Get the free Fee Structure. Connecticut Employee Enrollment Change Form (2-50 Eligible Employees)

Show details

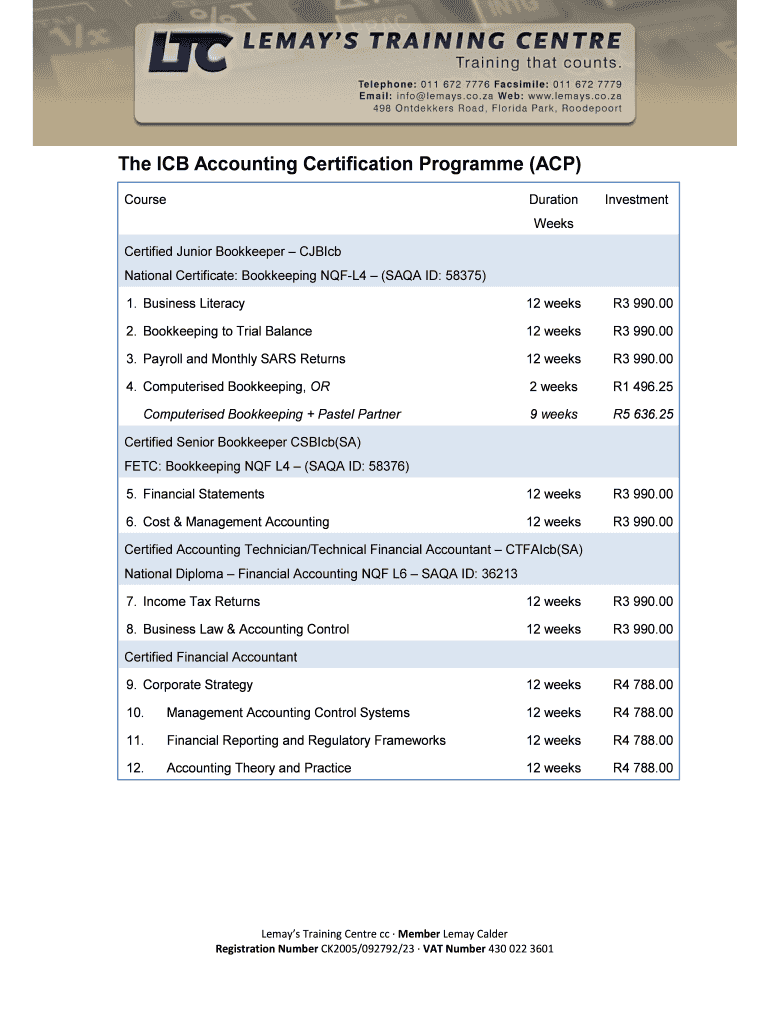

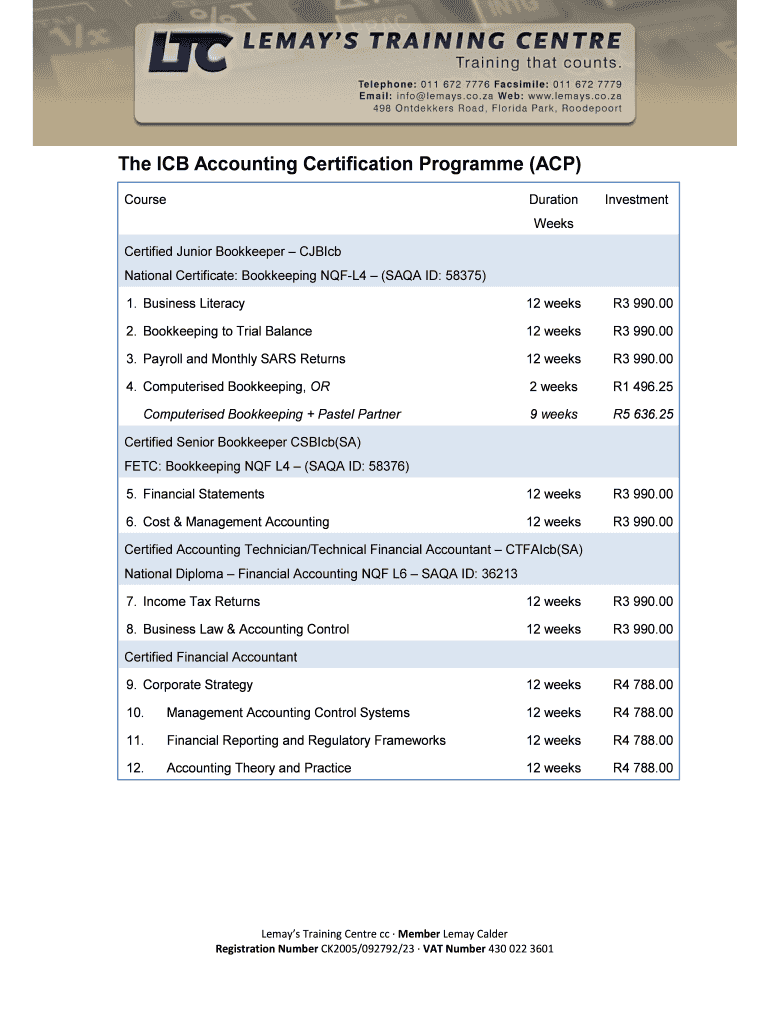

The ICB Accounting Certification Program (ACP) Course Duration Investment Weeks Certified Junior Bookkeeper Cubic National Certificate: Bookkeeping NQF-L4 (SAQ AID: 58375) 1. Business Literacy 12

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fee structure connecticut employee

Edit your fee structure connecticut employee form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fee structure connecticut employee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fee structure connecticut employee online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fee structure connecticut employee. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fee structure connecticut employee

How to fill out fee structure Connecticut employee:

01

Obtain the fee structure form: The first step is to acquire the fee structure form for Connecticut employees. This form can usually be obtained from the state's labor department or downloaded from their official website. It is essential to use the most up-to-date version of the form.

02

Provide employee details: Begin by filling out the form with the necessary employee details. This typically includes the employee's full name, address, social security number, and any other required personal identification information.

03

Specify the fee structure: Next, accurately detail the specific fee structure for the employee. This may include information such as hourly rates, salary breakdowns, commission structures, or any other relevant payment details. Ensure that the fee structure is clearly explained and that all calculations are accurate.

04

Include additional compensation: If the employee is eligible for any additional compensation, such as overtime pay, bonuses, or allowances, make sure to include these in the fee structure form. Specify the criteria for earning such compensation and provide any necessary calculations or explanations.

05

Attach supporting documents: Depending on the requirements of the fee structure form, you may need to attach supporting documents. These could include pay stubs, contracts, or any other relevant paperwork that verifies the accuracy of the fee structure information provided.

Who needs fee structure Connecticut employee?

01

Employers: Employers in Connecticut who have employees on their payroll need a fee structure document to accurately define the compensation and payment structure for their employees.

02

