Get the free Canada Payroll - Entertainment Partners

Show details

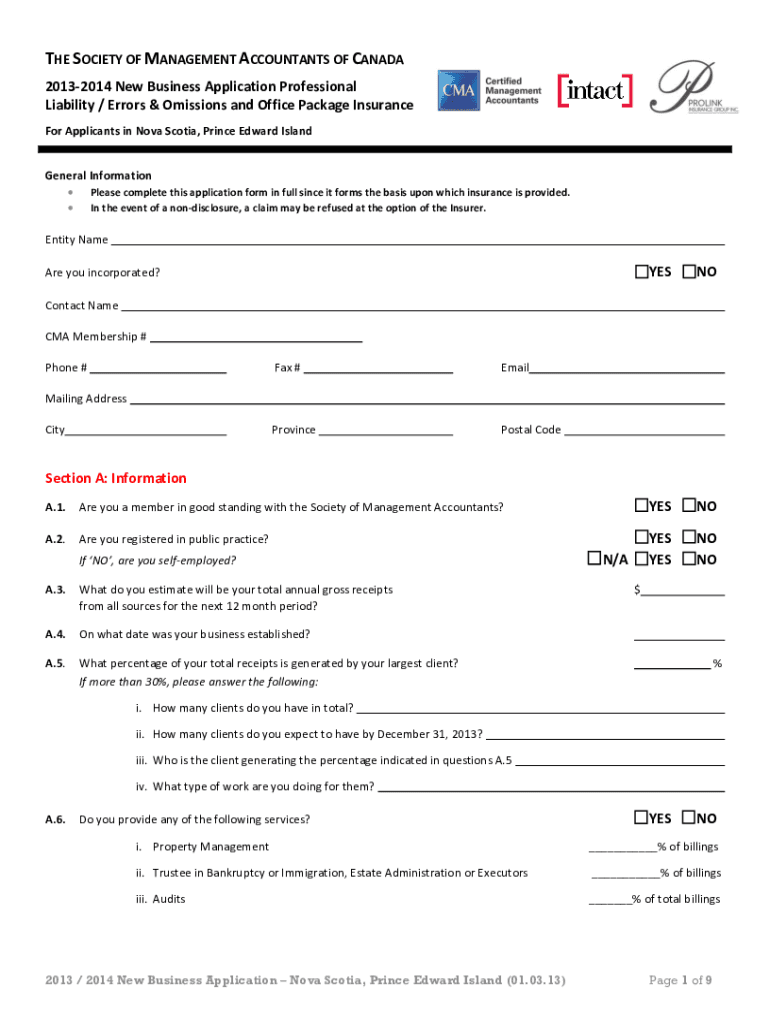

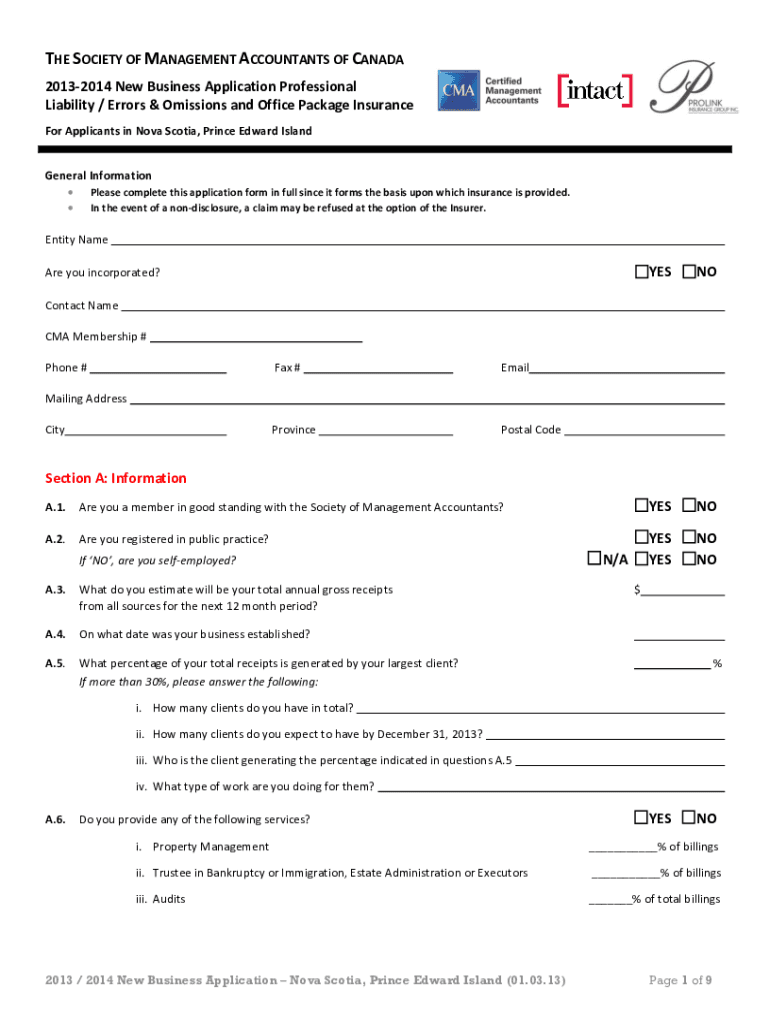

THE SOCIETY OF MANAGEMENT ACCOUNTANTS OF CANADA 20132014 New Business Application Professional Liability / Errors & Omissions and Office Package Insurance For Applicants in Nova Scotia, Prince Edward

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign canada payroll - entertainment

Edit your canada payroll - entertainment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your canada payroll - entertainment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit canada payroll - entertainment online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit canada payroll - entertainment. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out canada payroll - entertainment

How to fill out canada payroll - entertainment

01

To fill out Canada payroll for entertainment industry, follow these steps:

02

Obtain the necessary forms and documents: You will need to complete the T4 Slip, Statement of Remuneration Paid, which shows the employee's income and deductions for the year. You may also need documents such as the T4A Slip for self-employed or contract workers.

03

Gather information: Collect all relevant information about your employees, including their names, Social Insurance Numbers (SIN), addresses, and employment start and end dates.

04

Calculate earnings and deductions: Determine the gross pay for each employee based on their hourly rate or salary. Consider any overtime, vacation pay, or other benefits. Deduct any applicable taxes, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums.

05

Report income and deductions: Fill out the T4 Slip for each employee with the total income, deductions, and other relevant details. Make sure to accurately report all information.

06

Submit forms and remit payments: File the T4 Slips along with the Summary, which summarizes all employees' earnings and deductions, to the Canada Revenue Agency (CRA) by the required deadline. Remit the applicable tax payments to the CRA as well.

07

Keep records: Maintain records of payroll information, including copies of T4 Slips and Summary, for at least six years in case of future audits or inquiries.

08

Stay updated with regulations: Familiarize yourself with any changes or updates to the payroll system in Canada. Make sure you comply with all applicable laws and regulations.

09

Remember, it's always advisable to consult a professional or use payroll software to ensure accuracy and compliance with Canada payroll rules.

Who needs canada payroll - entertainment?

01

