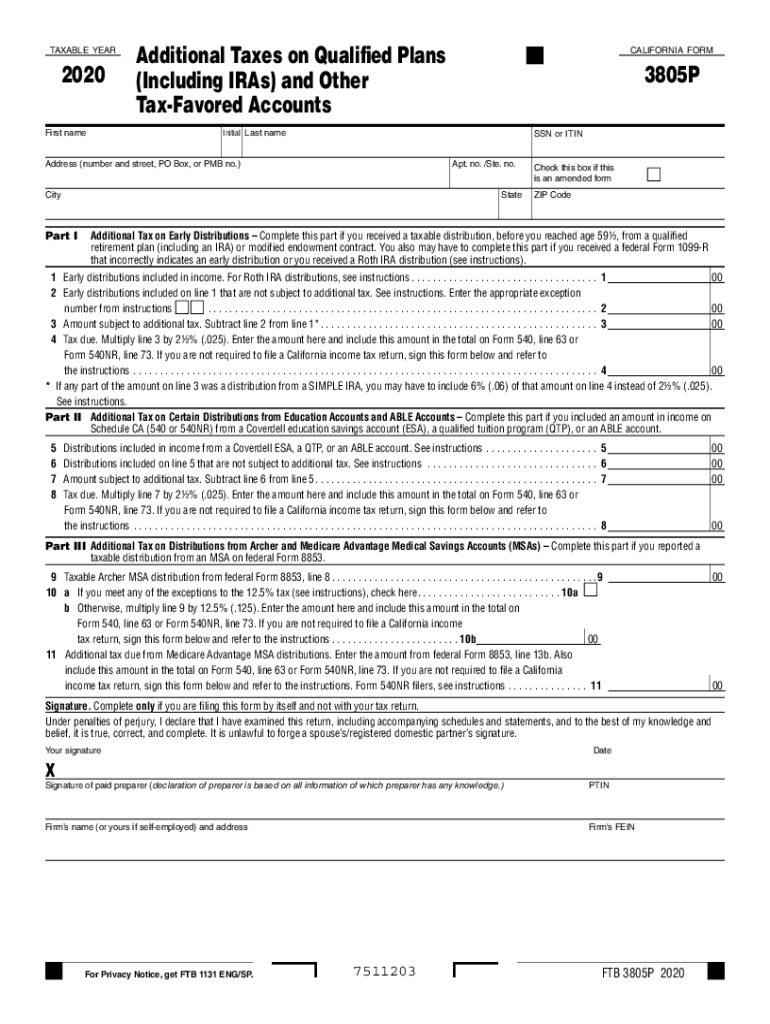

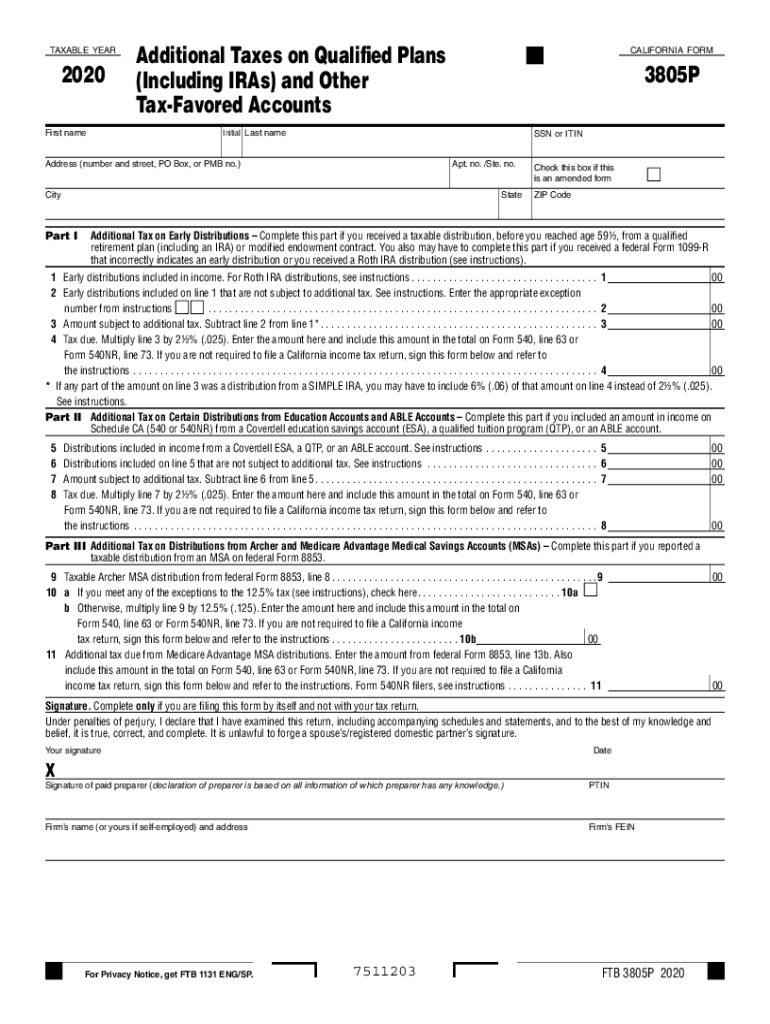

CA FTB 3805P 2020 free printable template

Get, Create, Make and Sign CA FTB 3805P

Editing CA FTB 3805P online

Uncompromising security for your PDF editing and eSignature needs

CA FTB 3805P Form Versions

How to fill out CA FTB 3805P

How to fill out CA FTB 3805P

Who needs CA FTB 3805P?

Instructions and Help about CA FTB 3805P

All right we have a Dell laptop here with a DC jack problem that was described to us by the user so what were going to do is plug this in and see what happens you have power indicator right here actual laptop feels like it to start to talk to herself fog its just kind of different but the seams that's actually the case here fill things running we've seen a hard drive running we've got a had a battery light for a second you can still feel the hard drive, so this is very different never seen anything quite like that plug a power adapter in especially on one its bad they turned itself on, so I had to hook this one up to the extra water and see what we see I see if we can't get anything out of it of course we have a power go into it seems to be turned on that was what we just liked it in, so lets see what I said what we get what we hunt the XL water up to it so our external here we've turned it on we have it turned on I will plug this up to it and see where it goes, so we put that in and fragile we have we've got external video on a system that has a DC jack problem now its said that he cannot determine the adapter that's plugged in, but it is an actual Dell adapter it's the correct adapter T goes to it, so this is going to be what does deals where I think it may ant be a subset problem even though it is a do Dell system so what were going to do is turn this off and check it lets see if the actual power adapter port is bad on it and then go from there and see what we find okay to see if this does anything were going to reflow it and see if that changes the aspect of behavior of the