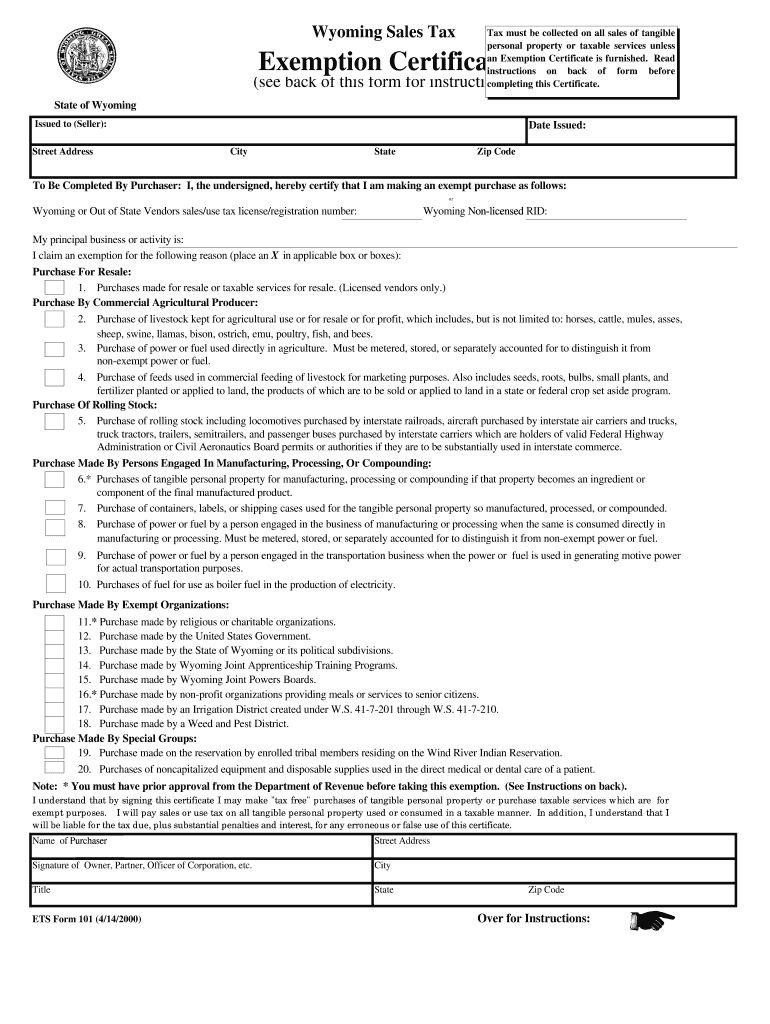

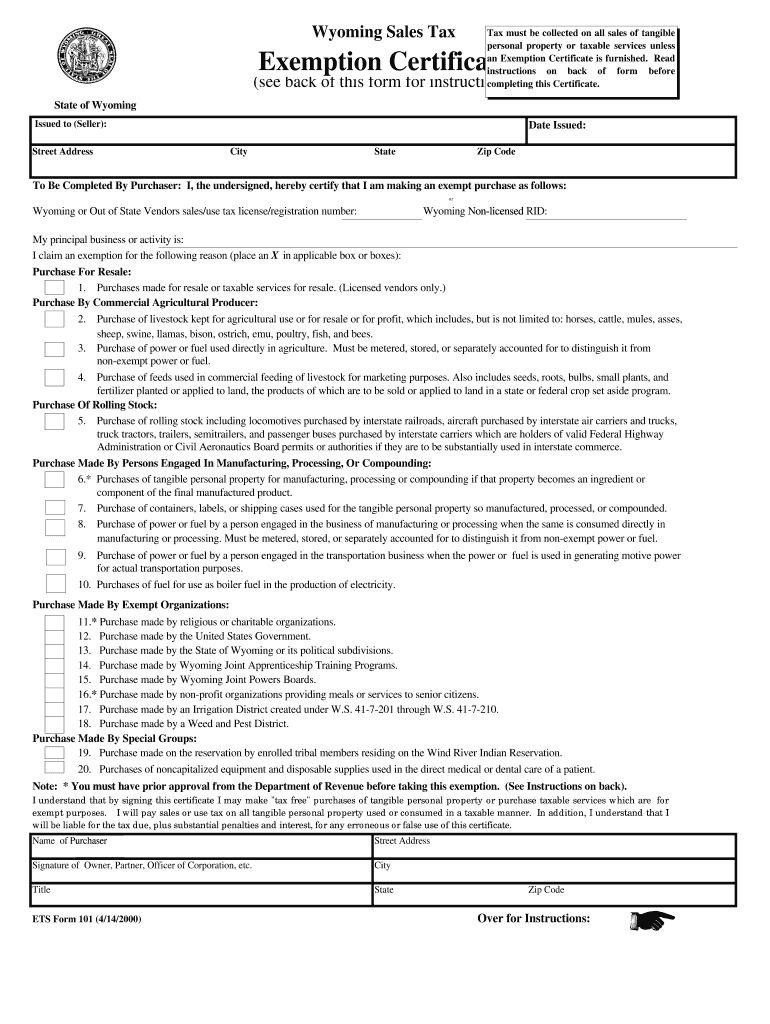

WY ETS 101 2000 free printable template

Get, Create, Make and Sign WY ETS 101

Editing WY ETS 101 online

Uncompromising security for your PDF editing and eSignature needs

WY ETS 101 Form Versions

How to fill out WY ETS 101

How to fill out WY ETS 101

Who needs WY ETS 101?

Instructions and Help about WY ETS 101

Been doing good gracias those Los organizadores / see a Worsen specialist k are you Donna organized Allah saint just to him, we like the CD without that mark para is meant to international and exist we attack me chakra in English thank you very much for coming here today I would like to talk about a few things that some of you may have heard about some of you may have not and some of you definitely have not I would like to talk about forms and best practices that I can use in each of your projects right, so I don't want to tell much about me, I think most of you know me I'm my name is Dan hotshot sake it's a horrible name for Spanish people I guess and for everybody else as well I'm a symphony core developer and in my professional life I am working as a freelancer and trainer and coach and on Twitter you can find me under the name of web motored is everybody hearing me well like good up there okay I will try to speak clearly because I think there's a lot of echo in the room so one of the questions that I frequently get is what is the hardest part of Symphony and become an answer is yeah or less like this every time I have to debug same free to forms I literally die a little inside those are really one of the dark sides of Symphony it's true fortunately there's also an answer to that which is like this right you feel like that before usually it takes a long time until you find the solution at some point that was this tweet by Jacob have you seen what Mozart's talk it is the perfect pill for fumbles so more like this the PHP elephant of course all right, so that's my talk and at this point that was the same last time my computer gets stuck this is like an evil video seriously okay sorry for that alright the goal of the forum component is