution. Enter "QCD" next to this line.

What are the IRS rules for QCD from IRA?

The maximum annual amount that can qualify for a QCD is $100,000.00 (Indexed starting in 2024). This applies to the sum of QCDs made to one or more charities in a calendar year. (If, however, you file taxes jointly, your spouse can also make a QCD from his or her own IRA within the same tax year for up to $100,000.)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute tiaa qcd form 2018 online?

pdfFiller makes it easy to finish and sign tiaa qcd form 2018 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit tiaa qcd form 2018 in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing tiaa qcd form 2018 and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out the tiaa qcd form 2018 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign tiaa qcd form 2018 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is TIAA F11185?

TIAA F11185 is a tax form used by the Teachers Insurance and Annuity Association to report certain financial information related to retirement plans.

Who is required to file TIAA F11185?

Individuals or entities that manage or administer retirement accounts under the TIAA organization are required to file TIAA F11185.

How to fill out TIAA F11185?

To fill out TIAA F11185, obtain the form from TIAA's website, provide the necessary financial information, sign where indicated, and submit it as directed.

What is the purpose of TIAA F11185?

The purpose of TIAA F11185 is to provide documentation and reporting of contributions and distributions related to retirement plans to ensure compliance with regulatory requirements.

What information must be reported on TIAA F11185?

TIAA F11185 must report information including participant details, account balances, contributions, distributions, and any applicable tax information.

Fill out your tiaa qcd form 2018 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tiaa Qcd Form 2018 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.