Any company or employer in the entertainment industry operating in Canada may need to use Canada payroll for entertainment. This includes production companies, casting agencies, talent agencies, event management companies, and any other business involved in the entertainment sector that hires employees or contracts with self-employed individuals. Adhering to the Canada payroll system ensures compliance with taxation laws and proper payment to employees or contractors.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get canada payroll - entertainment?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific canada payroll - entertainment and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I edit canada payroll - entertainment on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute canada payroll - entertainment from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out canada payroll - entertainment on an Android device?

On an Android device, use the pdfFiller mobile app to finish your canada payroll - entertainment. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is Canada payroll - entertainment?

Canada payroll - entertainment refers to the payroll processes and obligations associated with compensating individuals in the entertainment industry, including actors, musicians, and other performers. It involves calculating and remitting payroll taxes and ensuring compliance with Canadian tax laws.

Who is required to file Canada payroll - entertainment?

Employers in the entertainment industry who pay performers, crew members, or any individuals earning income from entertainment-related engagement are required to file Canada payroll - entertainment.

How to fill out Canada payroll - entertainment?

To fill out Canada payroll - entertainment, employers should gather employee information, calculate the gross pay, deductions (like taxes and social contributions), and complete the appropriate payroll forms, ensuring accurate reporting of all earnings and deductions.

What is the purpose of Canada payroll - entertainment?

The purpose of Canada payroll - entertainment is to ensure compliance with tax regulations, facilitate the accurate payment of wages to entertainers, and properly account for payroll taxes and contributions.

What information must be reported on Canada payroll - entertainment?

The information that must be reported includes the employee's name, address, Social Insurance Number (SIN), total earnings, deductions, and the applicable withholding tax amounts.

Fill out your canada payroll - entertainment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada Payroll - Entertainment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.