Get the free Pre - Mortgage Counseling Application - awest

Show details

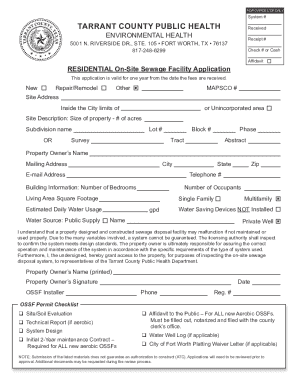

2801 Hunting Park Avenue Philadelphia, PA 19129-1392 Remortgage Counseling Application Name: Date: Address: City: State: Zip: Social Security #: Birth Date: Race: Sex: M F Home Phone #: Work Phone

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pre - mortgage counseling

Edit your pre - mortgage counseling form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pre - mortgage counseling form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pre - mortgage counseling online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit pre - mortgage counseling. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pre - mortgage counseling

How to fill out pre - mortgage counseling?

01

Find a HUD-approved housing counseling agency. They will provide the necessary counseling sessions.

02

Contact the agency and schedule an appointment for pre - mortgage counseling.

03

Gather all relevant financial information, such as income documents, monthly expenses, and credit reports.

04

Prepare a list of questions or concerns related to the mortgage process that you would like to discuss during the counseling session.

05

Attend the counseling session and actively participate in the discussion.

06

Listen carefully to the advice and guidance provided by the counselor regarding your financial situation and the mortgage process.

07

Take notes during the counseling session to retain important information.

08

Follow any action steps or recommendations given by the counselor to improve your financial readiness or address any issues identified during the counseling.

09

Keep all documentation provided during the counseling session, as it may be required for future mortgage applications or assistance programs.

Who needs pre - mortgage counseling?

01

First-time homebuyers who are navigating the mortgage process for the first time.

02

Borrowers with a low credit score or limited credit history.

03

Individuals with a high debt-to-income ratio or inconsistent income.

04

Those who are unsure about the mortgage process and need guidance on various aspects, such as loan options, down payment requirements, and closing costs.

05

Homeowners facing financial challenges or potential foreclosure who may need assistance in exploring loan modification or foreclosure prevention options.

06

Individuals interested in obtaining information about homebuyer assistance programs or down payment assistance.

07

Anyone who wants to be fully informed and educated about the mortgage process before making a home purchase decision.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in pre - mortgage counseling?

With pdfFiller, the editing process is straightforward. Open your pre - mortgage counseling in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit pre - mortgage counseling on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute pre - mortgage counseling from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete pre - mortgage counseling on an Android device?

Use the pdfFiller app for Android to finish your pre - mortgage counseling. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is pre - mortgage counseling?

Pre-mortgage counseling is a process where potential homebuyers receive guidance and advice from certified housing counselors to help them make informed decisions about buying a home and obtaining a mortgage.

Who is required to file pre - mortgage counseling?

Pre-mortgage counseling is not something that needs to be filed. It is a service that is typically required for certain types of government-backed mortgages, such as FHA loans, for first-time homebuyers or individuals with lower credit scores.

How to fill out pre - mortgage counseling?

Pre-mortgage counseling does not involve filling out any forms. It usually consists of attending a counseling session with a certified housing counselor, either in person, over the phone, or online.

What is the purpose of pre - mortgage counseling?

The purpose of pre-mortgage counseling is to educate and empower potential homebuyers by providing them with information about the homebuying process, their rights and responsibilities as borrowers, and the various options available to them in obtaining a mortgage.

What information must be reported on pre - mortgage counseling?

There is no specific information that needs to be reported on pre-mortgage counseling. The counseling session is meant to provide information and guidance to the potential homebuyer, rather than to gather information from them.

Fill out your pre - mortgage counseling online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pre - Mortgage Counseling is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.