MA ST-10 2009 free printable template

Show details

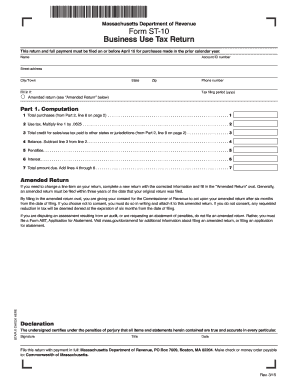

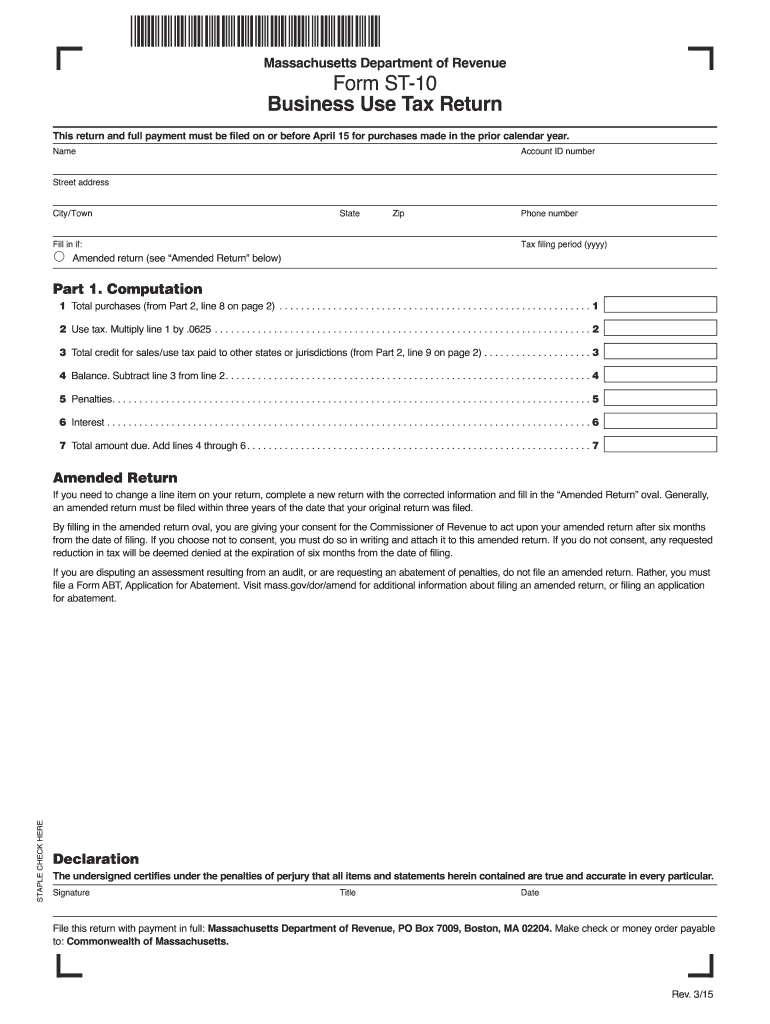

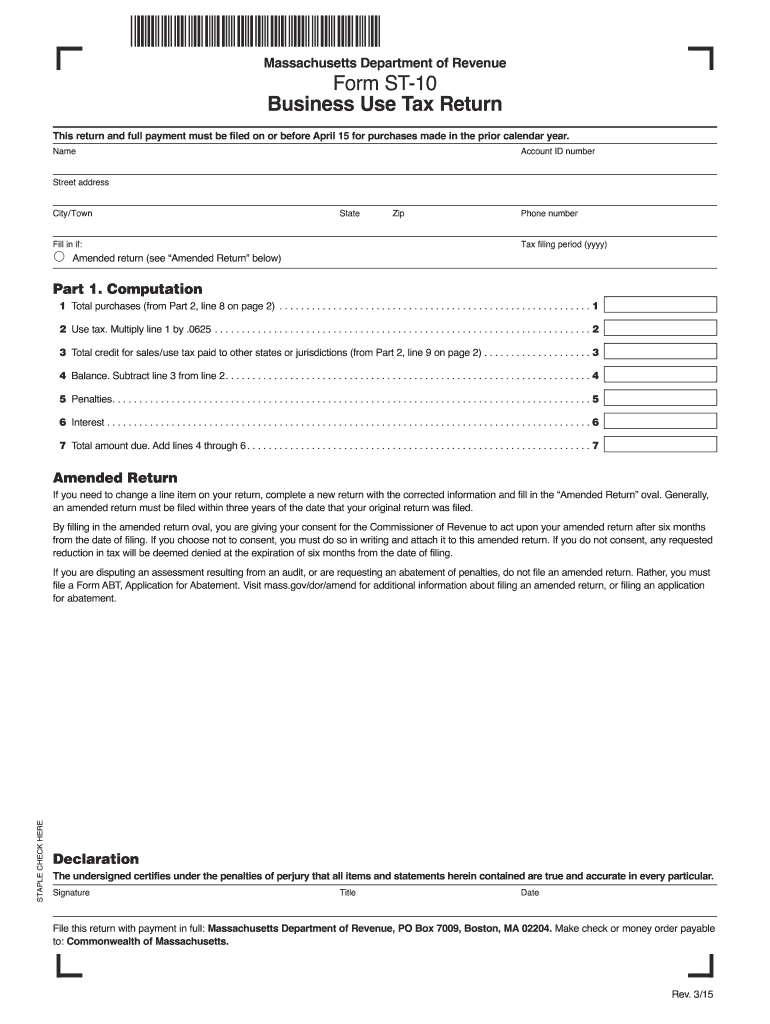

Massachusetts Department of Revenue Business Use Tax Return O V I E TE M BE ID T AM EN SV B L I T OF EV AC RT PL AT E PE TI T M EN U E TS SACHUSET AS EN SE Rev. 7/09 D E PA R FORM ST-10 R Business Name Federal Identification number Address State Zip Return is due with payment on or before April 15 for purchases made in the prior calendar year.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MA ST-10

Edit your MA ST-10 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MA ST-10 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MA ST-10 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MA ST-10. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MA ST-10 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MA ST-10

How to fill out MA ST-10

01

Download the MA ST-10 form from the Massachusetts Department of Revenue website.

02

Provide your name, address, and other identifying information at the top of the form.

03

Indicate the type of exemption you are applying for by checking the relevant box.

04

List the items involved in the transaction or sale that qualify for the exemption.

05

Include any required documentation or proof to support your exemption claim.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the form to the appropriate state agency as indicated in the instructions.

Who needs MA ST-10?

01

Businesses making tax-exempt purchases in Massachusetts.

02

Organizations qualifying for tax exemptions under Massachusetts law.

03

Individuals or entities selling goods that are tax-exempt.

Fill

form

: Try Risk Free

People Also Ask about

What is an ST 10 Massachusetts?

INSTRUCTIONS: MASSACHUSETTS BUSINESS USE TAX RETURN (Form ST-10) All Massachusetts businesses must file an annual use tax return documenting purchases of goods for use, consumption and storage within the state on which no state sales tax has been paid.

What is form st1 in Massachusetts?

Registering to collect sales/use tax After you register with DOR, you will receive a Sales and Use Tax Registration Certificate (Form ST-1) for each business location. The form must be displayed on the business premises where customers can easily see it.

How do I get a tax exempt certificate in Massachusetts?

