Get the free Mortgage Affordability Calculation Form

Show details

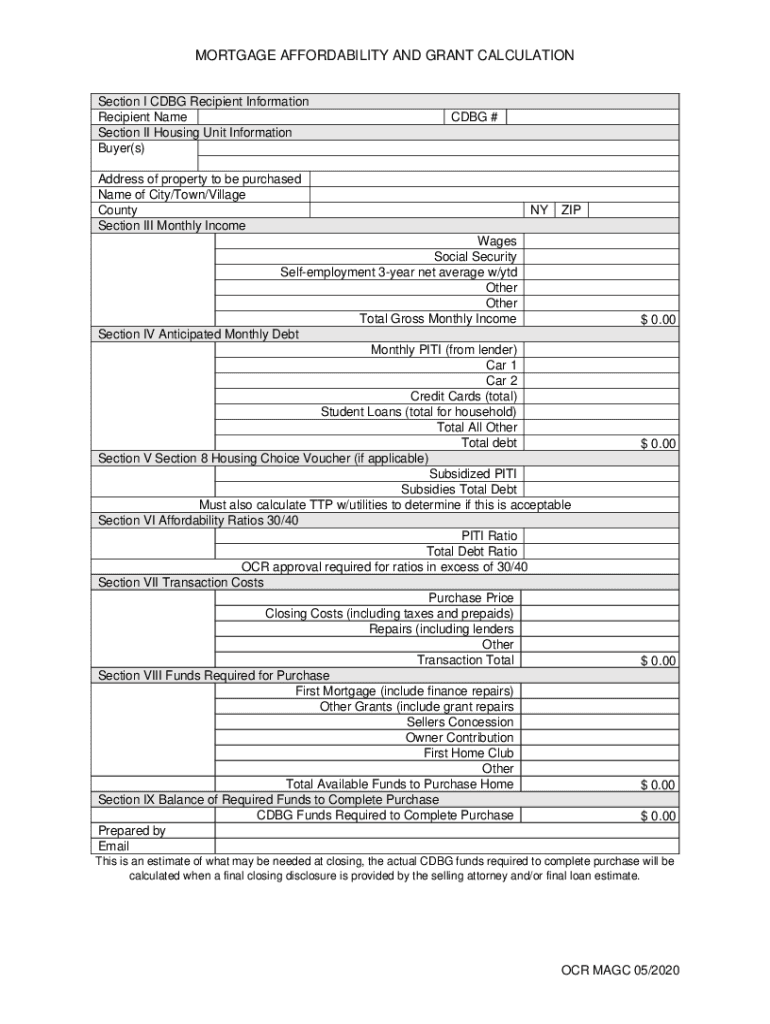

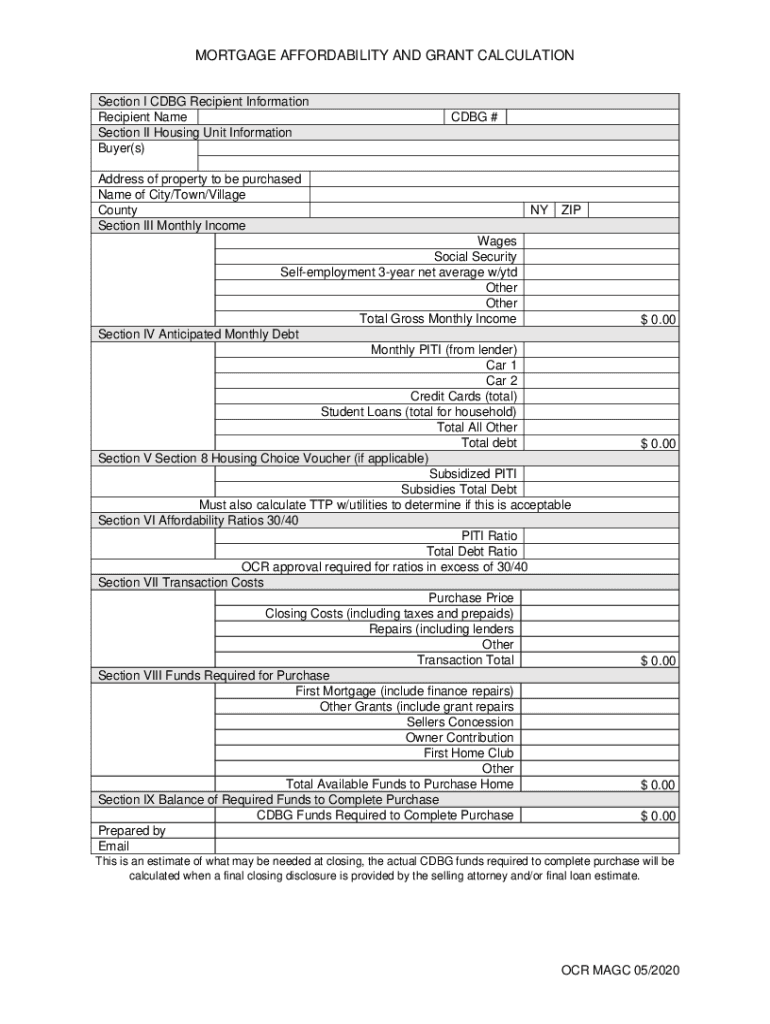

MORTGAGE AFFORDABILITY AND GRANT CALCULATION

Section I CBG Recipient Information

Recipient Name

Section II Housing Unit Information

Buyer(s)

Address of property to be purchased

Name of City/Town/Village

County

Section

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage affordability calculation form

Edit your mortgage affordability calculation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage affordability calculation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mortgage affordability calculation form online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mortgage affordability calculation form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage affordability calculation form

How to fill out mortgage affordability calculation form

01

Start by gathering all your financial information, including your income, expenses, and debts.

02

Use these details to calculate your monthly income and expenses. Subtract your expenses from your income to determine your disposable income.

03

Determine the maximum monthly mortgage payment you can afford by considering your disposable income, desired loan term, and interest rate.

04

Take into account other financial commitments, such as property taxes, homeowners insurance, and private mortgage insurance (if applicable).

05

Consider your future financial goals and potential changes in your income and expenses.

06

Use an online mortgage affordability calculator or consult with a mortgage lender to obtain an accurate estimate.

07

Fill out the mortgage affordability calculation form accurately with all the required details.

08

Review the calculated results and make adjustments if necessary to ensure you are comfortable with the affordability.

09

Seek professional advice from a mortgage broker or financial advisor if you have any doubts or questions about the calculation.

10

Keep a copy of the completed mortgage affordability calculation form for your records.

Who needs mortgage affordability calculation form?

01

Anyone planning to apply for a mortgage needs to fill out a mortgage affordability calculation form.

02

First-time homebuyers who want to determine how much they can afford to borrow.

03

