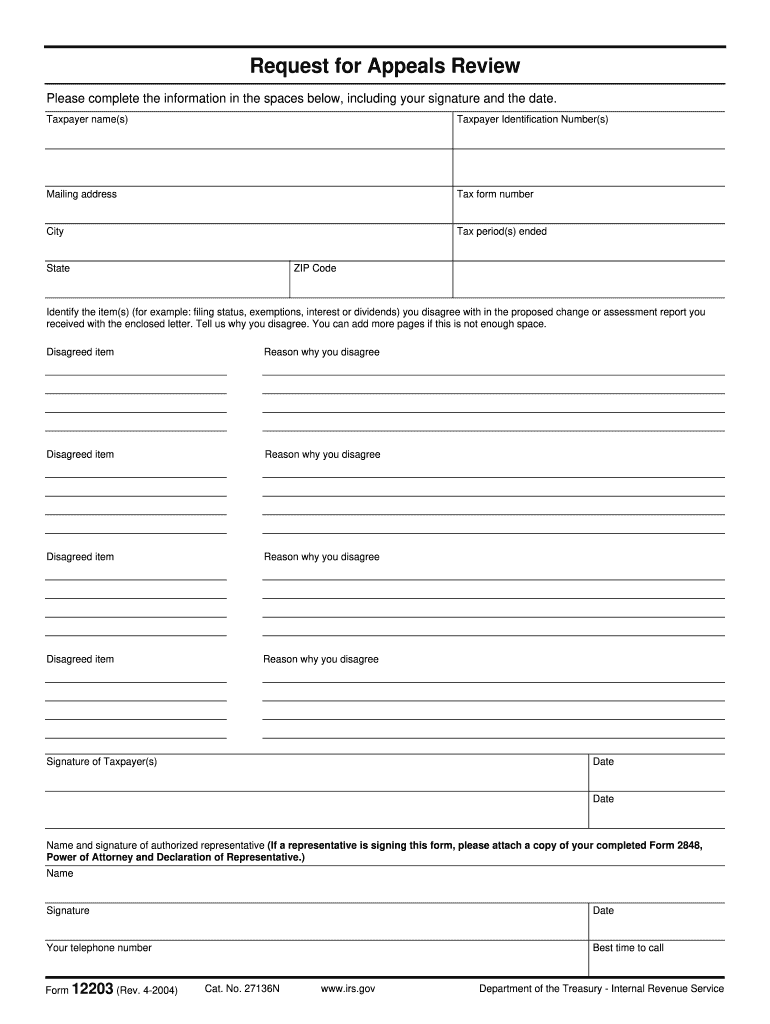

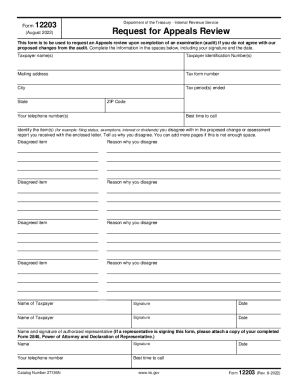

Who Needs Form 12203?

Sometimes the IRS audits an individual’s taxes if there is some reason for a review. The findings may not be quite what a taxpayer expects to find out. To show disagreement with these findings, every taxpayer is allowed to ask for a review. Form 12203 is designed for a taxpayer to ask for such a review.

What is Form 12203 for?

Form 12203 or as it is called Request for Appeals Review was designed to disagree with IRS determination. If you have some doubts concerning an IRS decision, or if you think that the IRS hasn’t considered all the facts that may influence the final decision you can fill out Form 12203.

Is Form 12203 Accompanied by Other Forms?

Generally, Form 12203 doesn’t require other documents to be attached to it. You may send the form alone or with other documents, if specified.

When is Form 12203 Due?

Form 12203 is due when it is needed. There is no fixed due date as this document is sent as a response to an IRS audit.

How do I Fill out Form 12203?

The form is rather short, however it requires substantial information to be provided. First, you are asked to enter your name, detailed contact information and Taxpayer Identification Number. Then go the fields entitled Disagreed item where you should describe the thing that you disagree with. Provide as much information as you can. On the right, there are fields entitled Reason why you disagree. Here you can state the reason for your disagreement with the IRS findings. At the bottom of the page, there are some fields for a signature, date, taxpayer’s name and contact information.

Where do I send Form 12203?

When you are ready to send Form 12203, send it to the Office of Appeals. Visit the IRS website to get more information about the procedure.