to make simple cases possible, and it's simple to make simple cases simple and complex pieces possible all right, so I think that's well achieved the simple case is simple that actually works all right, so forms are not as hard as people usually say that they are because most of the simple stuff just works out of the box, and today I want to show you some best practices and want to give you some insight on how you can leverage those skills right so if we look at the workflow of a form in a controller as you use it is starts in the controller then you usually create form you call the method create form on the controller which goes to the form Factory and that in turn calls built form on your form type okay so there you do all the configuration you get this form builder object you can add your fields and configure your data transformers and all that stuff and at some point that phone takes factory takes the Builder converts that into a form and returns it back to your controller all right in your controller you then call handle request on that form object and once you do, that there's a few things happening the first thing that is happening is that the form will write the request data the data of your requests into...

People Also Ask about

What is the homeowners exemption in Wyoming?

What taxes do you pay in Wyoming?

Are groceries in Wyoming exempt from sales tax?

Is Wyoming a tax free state?

At what age do you stop paying property taxes in Wyoming?

Is Wyoming a tax exempt state?

What is the property exemption in Wyoming?

Does Wyoming exemption certificate expire?

How to fill Wyoming resale certificate?

What taxes are exempt in Wyoming?

Does Wyoming have a sales tax exemption form?

What items are tax exempt in Wyoming?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit WY ETS 101 on an iOS device?

How do I complete WY ETS 101 on an iOS device?

How do I fill out WY ETS 101 on an Android device?

What is WY ETS 101?

Who is required to file WY ETS 101?

How to fill out WY ETS 101?

What is the purpose of WY ETS 101?

What information must be reported on WY ETS 101?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.