PA REV-420 AS 1999 free printable template

Show details

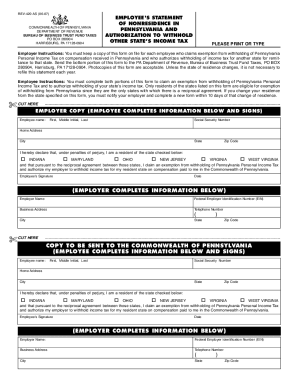

REV-420 AS 10-99 I COMMONWEALTH OF PENNSYLVANIA DEPARTMENT OF REVENUE BUREAU OF BUSINESS TRUST FUND TAXES DEPT. 280904 HARRISBURG PA 17128-0904 EMPLOYEE S STATEMENT OF NONRESIDENCE IN PENNSYLVANIA AND AUTHORIZATION TO WITHHOLD OTHER STATE S INCOME TAX PLEASE PRINT OR TYPE Employer Instructions You must keep a copy of this form on file for each employee who claims exemption from withholding of Pennsylvania Personal Income Tax on compensation recei...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA REV-420 AS

Edit your PA REV-420 AS form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA REV-420 AS form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA REV-420 AS online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit PA REV-420 AS. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA REV-420 AS Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA REV-420 AS

How to fill out PA REV-420 AS

01

Obtain the PA REV-420 AS form from the Pennsylvania Department of Revenue website or a local office.

02

Fill out the top section with your personal information, including your name, address, and Social Security number.

03

Indicate the type of taxpayer you are by checking the appropriate box.

04

In the income section, report your total income as required.

05

Provide details about any deductions or credits that apply to your situation.

06

Carefully review the instructions on the form for any additional required information specific to your circumstances.

07

Sign and date the form to certify that the information is accurate and complete.

08

Submit the completed form to the designated office as specified in the instructions.

Who needs PA REV-420 AS?

01

Individuals or entities in Pennsylvania seeking a refund or adjustment of a previously filed tax return.

02

Taxpayers who need to report changes in income or deductions for tax periods.

Fill

form

: Try Risk Free

People Also Ask about

Who is subject to PA Local tax?

Worksites include factories, warehouses, branches, offices, and residences of remote employees. Again, PA has two local taxes: Earned Income Tax (EIT): All employees working in Pennsylvania must pay a local earned income tax. Local Services Tax (LST): This local tax only applies to certain locations.

Do I have to pay LST tax in PA?

If you are self-employed or work from home for an employer that does not withhold the tax, you are required to pay the appropriate LST to the taxing jurisdiction where you work. Access the Pennsylvania Department of Community & Economic Development Municipal Statistics to find the LST rate and tax collector.

What is rev 420?

Employee's Statement of Nonresidence in Pennsylvania and Authorization to Withhold Other State's Income Tax (REV-420)

Who has to pay LST tax in PA?

Self-Employed Individuals. Self-employed taxpayers shall pay the tax to the municipality or the tax collector 30 days after the end of each calendar quarter.

What is the Rev 419 form?

PURPOSE OF FORM Complete Form REV-419 so that your employer can with- hold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial situation changes. Photo- copies of this form are acceptable.

Who is exempt from Pennsylvania local services tax?

If the total LST rate enacted exceeds $10.00, the Act requires that all jurisdictions exempt individuals with incomes within their jurisdictions of less than $12,000 or $15,600 in areas whose rate is greater than $52.00.

What is exemption from local services tax?

exempTion appLicaTion Income exemption for Local Services Tax is $12,000 or less from all sources of earned income and net profits, when the LST tax rate exceeds $10 per year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit PA REV-420 AS online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your PA REV-420 AS to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for the PA REV-420 AS in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your PA REV-420 AS.

Can I create an eSignature for the PA REV-420 AS in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your PA REV-420 AS and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is PA REV-420 AS?

PA REV-420 AS is a form used in Pennsylvania for reporting the allocation of income, deductions, and taxable income for a business entity for the purposes of determining state tax obligations.

Who is required to file PA REV-420 AS?

Business entities operating in Pennsylvania that have income subject to tax are required to file PA REV-420 AS.

How to fill out PA REV-420 AS?

To fill out PA REV-420 AS, businesses need to provide accurate information regarding their income, deductions, and other relevant financial data as specified in the form instructions.

What is the purpose of PA REV-420 AS?

The purpose of PA REV-420 AS is to ensure proper reporting of income and expenses for tax purposes, enabling the Pennsylvania Department of Revenue to assess the correct tax liability.

What information must be reported on PA REV-420 AS?

PA REV-420 AS requires reporting of gross income, deductions, tax credits, and other relevant financial information related to the business's operations in Pennsylvania.

Fill out your PA REV-420 AS online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA REV-420 AS is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.