IRS W-4P 2021 free printable template

Instructions and Help about IRS W-4P

How to edit IRS W-4P

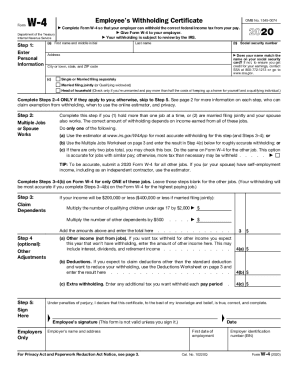

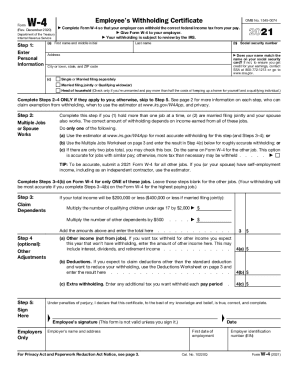

How to fill out IRS W-4P

About IRS W-4P previous version

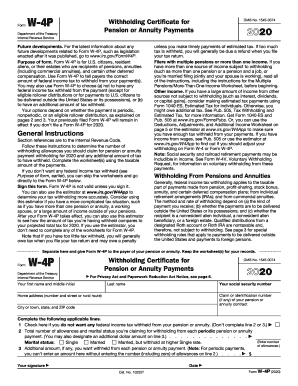

What is IRS W-4P?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-4P

What should I do if I realize there's an error on my submitted IRS W-4P?

If you notice an error after submitting your IRS W-4P, you can correct it by submitting a new W-4P form with the correct information. Ensure you mark it as an amendment if necessary, and check how your submitted form may affect your withholding or payments.

How can I verify if my IRS W-4P has been received and processed?

To verify the receipt and processing of your IRS W-4P, you can contact the IRS directly or check online through the IRS website, which may provide status updates for e-filed forms. Keep in mind that processing times can vary based on the method of submission.

Are there any specific service fees if I choose to e-file my IRS W-4P?

Yes, some online e-filing services may charge a fee for submitting your IRS W-4P electronically, so it’s advisable to compare platforms. Always check the costs associated with e-filing to ensure you're aware of any extra charges.

What steps should I take if I receive a notice regarding my IRS W-4P?

If you receive a notice from the IRS about your W-4P, carefully read the document and identify any actions required. Prepare the necessary documentation to address the notice and, if needed, consult a tax professional for guidance on your specific situation.

See what our users say