Get the free Flexible Benefits Policies - aviva co

Show details

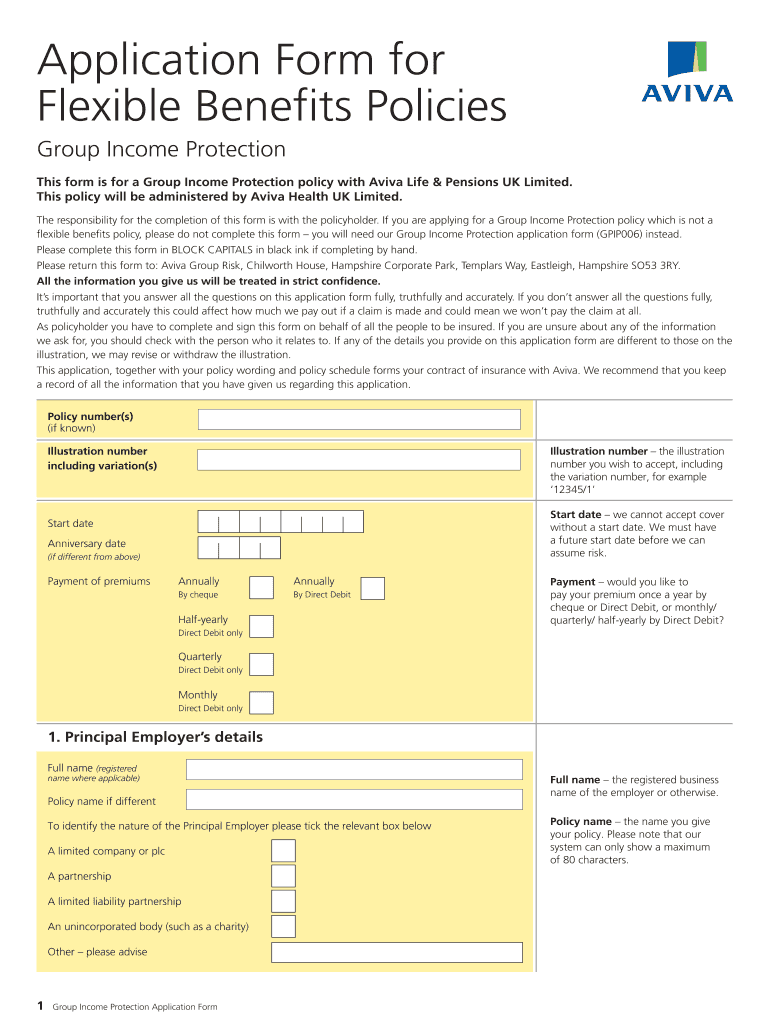

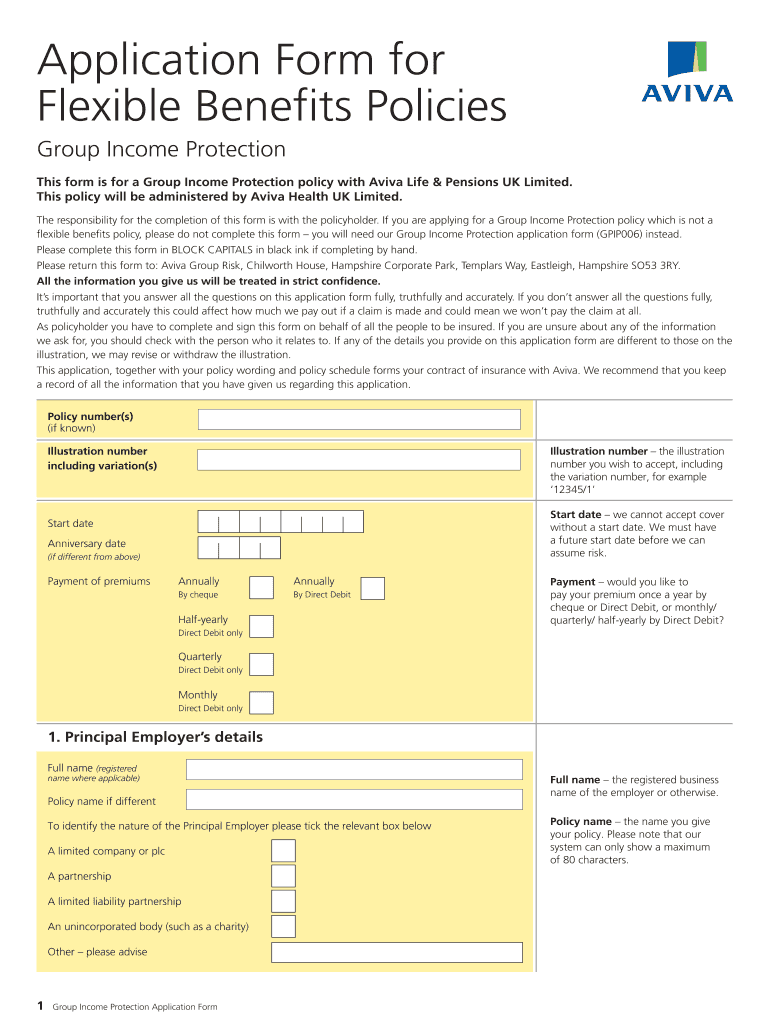

Application Form for Flexible Benefits Policies Group Income Protection This form is for a Group Income Protection policy with Aviva Life & Pensions UK Limited. This policy will be administered by

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign flexible benefits policies

Edit your flexible benefits policies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your flexible benefits policies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing flexible benefits policies online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit flexible benefits policies. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out flexible benefits policies

How to fill out flexible benefits policies?

01

Obtain a copy of the flexible benefits policy: Start by requesting a copy of the flexible benefits policy from your employer or human resources department. This document will outline the various options and guidelines for selecting your benefits.

02

Review the available benefits: Take the time to carefully read through the different benefits that are offered. This may include health insurance, dental coverage, retirement plans, life insurance, and more. Understand the coverage limits, costs, and any eligibility requirements associated with each benefit.

03

Consider your personal needs and priorities: Evaluate your personal circumstances and determine which benefits are most important to you. Consider factors such as your health, lifestyle, family situation, and future goals. This will help you prioritize the benefits that align with your needs.

04

Assess your budget: Evaluate your financial situation and determine how much you can afford to allocate towards your benefits. Some benefits may require contributions from your paycheck, so ensure that you factor this into your budget. It's important to strike a balance between choosing beneficial benefits and maintaining financial stability.

05

Seek guidance if needed: If you are unsure about any aspect of the flexible benefits policies or require assistance in understanding the details, don't hesitate to reach out to your human resources department. They can offer guidance and clarify any questions you may have.

Who needs flexible benefits policies?

01

Employees with varying healthcare needs: Flexible benefits policies are particularly beneficial for employees who have different healthcare needs. Whether you require regular medical treatments, have ongoing conditions, or anticipate major healthcare expenses, having the flexibility to select the right health insurance plan can provide essential coverage.

02