Employees: Employees in Connecticut who want to have a clear understanding of their compensation and how it is structured will benefit from having a fee structure document. It provides transparency and ensures that both parties are on the same page regarding payment terms.

03

Government authorities: Government authorities, such as the state's labor department, may require fee structure documents to ensure compliance with labor laws and regulations. These documents serve as evidence of fair and legal compensation practices.

In conclusion, filling out the fee structure form for Connecticut employees involves providing accurate employee details, specifying the payment structure, including additional compensation, and attaching any necessary supporting documents. Both employers and employees require fee structure documents for different purposes, such as defining compensation terms and ensuring compliance with labor regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my fee structure connecticut employee directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your fee structure connecticut employee and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I send fee structure connecticut employee for eSignature?

Once you are ready to share your fee structure connecticut employee, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I edit fee structure connecticut employee on an iOS device?

Create, edit, and share fee structure connecticut employee from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is fee structure connecticut employee?

The fee structure for Connecticut employees typically includes details about the amount or percentage of the fee that needs to be paid by the employee to the employer.

Who is required to file fee structure connecticut employee?

Employers in Connecticut are typically required to file the fee structure for their employees in order to ensure compliance with state regulations.

How to fill out fee structure connecticut employee?

Employers can fill out the fee structure for Connecticut employees by including all relevant information such as the amount of the fee, payment schedule, and any other required details.

What is the purpose of fee structure connecticut employee?

The purpose of the fee structure for Connecticut employees is to establish clear guidelines for the payment of fees by employees and ensure transparency in the payment process.

What information must be reported on fee structure connecticut employee?

The fee structure for Connecticut employees must typically include details such as the amount of the fee, payment schedule, deductions, and any other relevant information related to the fee payment.

Fill out your fee structure connecticut employee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fee Structure Connecticut Employee is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.