If you need to apply for a registration, please complete and file Massachusetts Form TA-1, Application for Original Regis- tration. Form TA-1 may be obtained at any DOR office or by calling (617) 887-MDOR or toll-free, in-state 1-800-392-6089.

What is the Massachusetts state sales tax exemption form?

In order to claim an exemption from sales tax on purchases in MA, a copy of the Certificate of Exemption (Form ST-2) must be presented to the vendor at the time of purchase. In addition, Form ST-5 must be completed.

What is a ST 2 form Massachusetts?

Procedure. In order for a purchase to be exempt from Massachusetts tax, an authorized federal employee must present to the vendor the GSA card with appropriate identification at the time of purchase. A Certificate of Exemption (Form ST-2) and a Sales Tax Exempt Purchaser Certificate (Form ST-5) are not required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MA ST-10 directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your MA ST-10 as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

Can I create an electronic signature for signing my MA ST-10 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your MA ST-10 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit MA ST-10 straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing MA ST-10.

What is MA ST-10?

MA ST-10 is a Massachusetts Sales Tax Resale Certificate used by businesses to purchase goods tax-exempt when they intend to resell those goods in the regular course of their business.

Who is required to file MA ST-10?

Businesses that are registered to collect sales tax in Massachusetts and intend to purchase items for resale without paying sales tax must file MA ST-10.

How to fill out MA ST-10?

To fill out MA ST-10, businesses need to provide their name, address, sales tax registration number, the seller’s details, a description of the property being purchased, and a signature certifying that the information provided is accurate.

What is the purpose of MA ST-10?

The purpose of MA ST-10 is to allow businesses to purchase inventory without paying sales tax, ensuring that tax is collected only when the product is sold to the end consumer.

What information must be reported on MA ST-10?

The MA ST-10 must report the purchaser's name and address, the seller's name and address, the sales tax registration number of the purchaser, a description of the property being purchased, and a certification statement.

Fill out your MA ST-10 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MA ST-10 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.