Get the free Income Drawdown plan - Aviva - aviva co

Show details

Income Drawdown plan Dependent s application form From age 75 (alternatively secured pension) Agent code Illustration ref now When to use this form ? You can use this form to apply for a dependent

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income drawdown plan

Edit your income drawdown plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income drawdown plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income drawdown plan online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit income drawdown plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

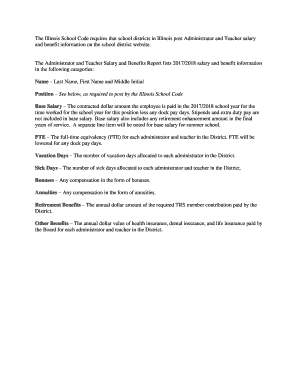

How to fill out income drawdown plan

How to Fill Out an Income Drawdown Plan:

01

Begin by understanding the purpose of an income drawdown plan. It is a retirement option that allows individuals to take income from their pension pot while keeping their pension invested.

02

Determine if you are eligible for an income drawdown plan. Typically, you must be at least 55 years old and have a defined contribution pension scheme.

03

Assess your financial situation and consider seeking professional advice from a financial advisor who specializes in pensions and retirement planning. They can provide guidance on whether an income drawdown plan is suitable for your needs and goals.

04

Research and compare different pension providers that offer income drawdown plans. Look for providers that offer flexibility, competitive fees, and a variety of investment options.

05

Contact your chosen pension provider and express your interest in opening an income drawdown plan. They will guide you through the application process and provide the necessary paperwork, such as application forms and risk assessment questionnaires.

06

Complete the application forms accurately and provide all requested documentation, including identification and proof of address.

07

Make decisions regarding your income withdrawals. You can choose to take a regular income, ad-hoc withdrawals as and when needed, or a combination of both.

08

Consider your investment strategy and decide how your pension pot will be invested. This should be aligned with your risk tolerance and time frame for retirement.

09

Keep track of your income withdrawals and regularly review your investment performance. You may need to adjust your income withdrawals and investment strategy over time to ensure your retirement income remains sustainable.

10

Stay informed about any changes in legislation or regulations that may impact your income drawdown plan. Regularly review your plan and consider seeking professional advice whenever necessary.

Who Needs an Income Drawdown Plan:

01

Individuals who wish to have more control over their pension savings during retirement may opt for an income drawdown plan.

02

Those who desire flexibility in their retirement income by being able to adjust the amount and frequency of withdrawals may benefit from an income drawdown plan.

03

Individuals with sufficient pension savings who are comfortable managing their investments may find an income drawdown plan appealing.

04

People who want to leave a legacy and pass on any remaining pension savings to their beneficiaries may choose an income drawdown plan.

05

Those looking for potential tax advantages, such as lowering their inheritance tax liability or making use of pension freedoms, may consider an income drawdown plan.

06

Individuals who want to keep their options open for other retirement income options, such as purchasing an annuity, may opt for an income drawdown plan.

07

People who expect their income needs to fluctuate throughout retirement may find an income drawdown plan more suitable than a fixed annuity.

Note: It is important to consult with a financial advisor or pension specialist to assess your individual circumstances and determine if an income drawdown plan is suitable for your retirement goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is income drawdown plan?

An income drawdown plan is a way of accessing your pension savings while leaving your money invested.

Who is required to file income drawdown plan?

Individuals who have decided to access their pension savings using an income drawdown plan are required to file it.

How to fill out income drawdown plan?

To fill out an income drawdown plan, you need to provide details about your pension savings, investment choices, and income withdrawal strategy.

What is the purpose of income drawdown plan?

The purpose of an income drawdown plan is to provide a regular income in retirement while keeping your pension savings invested for potential growth.

What information must be reported on income drawdown plan?

Information such as pension savings amount, investment options chosen, and income withdrawal frequency and amount must be reported on an income drawdown plan.

How do I modify my income drawdown plan in Gmail?

income drawdown plan and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an eSignature for the income drawdown plan in Gmail?

Create your eSignature using pdfFiller and then eSign your income drawdown plan immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit income drawdown plan on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as income drawdown plan. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your income drawdown plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Drawdown Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.