Get the free Annotated workbook for auditors - Episcopal Diocese of New York

Show details

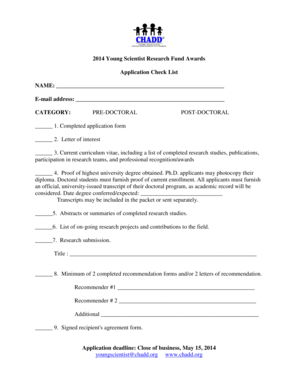

DIOCESE OF NEW YORK ALTERNATIVE AUDIT PROCEDURE For use only by congregations of the Diocese of New York with Normal Operating Income of less than $150,000. ANNOTATED WORKBOOK FOR AUDITORS The pages

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annotated workbook for auditors

Edit your annotated workbook for auditors form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annotated workbook for auditors form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annotated workbook for auditors online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit annotated workbook for auditors. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annotated workbook for auditors

How to fill out annotated workbook for auditors:

01

Start by gathering all relevant information and documents needed for the audit. This may include financial statements, invoices, receipts, bank statements, and any other records that are necessary for the audit process.

02

Familiarize yourself with the format and structure of the annotated workbook. This typically includes sections for documenting the audit objectives, procedures, findings, and recommendations.

03

Begin by stating the audit objectives clearly in the workbook. These objectives should be specific and measurable, outlining what you aim to achieve through the audit process.

04

Document the audit procedures that will be followed to achieve the objectives. This includes the steps, tests, and methods that will be employed to gather and analyze the audit evidence.

05

As you conduct the audit, record your findings in the workbook. This includes any discrepancies, issues, or observations that you come across during the audit process.

06

Analyze the findings and draw conclusions based on the evidence collected. This may involve calculating financial ratios, assessing compliance with regulations, or identifying areas of improvement.

07

Based on your analysis, make recommendations for any necessary actions or changes that need to be implemented. These recommendations should be practical, feasible, and evidence-based.

08

Review and verify all the information documented in the annotated workbook. Double-check the accuracy of your findings, calculations, and recommendations.

09

Finally, ensure that the annotated workbook is properly organized and presented. Use clear headings, subheadings, and a consistent format throughout to enhance readability and understanding.

Who needs annotated workbook for auditors?

01

Auditors: Annotated workbooks are essential tools for auditors as they provide a structured format for documenting the entire audit process. It helps them stay organized, record their findings, and communicate their conclusions effectively.

02

Accounting firms: Accounting firms often require their auditors to maintain annotated workbooks as part of their quality control processes. These workbooks serve as a valuable reference for audits and can be used for training and review purposes.

03

Regulatory authorities: Regulatory authorities may also require auditors to maintain annotated workbooks to demonstrate compliance with professional standards and regulations. These workbooks can be examined during inspections and audits conducted by regulatory bodies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is annotated workbook for auditors?

An annotated workbook for auditors is a document that provides a detailed record of audit procedures, findings, and conclusions.

Who is required to file annotated workbook for auditors?

Auditors or auditing firms are required to file annotated workbooks for auditors.

How to fill out annotated workbook for auditors?

Annotated workbooks for auditors should be filled out by documenting audit procedures, findings, and conclusions in a clear and organized manner.

What is the purpose of annotated workbook for auditors?

The purpose of annotated workbooks for auditors is to provide a transparent and detailed record of the audit process for future reference.

What information must be reported on annotated workbook for auditors?

Information on audit procedures, findings, conclusions, and any recommendations must be reported on annotated workbooks for auditors.

How can I edit annotated workbook for auditors from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your annotated workbook for auditors into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit annotated workbook for auditors in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your annotated workbook for auditors, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out annotated workbook for auditors on an Android device?

Use the pdfFiller mobile app to complete your annotated workbook for auditors on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your annotated workbook for auditors online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annotated Workbook For Auditors is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.