TN Rooks CPA Client Information Form 2010-2024 free printable template

Show details

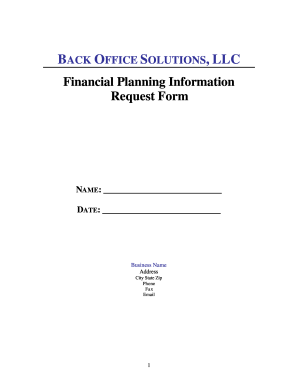

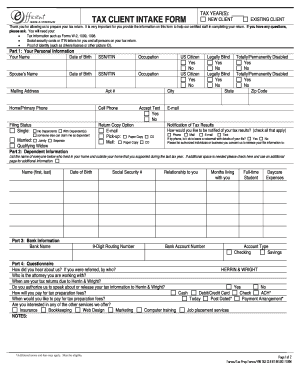

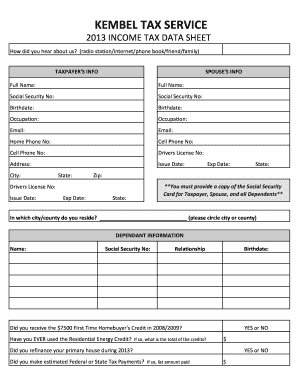

CLIENT INFORMATION FORM ROOKS CPA PLLC ROOKS WEALTH MANAGEMENT PLLC AND/OR INDIVIDUAL ACCOUNT INFORMATION Name SS Spouse SS D/O/B Spouse D/O/B Number of Dependents Children s NameSS D/O/B Dependent yes no Mailing Address City State Zip Physical Address City State Zip If different from mailing address Home Phone Cell Phone s Work Phone Fax Home Email Address Work Email Address Add l Email Address Add l Email Address Marital Status Anniversary Dat...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your tax preparation client intake form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax preparation client intake form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax preparation client intake form template pdf online

Follow the steps below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax preparation client intake form template. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out tax preparation client intake

How to fill out tax preparation client intake:

01

Begin by gathering all necessary personal information from the client, including their full name, address, contact information, and social security number.

02

Proceed to collect information about the client's employment, such as their employer's name, address, and contact details, as well as any relevant income or deductions related to their job.

03

Ask the client about their marital status, as well as any dependents they may have, in order to accurately determine their filing status and eligibility for certain tax benefits.

04

Inquire about the client's sources of income, such as investments, rental properties, or self-employment, and request supporting documentation or records for each source.

05

Gather information about the client's expenses, including mortgage interest, medical expenses, charitable contributions, and any other relevant deductions they may qualify for.

06

Record any additional tax-related information, such as prior year tax returns, estimated tax payments made, or any tax issues or complications the client may be facing.

07

Ensure that all information provided by the client is complete, accurate, and up-to-date, and clarify any uncertainties or discrepancies before proceeding with the preparation process.

08

Finally, review and double-check all completed forms and documents to ensure accuracy and compliance with tax laws and regulations.

Who needs tax preparation client intake:

01

Individuals or businesses who require assistance in preparing their tax returns and want to ensure accurate and efficient filing.

02

Anyone seeking to maximize their eligible deductions and credits while minimizing their tax liability.

03

Individuals or organizations with complex financial situations, including multiple sources of income, investments, or self-employment, that require professional expertise in tax matters.

Fill new tax client information sheet template : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file tax preparation client intake?

Anyone who is preparing taxes for a client must complete a tax preparation client intake. This includes tax professionals such as certified public accountants (CPAs), enrolled agents, and other tax preparers.

How to fill out tax preparation client intake?

1. Gather Basic Information: Ask the client for basic contact information such as full name, address, phone number, and email address.

2. Taxpayer Identification Number: Request the taxpayer's Social Security Number or other taxpayer identification number.

3. Request Documents: Ask the client to provide all relevant documents, such as W-2s, 1099s, and any other forms related to taxes.

4. Taxpayer Status: Ask the client to state their filing status, such as single, married filing jointly, or head of household.

5. Dependents: Ask the client to provide information on any dependents, such as name, age, and Social Security number.

6. Income: Ask the client to provide information on their income, such as wages, dividends, self-employment income, and investment income.

7. Tax Deductions: Ask the client to provide information on any deductions they are claiming, such as mortgage interest, charitable donations, or medical expenses.

8. Tax Credits: Ask the client to provide information on any tax credits they are claiming, such as the child tax credit or the earned income credit.

9. Signatures: Ask the client to sign the form authorizing you to prepare their tax return.

What is the purpose of tax preparation client intake?

Tax preparation client intake is an important process in the tax preparation process. Its purpose is to collect important information from a client in order to accurately prepare their taxes. This information typically includes personal information such as name, address, Social Security number, income, assets, and expenses. It also includes information about any dependents, filing status, and deductions. The client intake process also serves to establish the communication between the tax preparer and the client so that they can effectively work together.

What information must be reported on tax preparation client intake?

1. Client’s full name, address, and contact information

2. Social Security Number or Tax Identification Number

3. Marital status

4. Dependents’ information (names, ages, SSN/TIN)

5. Employment information (employer name, address, phone number)

6. Income sources (salary, investments, rental income, etc.)

7. Any personal or business deductions or credits

8. Information on any estimated tax payments or other payments

9. Any relevant tax forms (W-2, 1099, etc.)

10. Bank routing and account numbers for direct deposit

When is the deadline to file tax preparation client intake in 2023?

The deadline for filing tax preparation client intake in 2023 is April 15, 2023.

What is the penalty for the late filing of tax preparation client intake?

The penalty for the late filing of tax preparation client intake will depend on the specific circumstances and the jurisdiction in which the filing is taking place. Generally, late filing can result in fines and/or interest penalties.

What is tax preparation client intake?

Tax preparation client intake is the process of gathering and documenting relevant information from clients in order to prepare and file their tax returns accurately. This typically involves collecting personal and financial details such as the client's name, address, social security number, income sources, expenses, deductions, and any other information necessary to complete the tax return. The purpose of this intake process is to ensure that all necessary information is obtained to fulfill the client's tax obligations and maximize their tax benefits within the legal framework.

How do I execute tax preparation client intake form template pdf online?

pdfFiller makes it easy to finish and sign tax preparation client intake form template online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for signing my cpa release of client information in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your 2020 tax preparation client intake form template right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit accountant new client information form on an iOS device?

Create, modify, and share accounting client information sheet template using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your tax preparation client intake online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cpa Release Of Client Information is not the form you're looking for?Search for another form here.

Keywords relevant to cpa release of client information

Related to accounting client intake form template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.