Individuals with dependents: If you have dependents, such as children or a spouse, flexible benefits policies become even more valuable. They allow you to select benefits that cater to the specific needs of your family, such as dental coverage for your children or additional life insurance coverage to provide financial protection for your loved ones.

03

Those planning for the future: Flexible benefits policies often include retirement savings and investment options. If you have long-term financial goals or are actively planning for your retirement, these policies can enable you to contribute towards a retirement plan that suits your needs. This can help secure your financial future and provide peace of mind.

04

Employees looking for work-life balance: Some flexible benefits policies extend beyond traditional healthcare and retirement options. They may include perks such as flexible work schedules, remote work arrangements, or wellness programs. If you value a healthy work-life balance, these policies can offer additional benefits that enhance your overall well-being and satisfaction.

Remember, the specific eligibility and availability of flexible benefits policies may vary depending on your employer and location. It's advisable to consult your employer or human resources department for accurate and tailored information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my flexible benefits policies directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign flexible benefits policies and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I complete flexible benefits policies online?

pdfFiller has made filling out and eSigning flexible benefits policies easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I complete flexible benefits policies on an Android device?

Use the pdfFiller mobile app to complete your flexible benefits policies on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is flexible benefits policies?

Flexible benefits policies are a type of employee benefit plan that allows employees to choose from a variety of benefits to create a personalized benefits package.

Who is required to file flexible benefits policies?

Employers are required to file flexible benefits policies for their employees.

How to fill out flexible benefits policies?

Flexible benefits policies can be filled out by providing information on the available benefits options, employee selections, and any relevant administrative details.

What is the purpose of flexible benefits policies?

The purpose of flexible benefits policies is to offer employees choice and flexibility in selecting their benefits, ultimately leading to increased satisfaction and retention.

What information must be reported on flexible benefits policies?

Flexible benefits policies must include details on the available benefits options, employee selections, and any administrative guidelines.

Fill out your flexible benefits policies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Flexible Benefits Policies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.