Existing homeowners who wish to refinance their mortgage and need to assess their affordability.

04

Individuals or couples looking to buy a new home and need to evaluate their mortgage options.

05

Mortgage brokers and lenders who require this information from borrowers to assess their eligibility.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mortgage affordability calculation form for eSignature?

Once your mortgage affordability calculation form is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I get mortgage affordability calculation form?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific mortgage affordability calculation form and other forms. Find the template you need and change it using powerful tools.

Can I create an electronic signature for signing my mortgage affordability calculation form in Gmail?

Create your eSignature using pdfFiller and then eSign your mortgage affordability calculation form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is mortgage affordability calculation form?

The mortgage affordability calculation form is a document used by lenders to determine a borrower's ability to repay a mortgage based on their income, expenses, debts, and other financial factors.

Who is required to file mortgage affordability calculation form?

Individuals applying for a mortgage loan, typically first-time homebuyers or those refinancing existing mortgages, are required to file the mortgage affordability calculation form.

How to fill out mortgage affordability calculation form?

To fill out the mortgage affordability calculation form, applicants need to provide detailed information about their financial situation, including income, monthly expenses, outstanding debts, and any other assets.

What is the purpose of mortgage affordability calculation form?

The purpose of the mortgage affordability calculation form is to assess whether a borrower can afford to take on a mortgage, ensuring lenders make informed lending decisions.

What information must be reported on mortgage affordability calculation form?

Information reported on the mortgage affordability calculation form includes the borrower's income, monthly expenses, existing debts, credit score, and any other relevant financial information.

Fill out your mortgage affordability calculation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Affordability Calculation Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.