system given that this is a newer I 5 system were going to see if this actually changes the way in accidents they just wave does where it actually turns on by itself it does certain things by itself so what were going to do is preheat it and to get up to temp the demo you press the press that button didn't let it heat up the light see what happens all right, so we've put the system back together were turning it on and since we refund it we had the video on the screen perfectly fine we may or may not get an error for power adapter we didn't get an error for the power adapter before we had gotten in there for the power adapter we know that some controls for the low level processes are handled by the chipset and if the chipsets kind of going out without that that causes issues like that with the auto-sensing, so we have our user login like that we don't know anything for that so were not going to handle that what were going to do is restart the system then they go to the bias to check all the other functions and see what's going on now the power adapter psychic deal that is late to isolate to the chipset sometimes like we said before, so I'd say if we got battery information right here says that it's charging the battery we now get to doing it so what were going to do is unplug this says discharging we have our adapter right here and well plug it back in and see what happens...

People Also Ask about

What is the penalty for early withdrawal in California?

What is form 5329 vs 8915e?

What is a 3805P form?

What form replaced 8915-E?

What is IRS Form 5329?

What is IRS form 5329 used for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my CA FTB 3805P directly from Gmail?

How do I edit CA FTB 3805P online?

Can I edit CA FTB 3805P on an Android device?

What is CA FTB 3805P?

Who is required to file CA FTB 3805P?

How to fill out CA FTB 3805P?

What is the purpose of CA FTB 3805P?

What information must be reported on CA FTB 3805P?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.