Get the free Gift Aid and Restriction form - Save Moor Pool - s528695471 websitehome co

Show details

Gift Aid declaration for a single donation Name of charity Moor Pool Heritage Trust Please treat the enclosed gift of as a Gift Aid donation. I confirm I have paid or will pay an amount of Income

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift aid and restriction

Edit your gift aid and restriction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift aid and restriction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift aid and restriction online

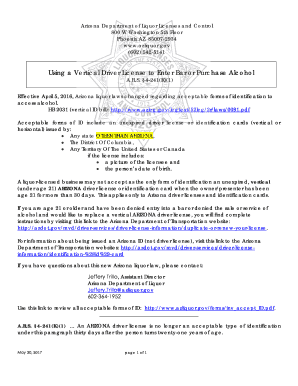

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gift aid and restriction. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

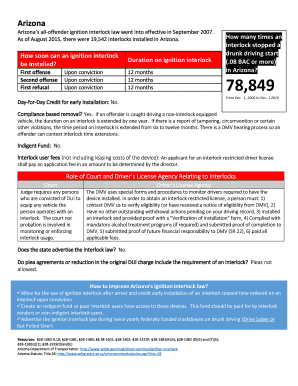

How to fill out gift aid and restriction

How to fill out gift aid and restriction:

01

Obtain the necessary forms: Start by acquiring the appropriate gift aid and restriction forms from the relevant charitable organization or institution. These forms are typically available on their website or can be requested directly from their offices.

02

Provide your personal information: Begin by entering your personal details, such as your full name, address, and contact information. Make sure all information is accurate and up-to-date.

03

Declare your eligibility: Confirm your eligibility for gift aid by indicating that you are a UK taxpayer and have paid enough income tax or capital gains tax in the current tax year. This step is crucial to ensure that the charity can claim gift aid on your donation.

04

Choose the donation amount: Decide on the amount you wish to donate and indicate it on the form. Ensure that you clearly state whether the donation is a one-time or recurring contribution.

05

Specify any restrictions: If you have any specific restrictions or conditions for your donation, such as how the funds should be used or allocated, clearly outline them on the form. This will help the charity understand your intentions and comply with any specific requests you may have.

06

Sign and date the form: After completing all the necessary sections, sign and date the gift aid and restriction form. This serves as your authorization and agreement with the terms and conditions stated on the form.

Who needs gift aid and restriction?

Gift aid and restriction are relevant for individuals who wish to provide financial support to charitable organizations and want to maximize the impact of their donations. Gift aid allows charities to reclaim the basic rate tax on your donations, increasing the value of your gift, while restrictions enable you to specify how your donation should be used or allocated.

Anyone who is a UK taxpayer and meets the requirements for gift aid eligibility can benefit from this scheme. Gift aid and restriction forms are typically utilized by individuals who want to ensure that their donations have a lasting and meaningful impact, aligning with their specific philanthropic goals and values.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gift aid and restriction?

Gift aid is a UK government scheme that allows charities to claim back 25p every time a UK taxpayer donates £1. Restrictions may include the types of donations that qualify for gift aid, eligibility of donors, and specific rules for claiming.

Who is required to file gift aid and restriction?

Charities and other eligible organizations that wish to claim gift aid must file for it.

How to fill out gift aid and restriction?

Gift aid can be filled out online through HM Revenue & Customs (HMRC) website or by submitting a paper form. Restrictions must be adhered to as per HMRC guidelines.

What is the purpose of gift aid and restriction?

The purpose of gift aid is to encourage donations to charities by providing tax relief to donors. Restrictions ensure that the scheme is used correctly and fairly.

What information must be reported on gift aid and restriction?

Information such as donor details, donation amount, confirmation of tax status, and declaration that they have paid enough tax to cover the gift aid claim must be reported.

How do I edit gift aid and restriction straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing gift aid and restriction right away.

How do I edit gift aid and restriction on an iOS device?

Create, edit, and share gift aid and restriction from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I fill out gift aid and restriction on an Android device?

Complete gift aid and restriction and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your gift aid and restriction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Aid And Restriction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.